Income Respect Decedent Rules

Income in respect of a decedent ird is money owed to a person before they passed away like a salary or wages.

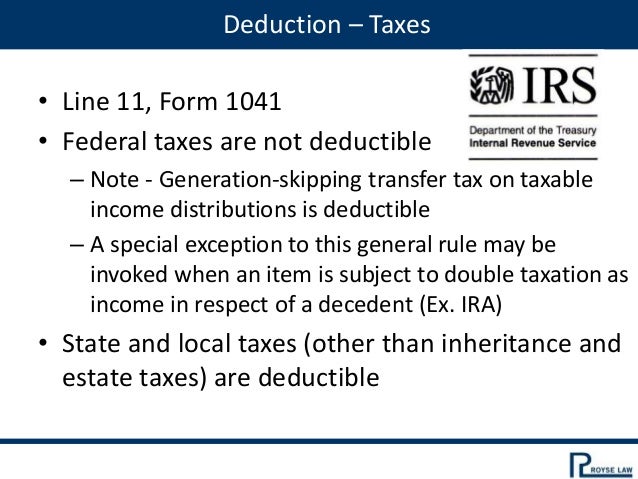

Income respect decedent rules. Instead such income referred to as income in respect of a decedent or ird is included as gross income in the decedent s estate for federal estate tax purposes. 862 discusses the scheme for taxing income in respect of a decedent ird. The person or entity that inherits the income pays the taxes. The ird scheme is intended to eliminate as much as possible the consequences of death on the operation of the income tax laws.

High died on february 15 before receiving payment. Income in respect of a decedent ird is the gross income a deceased individual would have received had he or she not died and that has not been included on the deceased individual s final income tax return. And ird also becomes taxable income to the person or entity who ultimately receives it in direct contrast to the general rule that inherited property is not included in an. Income in respect of a decedent updated on october 30 2020 6 views what is income in respect of a decedent.

Income in respect of a decedent ird refers to income that is untaxed. In other words the income in respect of a decedent is the gain the decedent would have realized had he lived. The gain to be reported as income in respect of a decedent is the 1 000 difference between the decedent s basis in the property and the sale proceeds. The rules regarding income with respect to a decedent can be confusing and if ignored can lead to penalties and interest from the internal revenue service.

Bloomberg tax portfolio income in respect of a decedent no. If like most people the deceased individual was a cash basis taxpayer ird is income that the decedent earned but did not receive. Deductions in respect to a decedent. It refers to decedent earning the right to receive the income for a lifetime.

George died on february 15 before receiving payment. If you received any money or property as an inheritance it is always advisable to speak to a tax professional to learn about any tax consequences that may apply to you. The gain to be reported as income in respect of a decedent is the 1 000 difference between the decedent s basis in the property and the sale proceeds.

/GettyImages-BA61273-883c9d0942db4168b8acd8b51acbe1bd.jpg)