Income Taxes Shelby Ohio

E file them directly with the irs.

Income taxes shelby ohio. Shelby county annex floor 3 129 e. Order online tickets tickets see availability directions. Sidney oh 45365 p. Under the standard rule that income level would allow for 1 081 to be budgeted for housing expenses each month at the most.

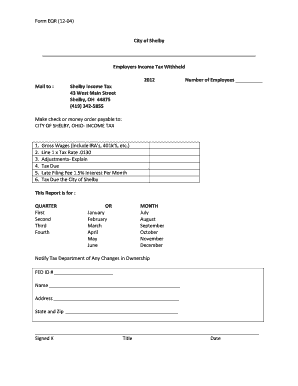

We can file your payroll taxes with the federal and state. Effective january 1 2015 the city of shelby tax on earned income is 1 50. This tax will become effective january 1 2006 and applies to all individuals who reside in the shelby city school district and to any income of estates of decedents who at the time of their death lived in the district. In business for over 30 years.

We can prepare your personal income tax returns and schedules. Visit the h r block tax office at 206 mansfield ave shelby oh for tax preparation and financial services. Shelby city schools income tax information. Schedule an appointment with a tax professional today.

This rate includes any state county city and local sales taxes. Renters on the other hand earn about 29 545 per the median income. Reviews 419 342 5885 website. Ohio state income tax is 28 higher than the national average.

The latest sales tax rate for shelby oh. Menu reservations make reservations. For residents who live in shelby and work in other municipalities or villages with an income tax effective january 1 2019 a credit is applied up to the first 75 of earned income the other 75 of earned income of which 30 was levied and passed to pay for the shelby justice center and 20 was. Get directions reviews and information for income tax department in shelby oh.

On may 2005 voters approved a 1 income tax to support shelby city schools. Monday thursday 8 30 am 4 30 pm friday 8 30 a m.