Washington Income Tax Brackets 2020

Washington state income tax rate for 2020 is 0 because washington does not collect a personal income tax.

Washington income tax brackets 2020. Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. 2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. The washington tax brackets on this page were last updated from the washington department of revenue in 2020. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples filing jointly.

2020 washington tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Before the official 2020 washington income tax brackets are released the brackets used on this page are an estimate based on the previous year s brackets. The bracket you land in depends on a variety of factors ranging from your total income your total adjusted income filing jointly or as an individual dependents deductions credits and so on. Washington income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31 2020.

District of columbia state income tax rate table for the 2019 2020 filing season has six income tax brackets with dc tax rates of 4 6 6 5 8 5 8 75 and 8 95. The washington income tax has one tax bracket with a maximum marginal income tax of 0 00 as of 2020. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples. This page has the latest district of columbia brackets and tax rates plus a district of columbia income tax calculator.

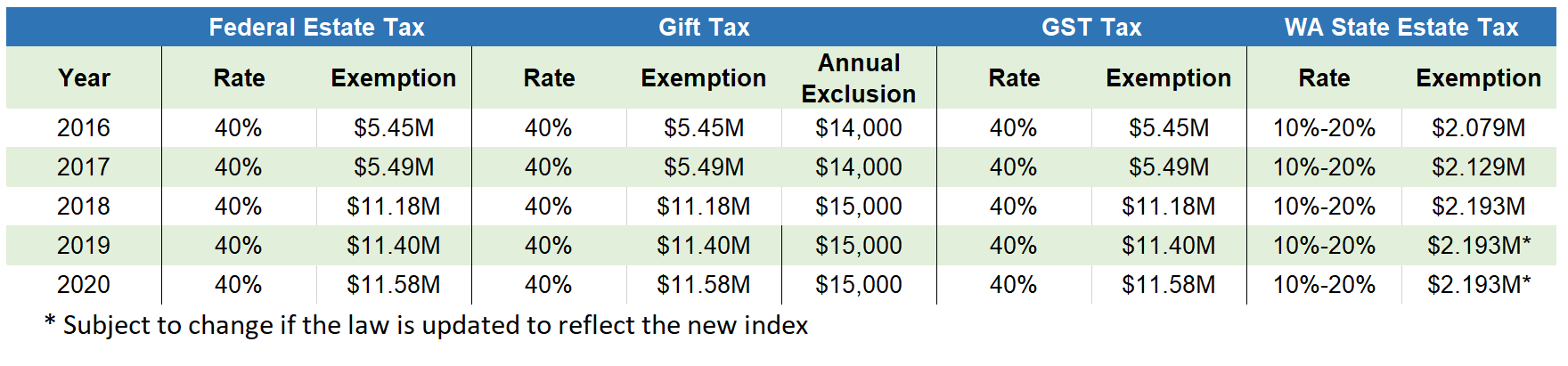

Washington state estate tax. Outlook for the 2019 washington income tax rate is to remain unchanged at 0. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1.

Detailed washington state income tax rates and brackets are available on this page. The table below shows the marginal estate tax rates for qualifying estates. Please contact us if any of our washington tax data is incorrect or out of date. The estate tax in washington state ranges from 10 up to a top rate of 20 but this only applies to gross estates exceeding 2 193 000 for deaths after jan.