Revenue And Expenses On The Income Statement Are Classified As Select All That Apply

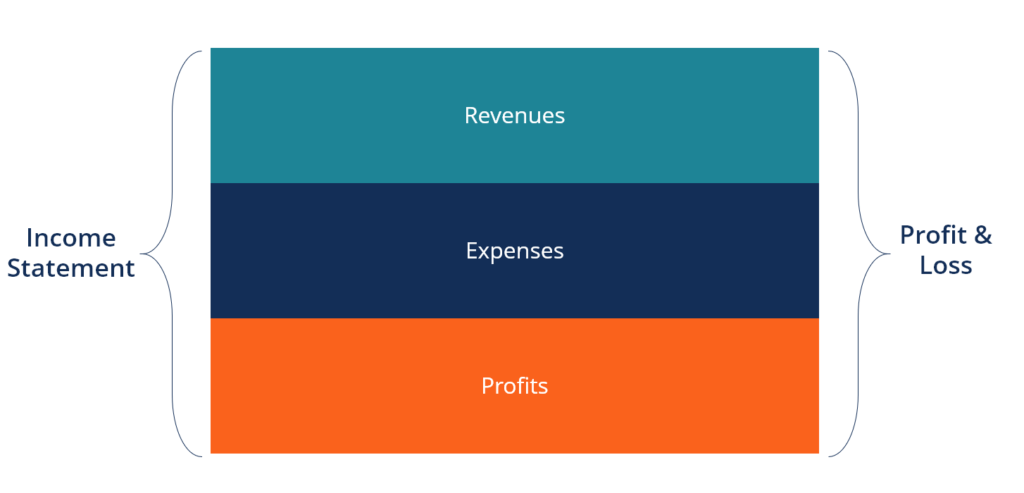

The components of the income statement are usually classified as.

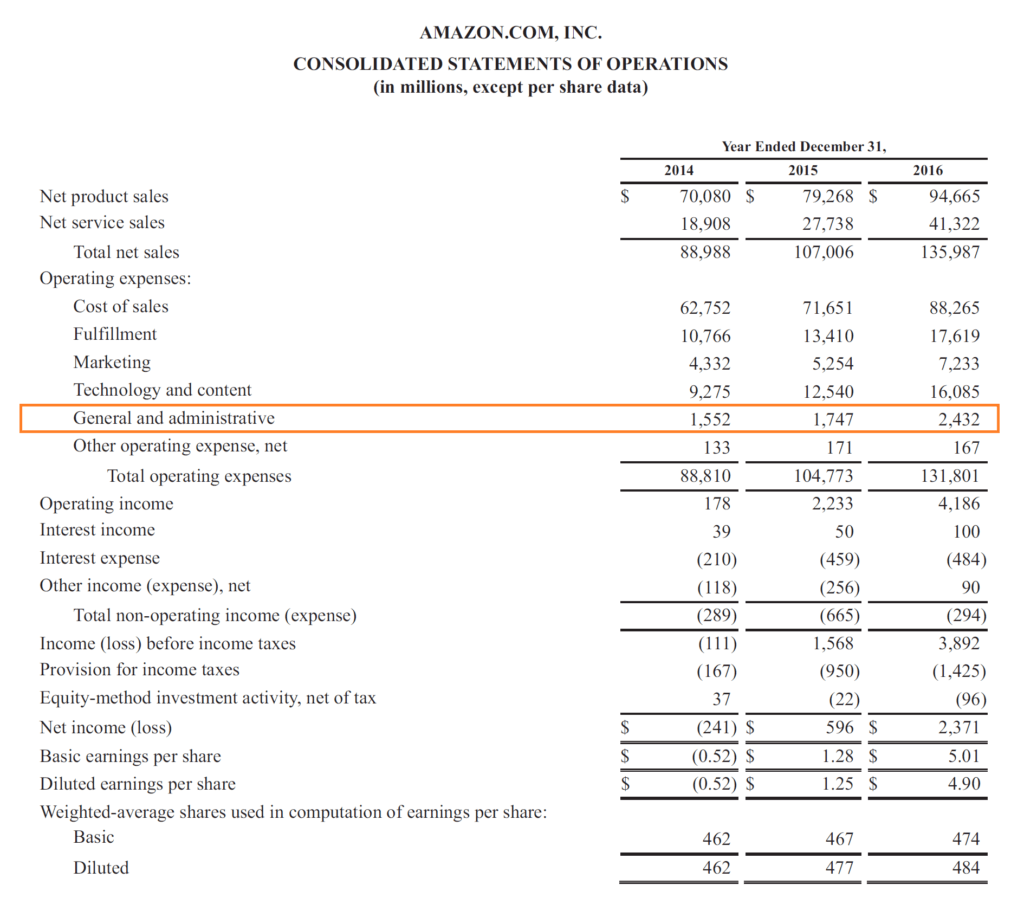

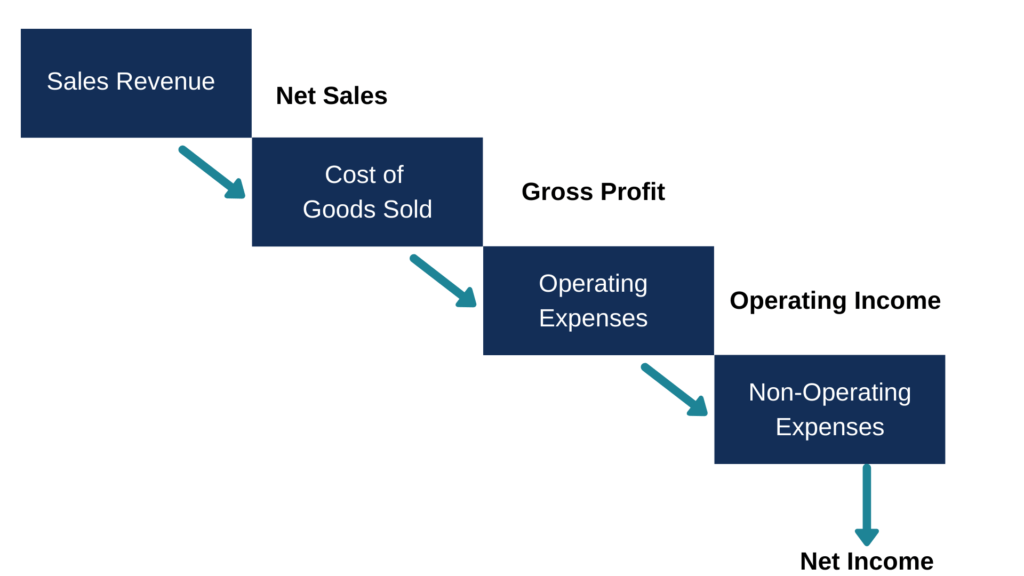

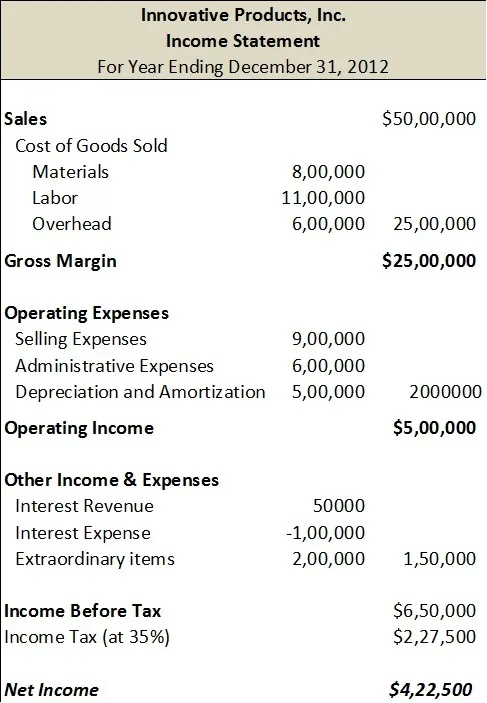

Revenue and expenses on the income statement are classified as select all that apply. The income statement can be prepared in one of two methods. Revenue or income accounts. Closing the sales revenue account requires a to sales revenue. The more complex multi step income statement as the name implies takes several steps to find the bottom line.

On december 31 it a crude an additional salaries expense of 2 million. The term income usually refers to the net profit of the business derived by deducting all expenses from revenue generated during a particular period of time. In its first year operation jetaway airlines paid salaries expense of 40 million. Assets which represent the amounts owed by customers.

The single step income statement totals revenues then subtracts all expenses to find the bottom line. Accrual based net income sales revenue cash based net income. Revenue and expenses on the income statement are classified as. There are two accounting principles use to record and recognize revenues in the income statement.

Grant s income statement reveals a loss from the sale of land. Cash receipts and cash payments for transactions relating to revenue and expense activities are classified on the statement of cash flows as. Income statement statement of cash flows statement of stockholders equity. The income statement comes in two forms multi step and single step.

In preparing the operating activities section of the statement of cash. The two major categories reported in the income statement are. Select all that apply debit. First operating expenses are subtracted from.

An adjusting entry for accrued expenses involves. The income statement summarizes a company s revenues and expenses over a period either quarterly or annually. Revenues in the income statement are records all together for both the revenues from the selling of entity main products or services principle activities as well as revenues that entity generate from the entity s non activities. Select all that apply credit to a liability debit to an expense.

Which should gently report in the income statement and balance sheet for its first year ended december 31. Enter one word per blank retained earnings. Select all that apply. The adjusting entry for an accrued revenue always includes.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)