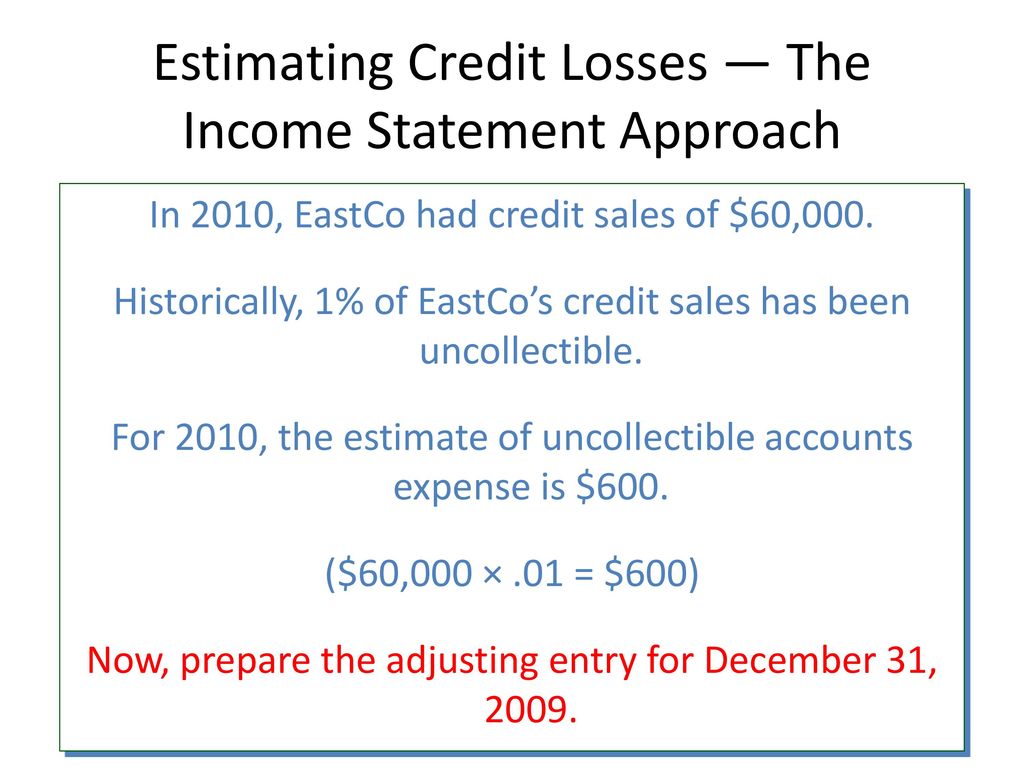

Income Statement Approach To Estimating Uncollectible Accounts Expense

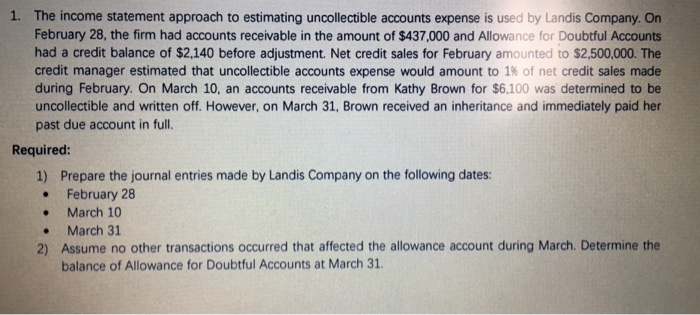

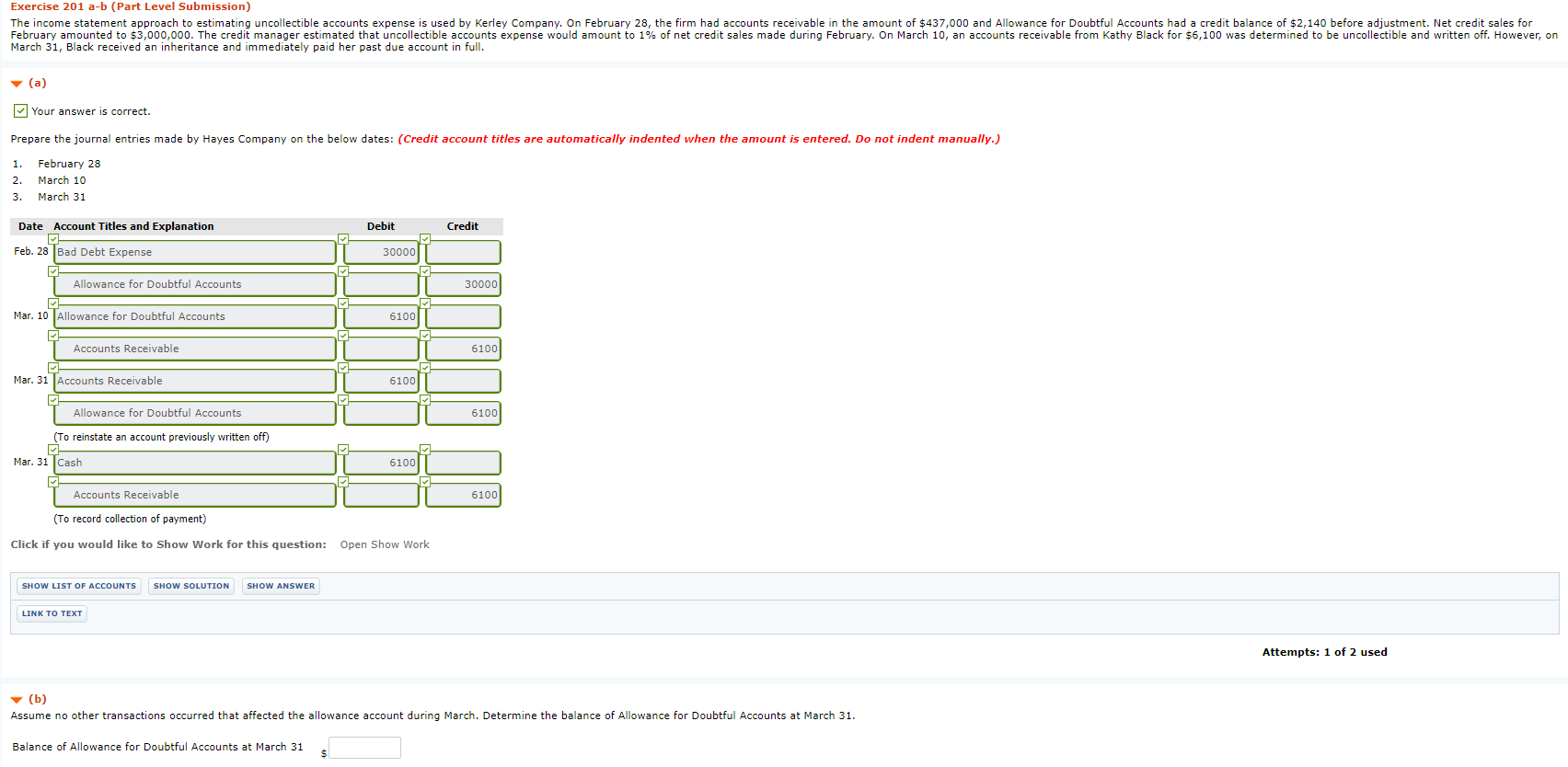

The income statement approach to estimating uncollectible accounts expense is used by kerley company.

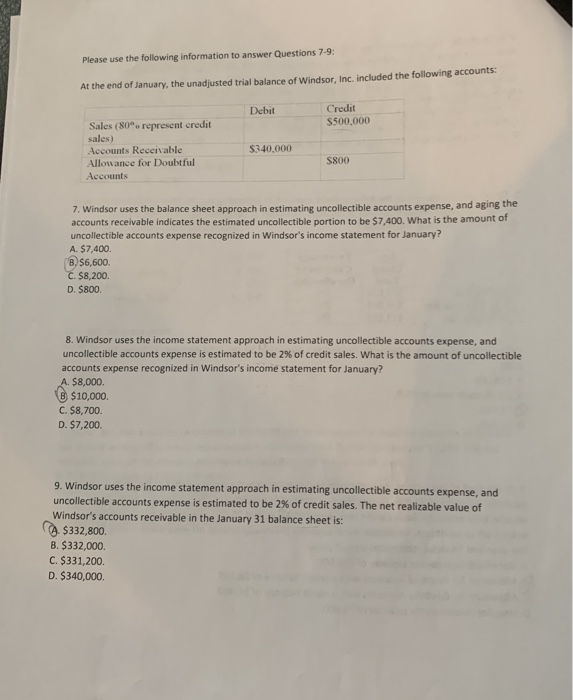

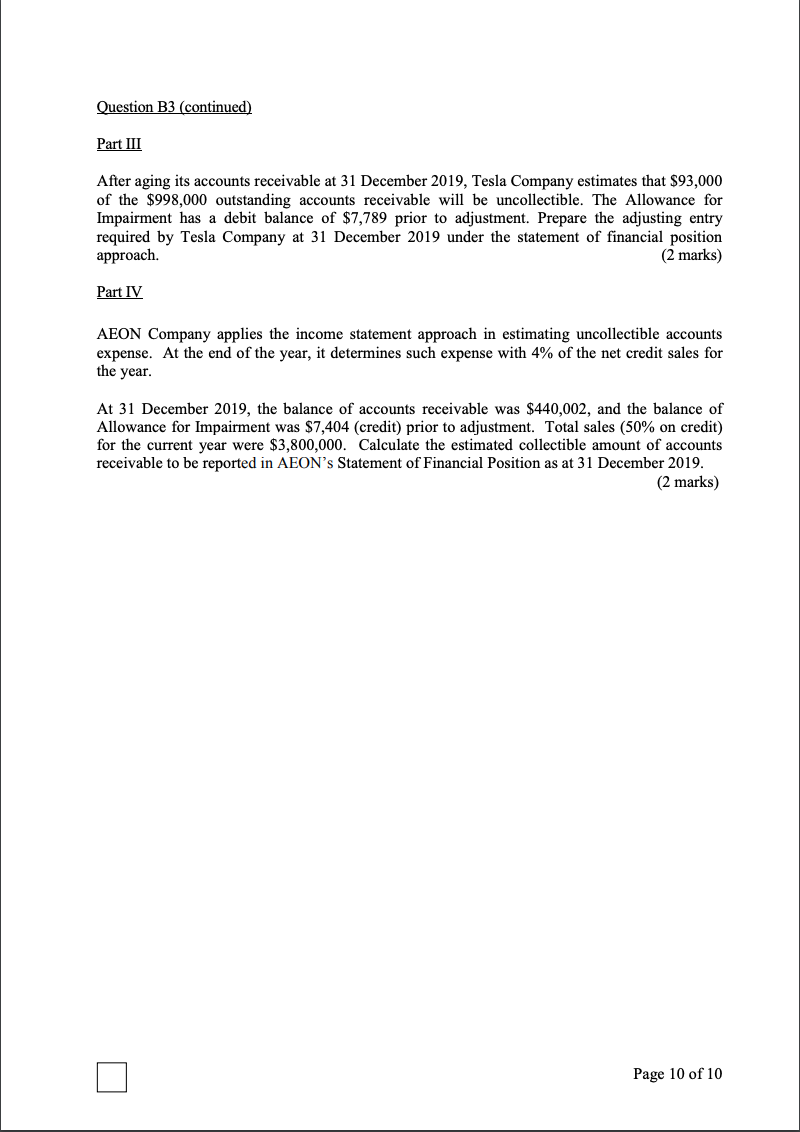

Income statement approach to estimating uncollectible accounts expense. Below are details regarding this expense and how it impacts the balance sheet and income statement. Net sales time percentage equals estimated uncollectible accounts expense true a company that estimates its uncollectible accounts receivable are 5 000 and a 200 credit balance in allowances for uncollectible accounts will increase the allowance account by 5 200. The net realizable value of windsor s accounts receivable in the january 31 balance sheet is. The first method percentage of sales method focuses on the income statement and the relationship of uncollectible accounts to sales.

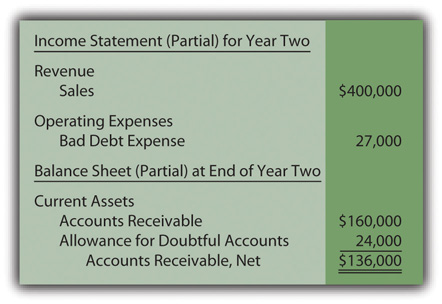

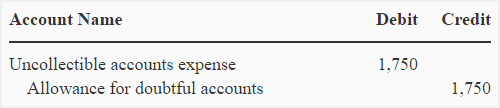

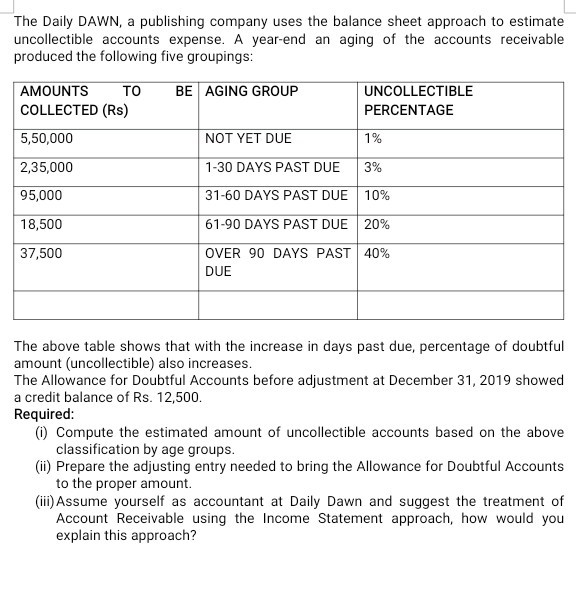

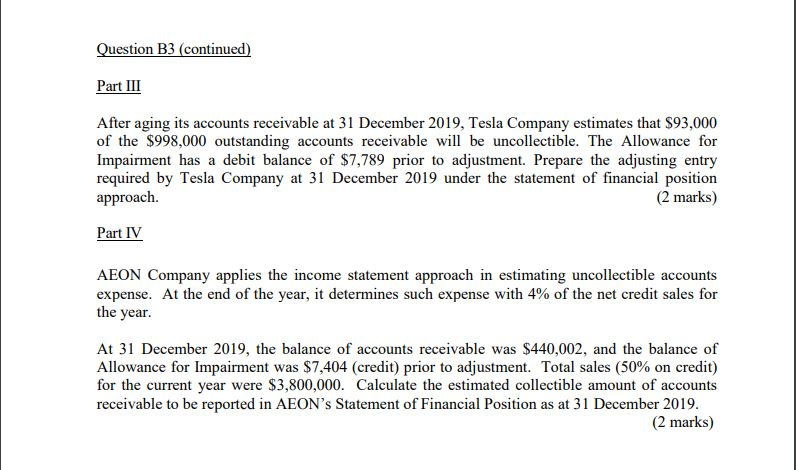

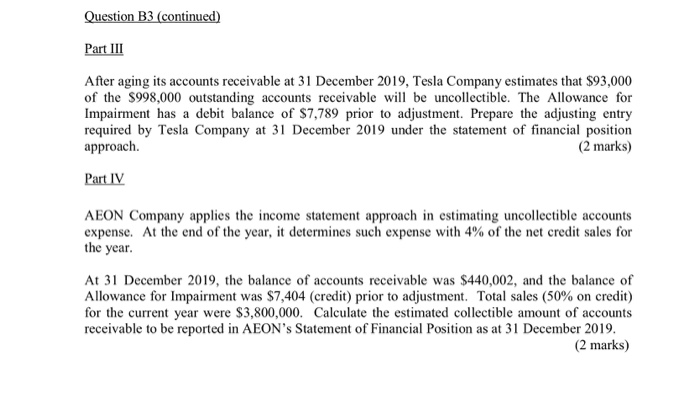

If uncollectible accounts are expected to be 8 percent of that amount the expense is reported as 32 000 400 000 8 percent. Once this account is identified as uncollectible the company will record a reduction to the customer s accounts receivable and an increase to bad debt expense for the exact amount uncollectible. The balance sheet approach to bad debts expresses uncollectible accounts as a percentage of accounts receivable. Prepare adjusting entry to recognize uncollectible accounts expense and to update the allowance for doubtful accounts account at the end of the year 2015.

The formula for calculating the amount of uncollectible accounts expense based on a percentage of net sales is. At the end of accounting period the amount of uncollectible accounts is estimated and the following adjusting entry is made to recognize them. On february 28 the firm had accounts receivable in the amount of 437 000 and allowance for doubtful. Bad debt expense the figure estimated must be raised from its present zero balance to 32 000.

Whether the allowance for doubtful accounts or the direct write off method are used an uncollectible accounts expense must be recorded to remain compliant with u s. Under generally accepted accounting principles gaap the direct write off method is not an acceptable method of recording bad debts because it violates the matching principle. To account for this lost income businesses record bad debt expense on a periodic basis. It s an inevitable reality that not all customers will pay down their account balances.

The first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach journal entry to recognize uncollectible accounts expense. Calculate allowance for doubtful accounts using sales method or income statement approach.