Income Withholding Order Ohio

In cleveland for example more than 85 of the city s income tax is generated from withholdings collected from suburbanites.

Income withholding order ohio. More details on employer withholding are available below. If there is more than one order notice to withhold income for child support against this employee obligor and you are unable to honor all support order notices due to federal or state withholding limits you. Ohio employers play a vital role in helping to secure the financial future of thousands of children. W 2 s need to reflect the 4 digit school district number.

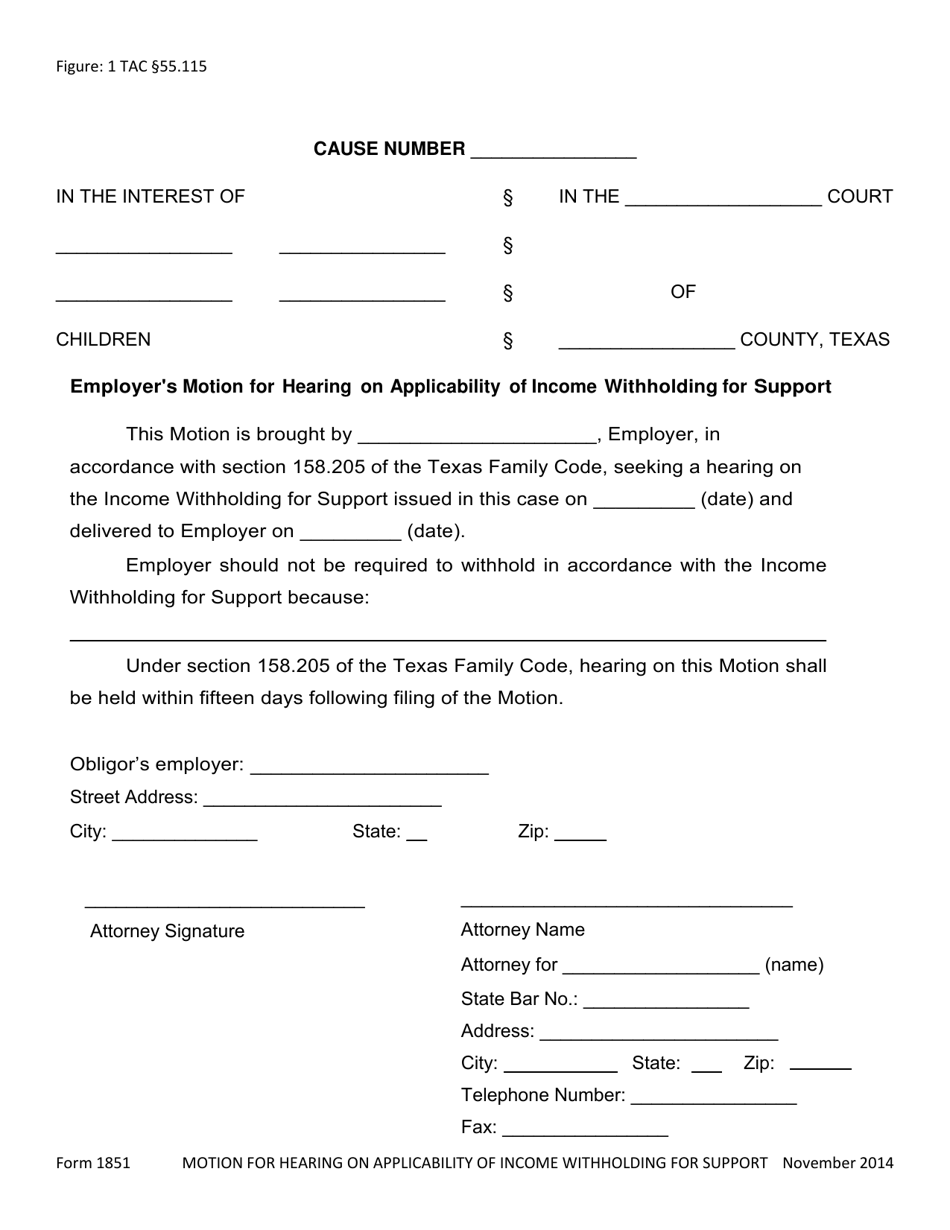

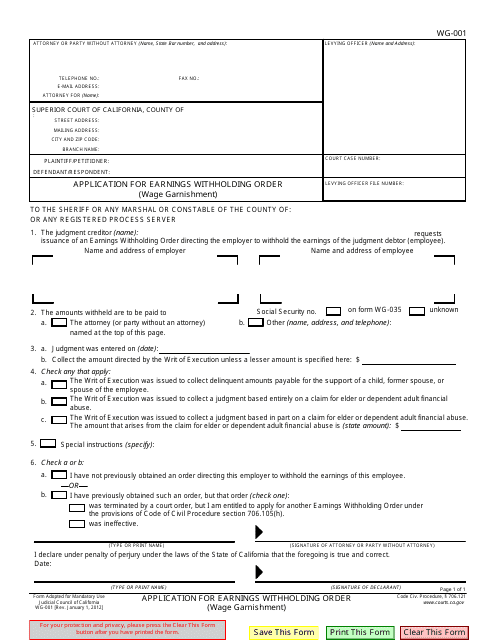

That could be key in any of ohio s cities that collect income tax. 3121 03 withholding or deduction from income or assets of obligor. Income withholding for support iwo order notice. Ohio employers also have the responsibility to withhold school district income tax from the pay of employees who reside in a school district that has enacted such a tax.

If a court or child support enforcement agency that issued or modified a support order or the agency administering the support order is required by the revised code to issue one or more withholding or deduction notices described in this section or other orders described in this section the court or agency shall issue one or. Office of child support enforcement current version expires on 8 31 2020. The iwo is the omb approved form used for income withholding in tribal intrastate and interstate cases as well as all child support orders that were initially issued in the state on or after january 1 1994 and all child support orders that were initially issued or modified in the state before january 1 1994 if arrearages occur. Working cooperatively to withhold and remit child support payments makes you a valuable resource in our efforts to secure these children s future.

Income withholding is just like any other automatic payroll deduction such as withholding for social security or state income taxes. Ohio income tax withholding is required on the amount of income included in wages as required to be reported in box 1 on the federal w 2 resulting from a disqualifying disposition of stock. The withholding order and forward the child support payments. 3115 502 employer s compliance with income withholding order of another state.

Child support agencies must update their systems and issue the current version by 8 31 2018. 4 employee obligor with multiple support withholdings. An income withholding for support order iwo a guide to the iwo and instructions november 2017. During state fiscal year 2002 74 of all child support collections in ohio came from income withholding.

In order for ohio department of taxation odt bulk file team to assist in locating payments specific information regarding the date the filing was.

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)