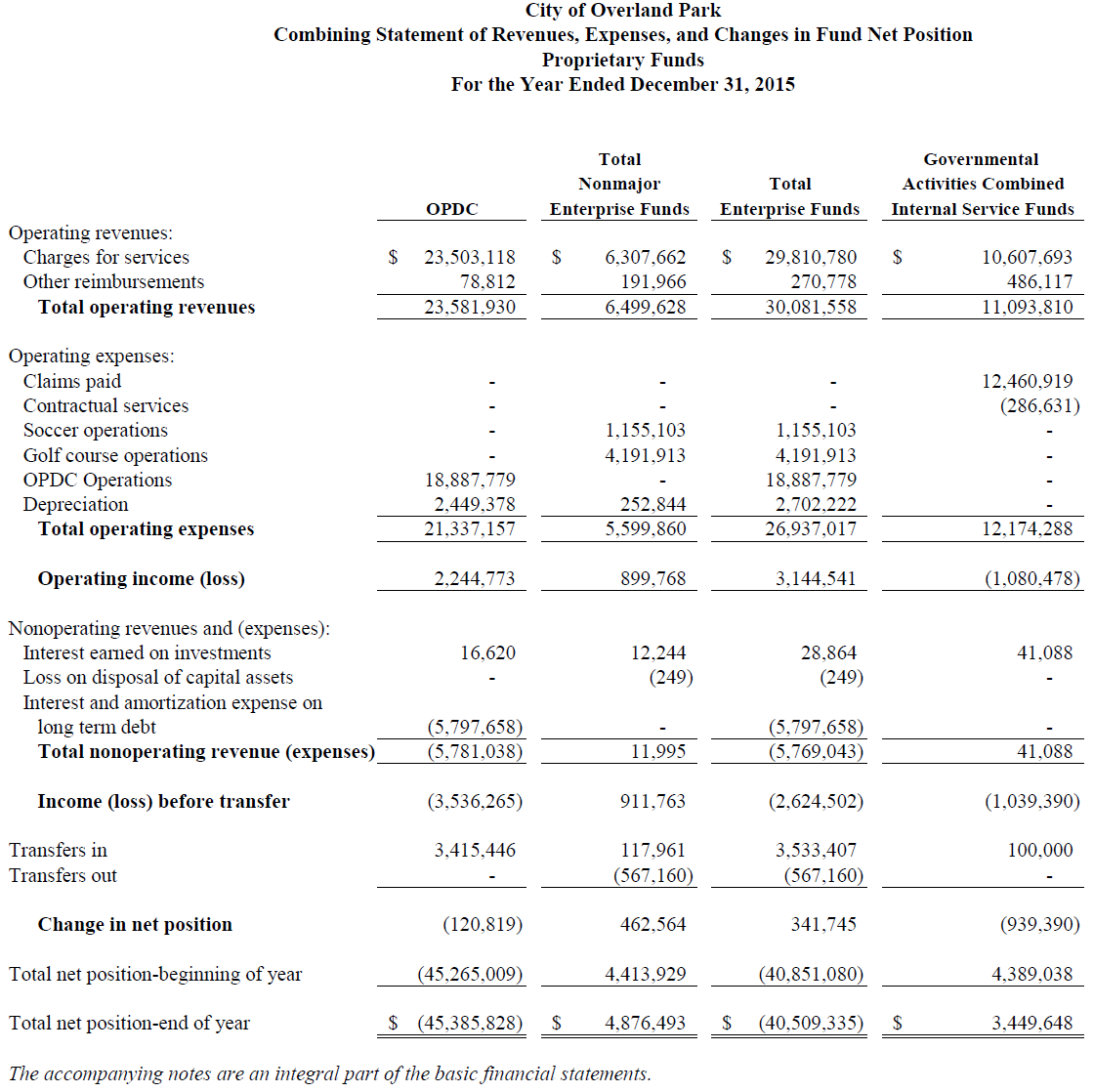

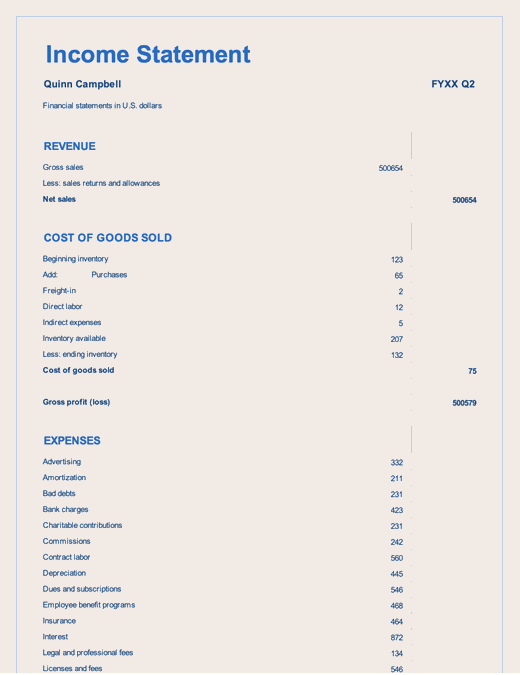

Income Statement List The Revenues And Expenses

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

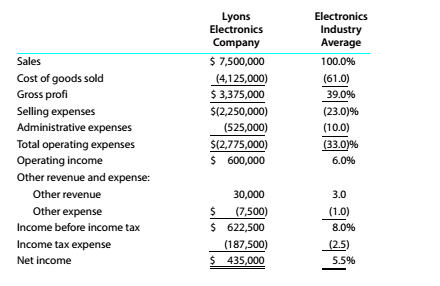

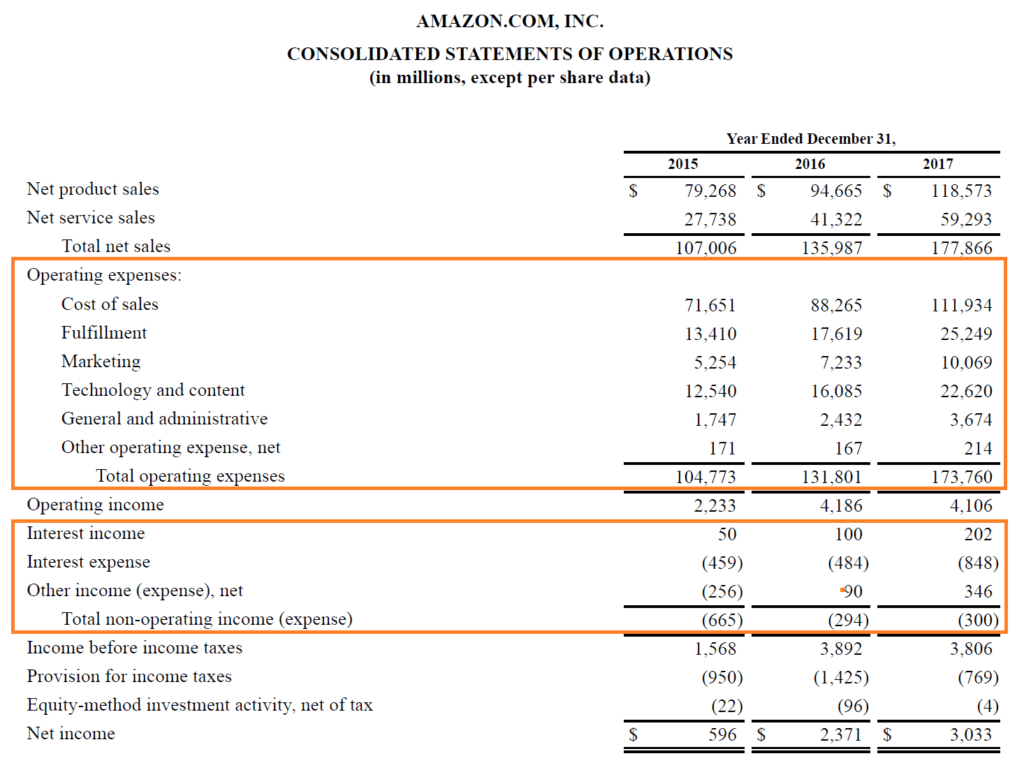

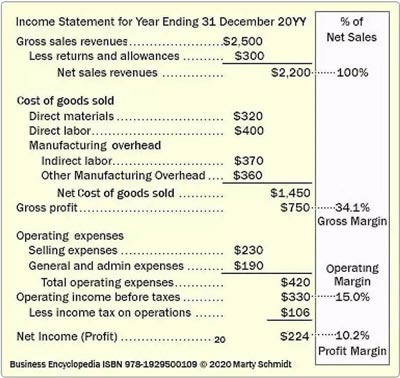

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

Income statement list the revenues and expenses. List of revenue accounts. Projecting income statement line items. When a business uses the accrual basis accounting method the revenue is counted as soon as an invoice is entered into the accounting system. This connection between the income statement.

Being able to project the main line items of the income. Sales revenue from selling goods to customers. Notice that the year to date net income bottom line of the income statement increased stockholders equity by the same amount 180. Other names for net income are profit net profit and the bottom line income is realized differently depending on the accounting method used.

But the expense piece on the income statement must be recorded in december to match it with the revenues that these employees helped to generate in december. The income statement comes in two forms multi step and single step. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. After the entries through december 3 have been recorded the balance sheet will look like this.

In january the company obtains a two year loan from the bank for 10 000. Net income is revenue less expenses. Another couple of examples. A larger organization may have hundreds or even thousands of income statement accounts in order to track the revenues and expenses associated with its various product lines departments and divisions.

It is the principal revenue account of merchandising and manufacturing companies. Other account titles may be used depending on the industry of the business such as professional fees for professional practice and tuition fees for schools. The income statement can either be prepared in report format or account format. The income statement summarizes a company s revenues and expenses over a period either quarterly or annually.

Revenues and expenses appear on the income statement as shown below. When building a three statement model 3 statement model a 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. Service revenue revenue earned from rendering services. 4 8 21 contents1 revenue definition 2 revenue examples 3 operating revenue definition 4 operating revenue examples 5 non operating revenue definition 6 non operating revenue examples 7 expenses definition 8 expenses examples.

In financial accounting an inflow of money usually from sales or services thru business activities is called as revenue. The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)