The Income Statement Shows Whether The Difference Between Sales And Costs Is

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

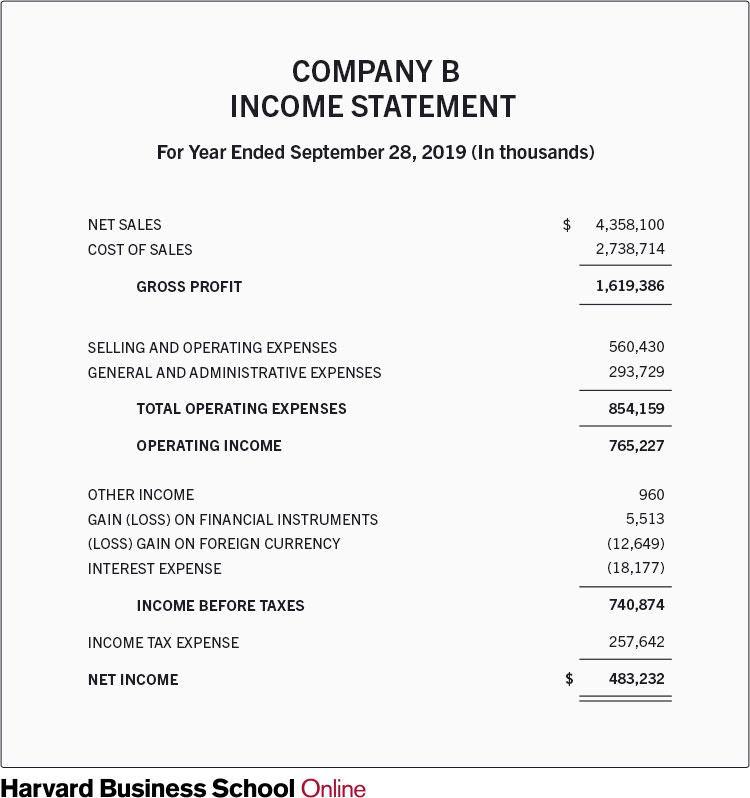

A total of 560 million in selling and operating expenses and 293 million in general and administrative expenses were subtracted from that.

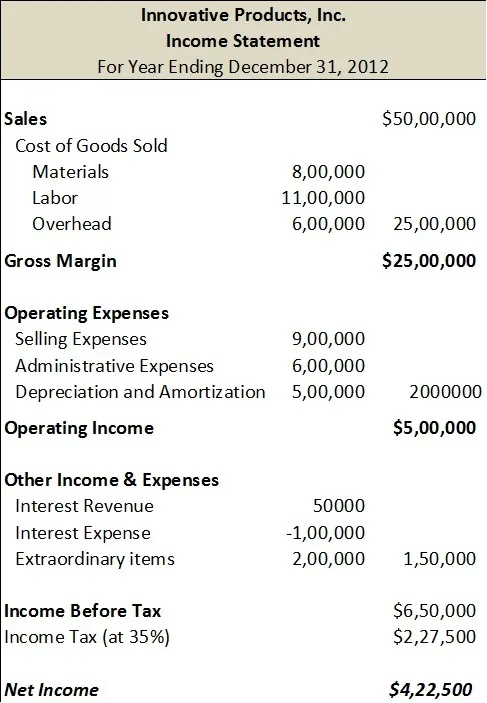

The income statement shows whether the difference between sales and costs is. Something you must know to calculate roi is. The income statement shows whether the difference between sales and costs is. This income statement shows that the company brought in a total of 4 358 billion through sales and it cost approximately 2 738 billion to achieve those sales for a gross profit of 1 619 billion. Cash itself or items that could be quickly turned into cash or will be used within one year are called.

A loss b net profit c breakeven d mess e yield. Analyzing income statement items as a percentage of sales makes clear. Which of the three financial statements an entrepreneur prepares is used to guide the day to day operations of the business. An investment may be.

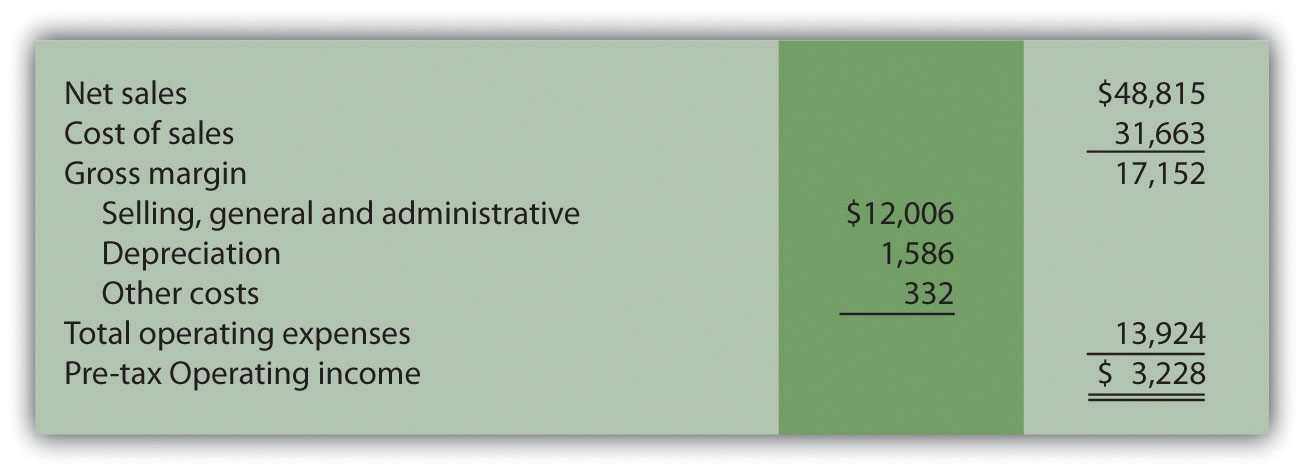

An income statement shows whether the difference between revenues sales and expenses costs is a profit or a. In the income statement which costs are subtracted from gross profit to get pre tax profit. Return on investment is expressed.

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)