Variable Costing Income Statement Meaning

6 per unit sold the manufacturing cost per unit is as follows.

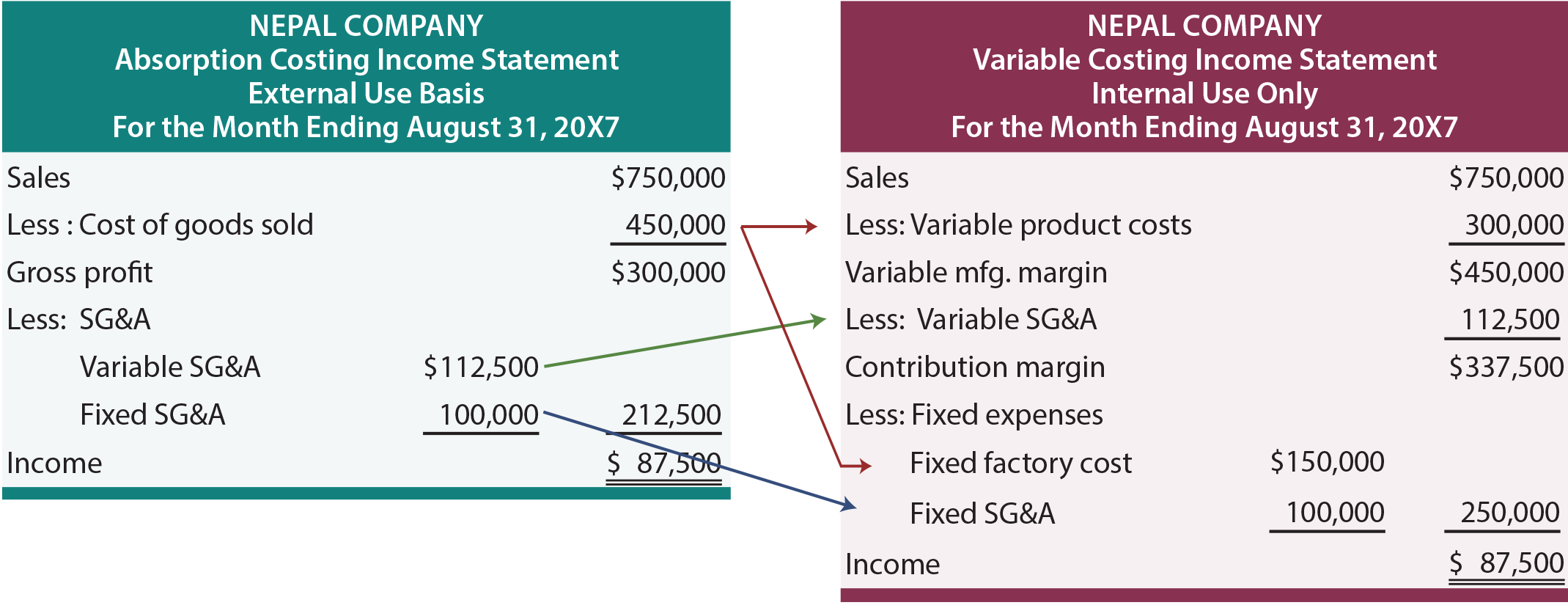

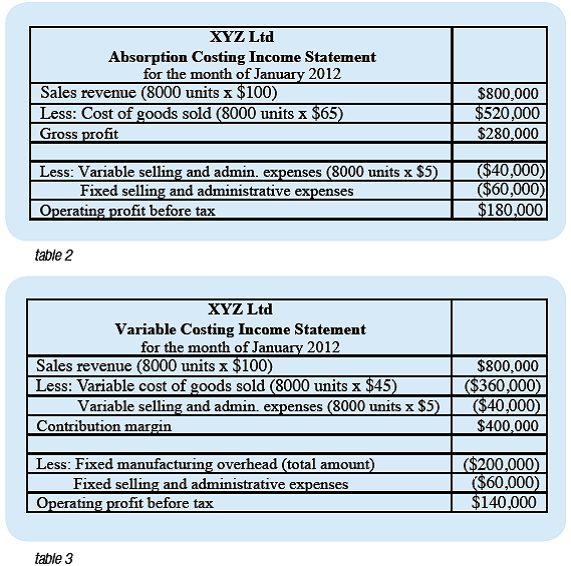

Variable costing income statement meaning. Notably traditional reports can be. Hence with both methods he arrives at the same conclusion but the difference is in the way each method allocates the fixed manufacturing overheads on the income statement. The logic behind this expensing of fixed manufacturing costs is that the company would incur such costs whether a plant was in production or idle. Variable costing income statement is an income statement where contribution margin is represented separately.

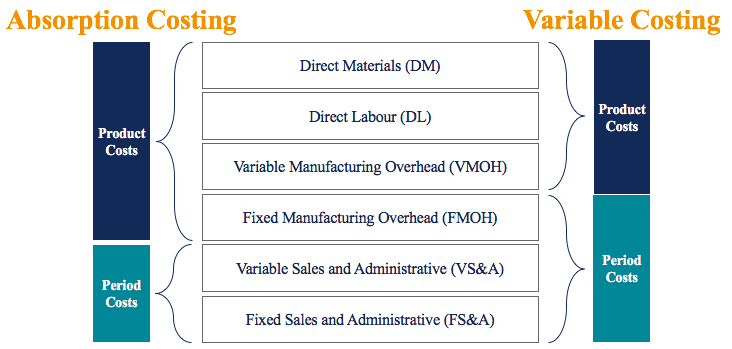

Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is incurred in the period that a product is produced. It is useful to create an income statement in the variable costing format when you want to determine that proportion of expenses that truly. Therefore the phrase absorption costing income statement cost of goods sold that is often used in google search to look for recommendations on how to prepare a variable costing income statement is incorrect. From this all fixed expenses are then subtracted to arrive at the net profit or loss for the period.

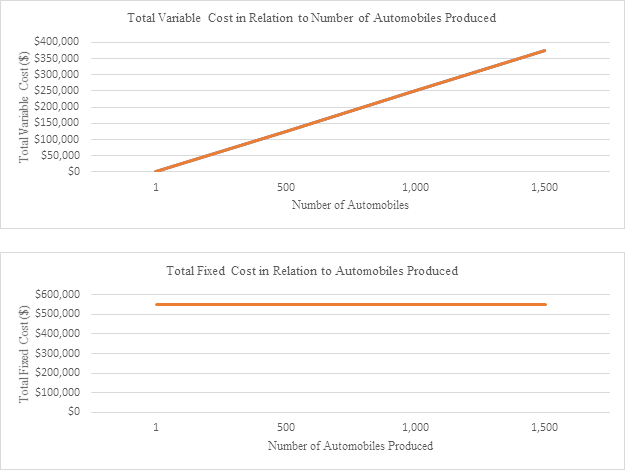

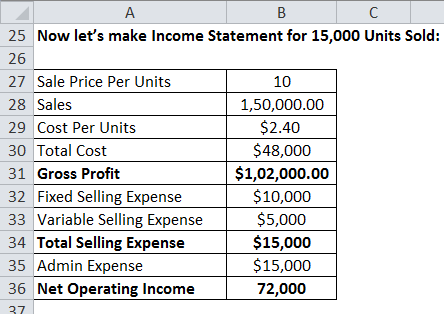

It is useful to determine the proportion of expenses that actually varies directly with revenues. We can clearly see in the income statement absorption costing reports an operating income of 12 100 whereas variable costing says an operating profit of 6 100. Absorption costing income statement of arora company for the first two years of operations is as follows. Variable costing means a method of accounting for production expenses where all variable costs are included in the product.

Thus income reporting differs under both cost accounting methods. It considers the variable costs exclusively. It is done by deducting fixed expenses and removing from the revenue with variable expenses appearing with corresponding contribution margins. Variable costing statement is different.

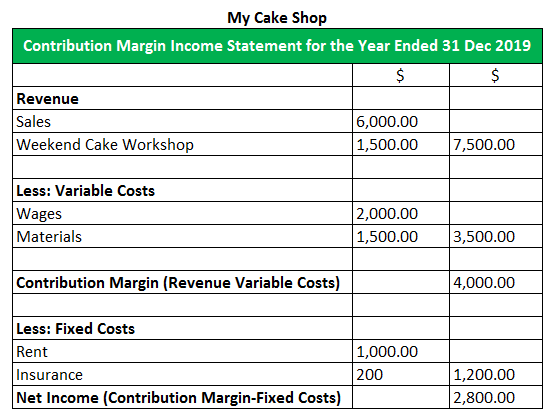

Variable costing also known as direct costing treats all fixed manufacturing costs as period costs to be charged to expense in the period received under variable costing companies treat only variable manufacturing costs as product costs. A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. Variable costing is one of approach which is used for the purpose of valuation of inventory or calculation of the cost of the product in the company where only the cost linked directly with the production of output are applied to the inventory cost or the cost of the production and other expenses are charged as expense in the income statement.

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)