Income Tax Withholding Variation

What is an income tax withholding variation.

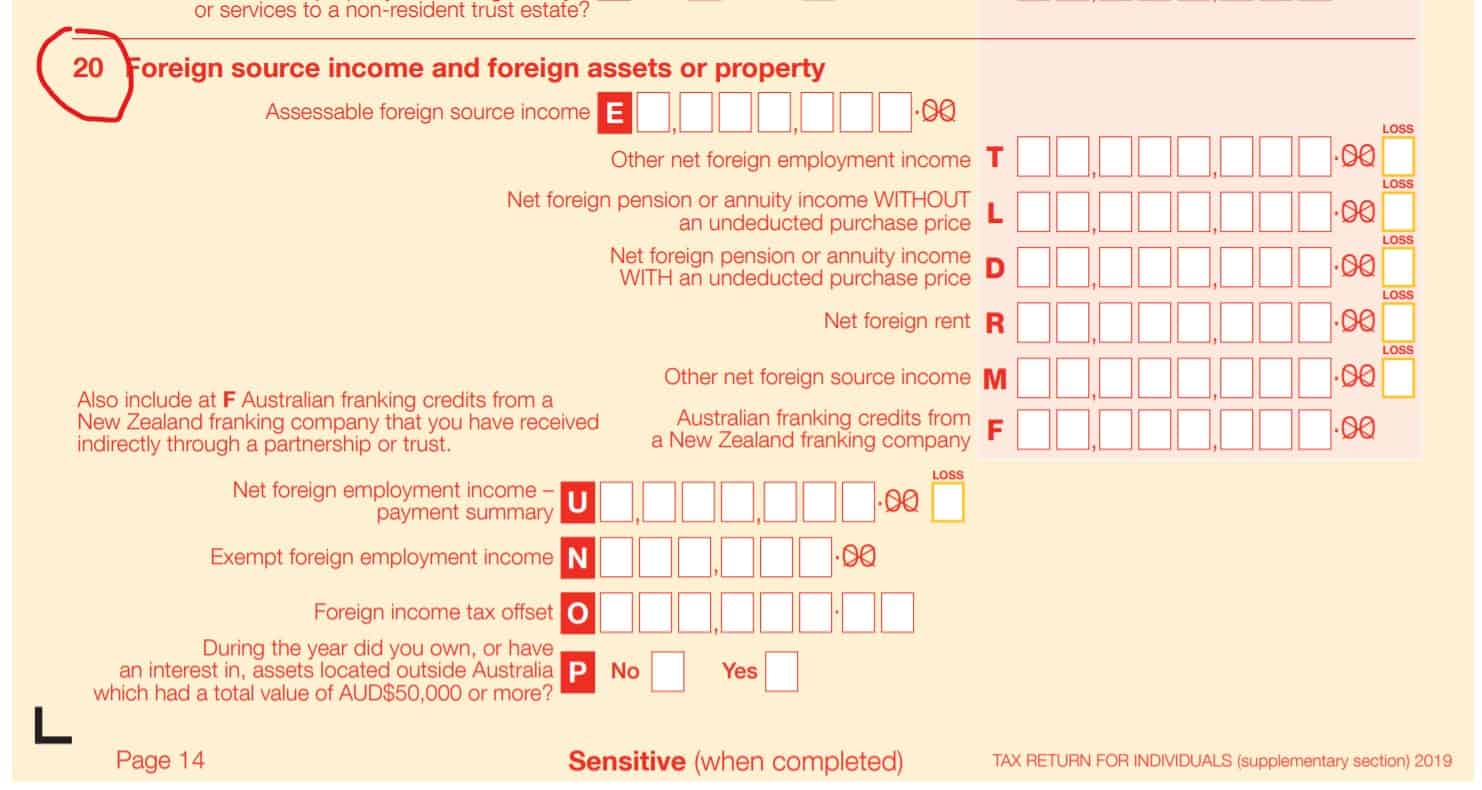

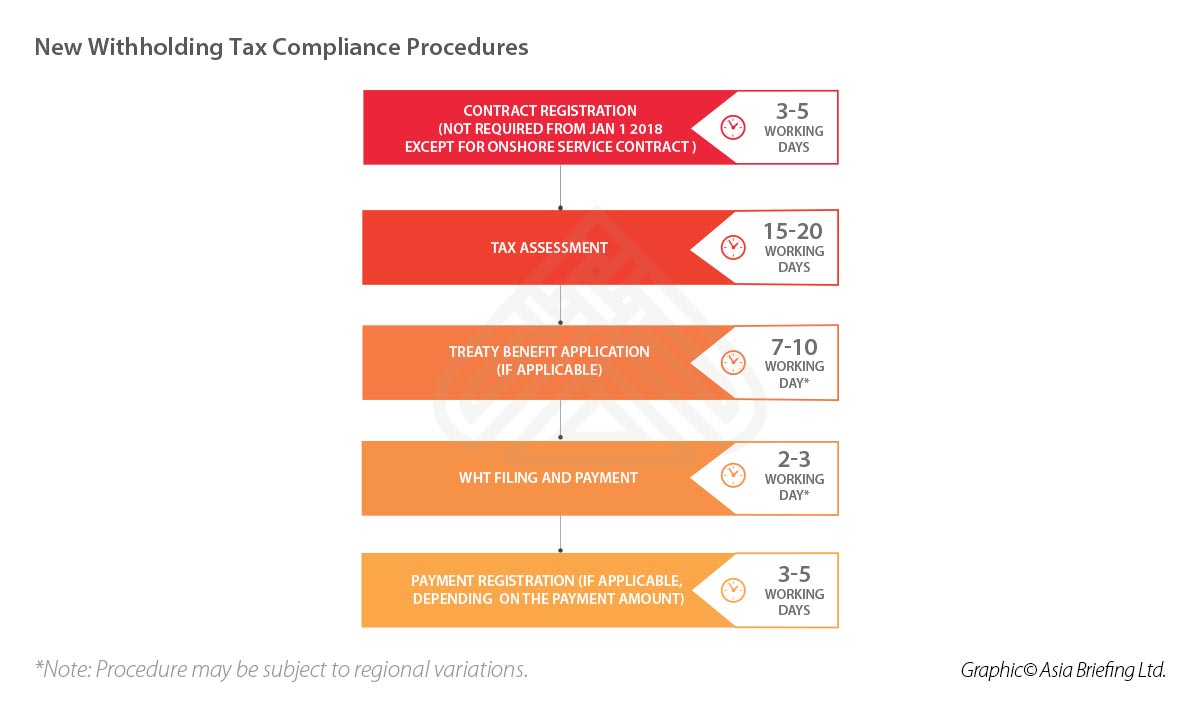

Income tax withholding variation. Payg withholding variation application e variation complete the payg withholding application e variation to vary or reduce the amount of pay as you go payg tax withheld from income paid to you in the application year. An income tax withholding variation itwv was previously known as a section 221yd variation. Get your figures right the only trap is that you need to be accurate in your variation estimate otherwise you may have to pay penalty interest on the extra tax that you kept from the ato. Please call us on 1300 889 743 or enquire online if you would like to know further information about payg income tax withholding variation.

The main purpose of varying your rate or amount of withholding is to make sure that the amount withheld during the income year best meets your end of year tax liability. This is an efficient tax strategy that can free up extra cash sooner. After tax cash flow negative 3 000. This is where payg withholding variation comes into play allowing you to receive your tax breaks each time you re paid.

For salary and wage earners their employer is required by law to deduct or withhold income tax from their regular pay packet. The variation is valid for the whole of the financial year 1 july to 30 june next if lodged part way through the year it. For example you may want to apply for a variation if the normal rate of withholding leads to a large credit at the end of the income year because your tax deductible expenses. I am a temporary contractor paid on fortnightly basis in arrear.

You can lodge a pay as you go payg withholding variation which if accepted will direct your employer to withhold less tax from your pay and give more cash to you during the year. Payg withholding variation application. Stop applying the varied rate of tax from the date of effect on the withdrawal notice and revert to withholding in accordance with the relevant tax tables. The last date for lodgment is 30 april of the application year.

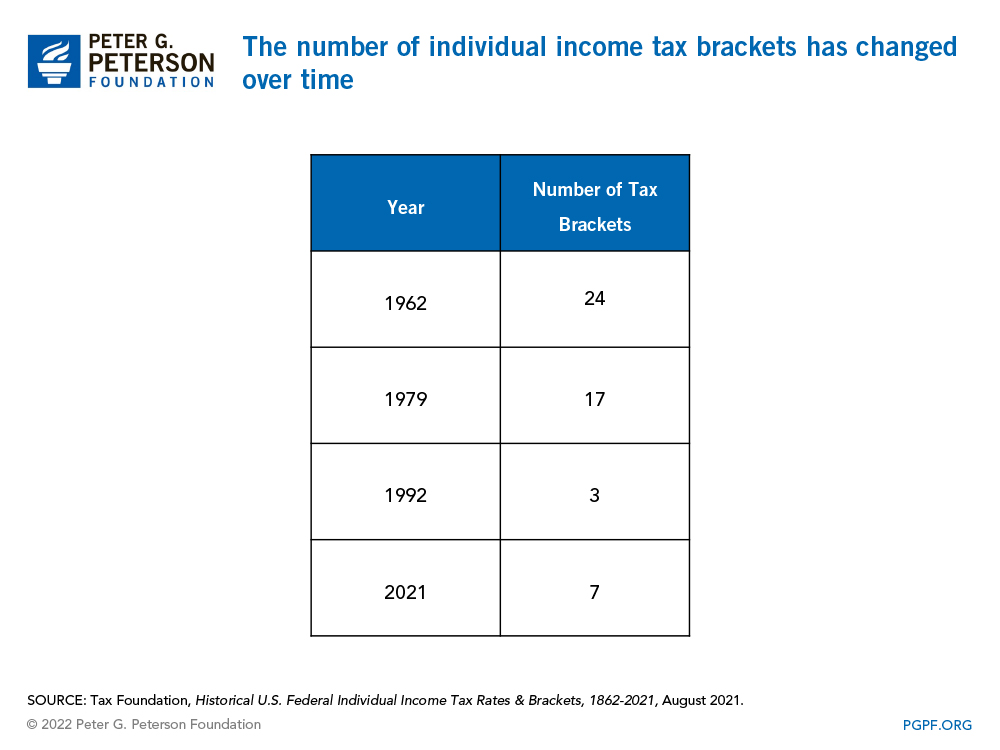

Complete the payg withholding variation application nat 2036 to vary or reduce the amount of pay as you go payg tax withheld from income paid to you in the application year. I have applied for income tax withholding variation and received a letter from ato confirming amended tax withholding percentage. The amount withheld is based on a number of factors with the key ones being your salary wage and the standard tax rates in place at that time. Example 1 you receive a class variation notice for all the workers of abc pty ltd and the prescribed rate of withholding has been varied to 15 of the gross payments listed as salary and wages.

Payg income tax withholding variation. The e variation is a transmittable form you need to lodge online over the internet. It is an annual application made to the ato to vary the amount of tax withheld from your salary each pay period by your employer. The letter dated 20 august 2019 and advises the amended percentage to be applied from next available pay.

Clearly 3 000 per year or 57 each week is easier to manage these tax breaks make investing in property much more affordable.