Operating Income Vs Profit Margin

Earnings before interest and taxes ebit and operating income are terms that are often used interchangeably although there is a notable difference.

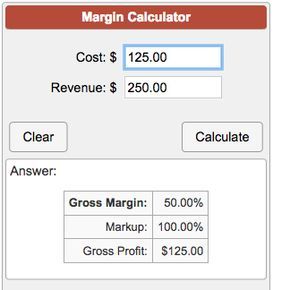

Operating income vs profit margin. To calculate the profit margin divide the net income for the business by the total amount of sales and multiply by 100 to arrive at a percentage. Operating income and gross profit show the income earned by a company and although there are differences both are essential in an analysis. This simplifies comparing profit margins of different companies. Operating margin operating income net sales operating income is the difference between income generated from your operations minus all expenses you must incur to run your business.

2 operating profit vs. For example if a business had total gross sales of 100 000 for the accounting period and reported a net profit of 10 000 the business had a 10 percent net profit margin. The profit margin represents a view in percentage terms of the operating income left after all expenses have been deducted. The key difference between the two is the non operating activities that are not included in the measurement of the operating margin.

The operating margin measures the percentage return generated by the core activities of a business while the profit margin measures the percentage return on all of its activities. Like gross profit margin operating profit margin can be expressed as a percentage by multiplying. Expressed as a percentage the net profit margin shows how much of each dollar collected by a company as revenue translates into profit. A large company might have what looks like a significant amount of operating profits but if it s operating costs are high it may have a low profit margin.

Operating margin operating profit represents the profit in dollar terms after incurring the direct costs associated with producing the goods and services sold by the business entity and all the operating expenses including the depreciation and amortization incurred during the operating cycle. Net profit margin takes into consideration the interest and taxes paid by a company. These activities typically include financing transactions such as interest income and interest expense.