Statement Of Comprehensive Income Grade 10

A statement of comprehensive income is a financial statement that includes both standard income and other comprehensive income.

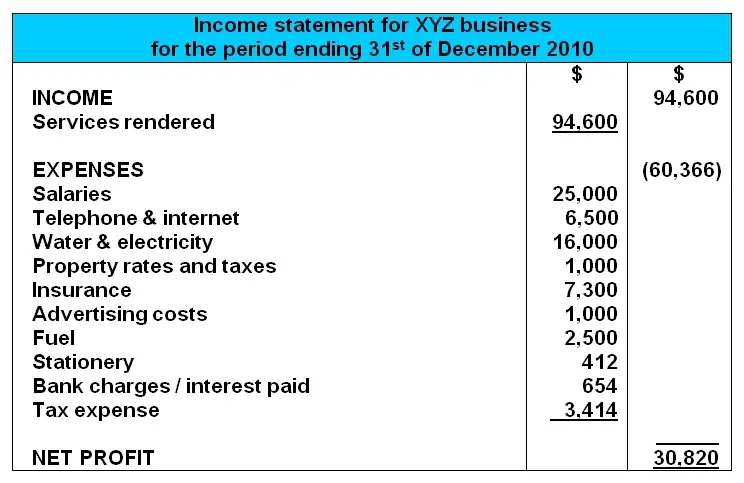

Statement of comprehensive income grade 10. The statement of comprehensive income illustrates the financial performance and results of operations of a particular company or entity for a period of time. Using a comprehensive income approach which includes all income and expenses all changes in net assets or equity other than transactions with owners are included in the measurement of profit c. An income statement is prepared to show the gross profit loss and net profit loss of the business. Gross profit sales cost of.

10 post closing trial balance as at 28 february 2015 debit credit balance sheet accounts section. Other comprehensive income does not include changes relating to ownership such as dividends paid to shareholders new shares issued or share buy backs. Extract from the income statement as at 28 february 2015 depreciation equipment 600 depreciation vehicle 3 024 net profit for the year 25 790. The net income net income net income is a key line item not only in the income statement but in all three core financial statements.

But don t depend solely on it. The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business. 2 of 14. According to international financial reporting standards since 1 january 2009 an entities make.

While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement. Grade 10 answer book. Cost of sales opening inventory net purchases closing inventory. A statement of comprehensive income is the overall income statement that consolidates standard income statement which gives details about the repetitive operations of the company and other comprehensive income which gives details about the non operational transactions such as the sale of assets patents etc.

There are 2 sections in an income statement. Balance at the end of the financial year 6 775 94 10 28 151 226 6 794 2013 balance at the beginning of the financial year 5 353 55 94 26 887 181 4 524 profit loss for the year 776 106 882 other comprehensive income and expense 122 23 145 total comprehensive income expense for the year 122 799 106 1 027. 3if a company prepares a statement of comprehensive income then disclosure is required for 1 other comprehensive income classified by nature 2 comprehensive income of associates and joint ventures and 3 total comprehensive income the statement of comprehensive income is discussed in more detail later in the chapter. Via a process of matching revenues for a period with expenses incurred in generating those revenues b.

A statement of comprehensive income contains two main things. Lecture wk 10 statement of comprehensive income mcq 10 1 profit is measured.