Comparative Income Statement Quickbooks

You can compare your performance this week month or year to other timeframes.

Comparative income statement quickbooks. Learn how to get a profit and loss comparison report in quickbooks online and quickbooks online accountant. This shows you how your business is performing over time. Sometimes the quickbooks comparative reports are referred to as diagnostic reports. This is because they can help you see trends.

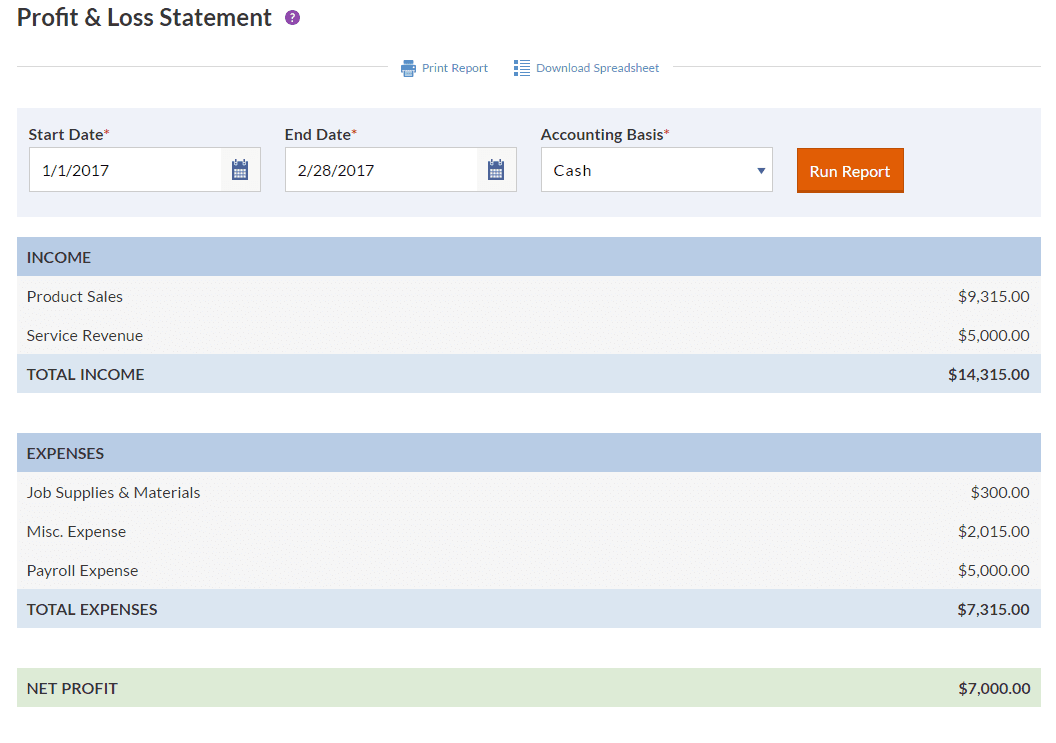

The quickbooks reporting menu provides several pre configured reports to help you with the process of creating your profit and loss report also known as an income statement. Display columns total. Quickbooks generates the income statement for you in just a few clicks. You can customize.

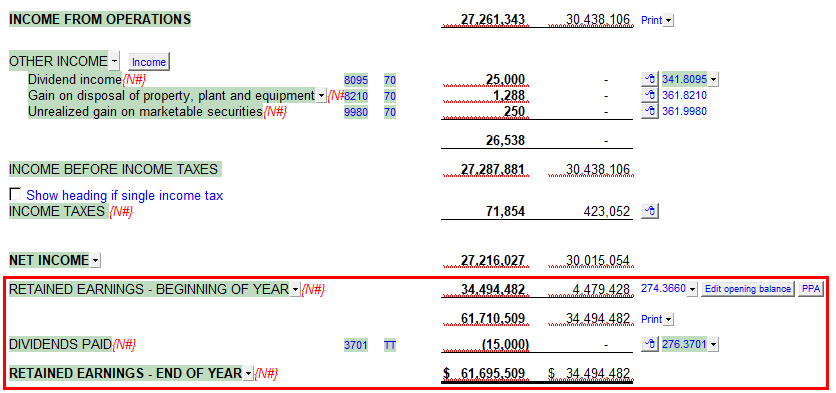

In header footer rename to comparative trial balance. The income statement also called the profit and loss statement is used to calculate profits by comparing revenue to expenses. This relates with making use of the same accounting principles for preparing each of the comparative statements. This percentage change in items is mentioned in column v of the comparative income statement.

Filters accounts select all accounts. Use profit and loss comparison reports to compare your income and expenses for different time periods. Below is how to run the comparative trial balance reports. You do not have to manually rearrange your chart of accounts.

Assume for example that a manufacturer s cost of goods sold cogs increases from 30 of sales to 45 of sales over three years. In quickbooks this is easy to do. Typically income statement and balance sheet are prepared in a comparative form to undertake such an analysis. Display rows account list.

And save in memorised reports. Consider the following income statement for m s singhania for the years ended december 31st 2017 and december 31st 2018. Quickbooks pro 2018 comparative balance sheet income statement will cover the generation of a comparative balance sheet and income statement in the accounting software. If you re using quickbooks online there are ready to use comparative reports.

Sub columns previous year and change. In case same. Now given this let s try to understand how a comparative statement is interpreted using an example. We will also generate a.

Management can use that data to. Because quickbooks tracks and organizes all of your accounting data you can easily generate reports to see where your business stands. Date range e g. Those are balance sheet comparison profit and loss comparison and profit and loss year to date comparison.

Furthermore there is a provision attached with comparing the financial data showcased by such statements. Just customize your report to sort by amount. Take the sample financial report the income statement above as an.