Net Income On The Income Statement Is Obtained After Subtracting Taxes For The

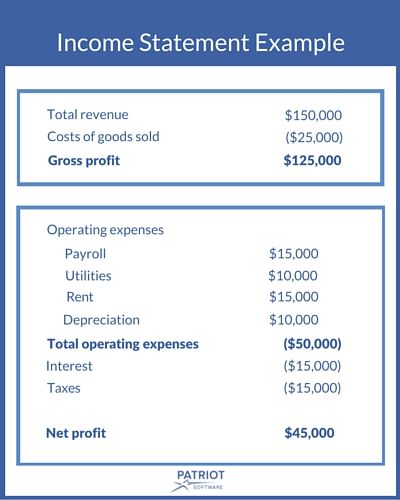

Here is a sample income statement.

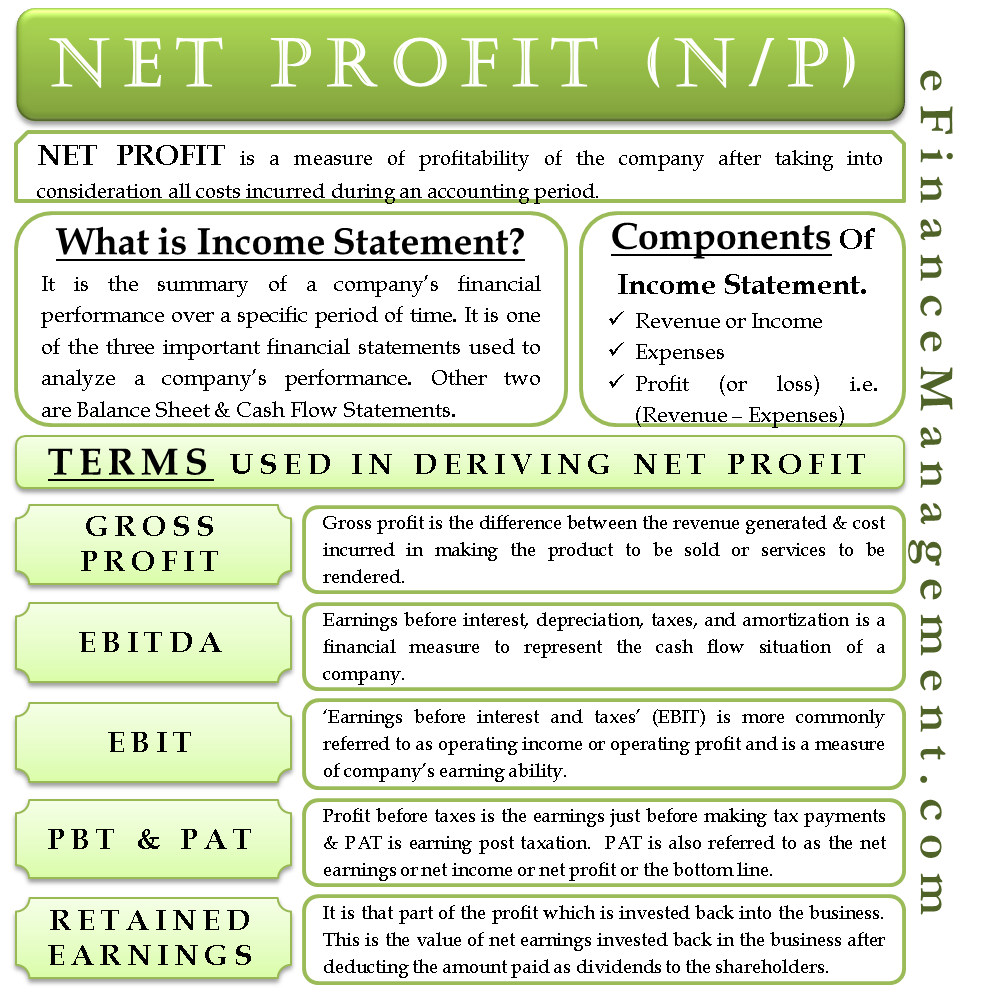

Net income on the income statement is obtained after subtracting taxes for the. In that case you likely already have a profit and loss statement or income statement that shows your net income. Net income after taxes niat is the net income of a business less all taxes. In other words niat is the sum of all revenues generated from the sale of the company s products and services minus. In this example if the company pays 1 7 million in taxes subtract 1 7 million from 3 5 million to find the company s net income after taxes equals 1 8 million.

Actually filling out an income statement while calculating net income is an easy way to organize your information. Net income in case of company accounting is the income value obtained after subtracting expenses costs depreciation interest losses and taxes from total revenue. Subtracting income tax expense from income before taxes yields net income after tax. Net income after tax.

The first is called single step. Income statements show the process of determining net income. This can be done either by hand or using a data management program. The income statement comes in two forms multi step and single step.

An income statement covers a specific period of time i e january 1 2014 to december 31 2014. Total revenues cost of goods sold gross income expenses taxes and net income are all line items on the income statement. See how to write an income statement for more information. Net income is the final line of the statement which is why it is also called the bottom line.

Reporting the results of operating activities learn with flashcards games and more for free. Obtained when the income before income taxes is multiplied by the tax rate. 20 000 net income 1 000 of interest expense 21 000 operating net income. Calculating net income and operating net income is easy if you have good bookkeeping.

Net income is shown on the income statement and is calculated by subtracting revenue from expenses o certain s assets revenue are classified as gains and some expenses are classified by losses there are two types of income statements. The income statement summarizes a company s revenues and expenses over a period either quarterly or annually.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)