How To Prepare Variable Costing Income Statement

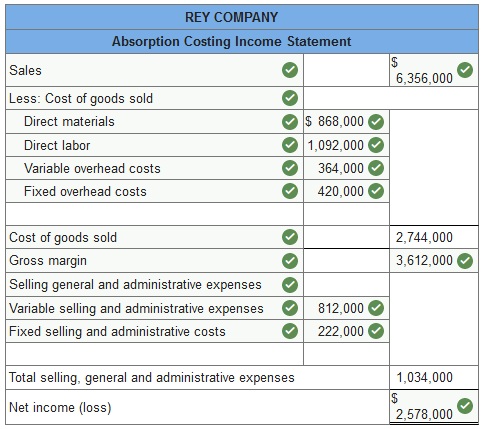

The variable costs will include relevant variable administrative costs and any variable cost related to production.

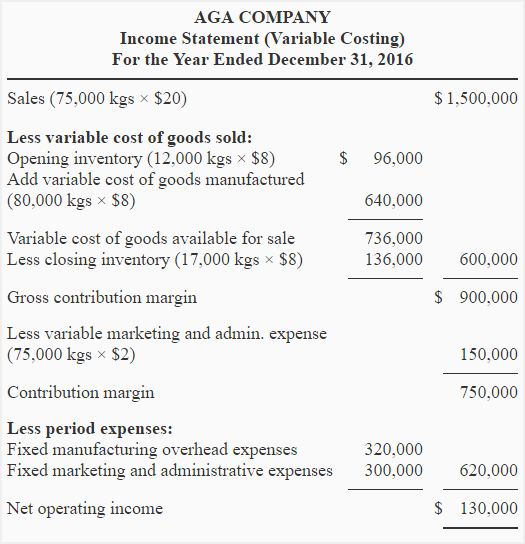

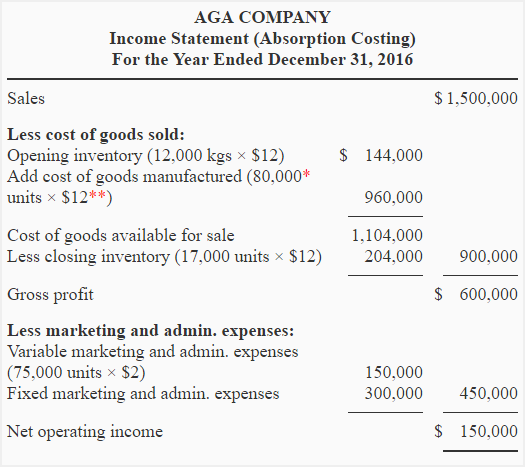

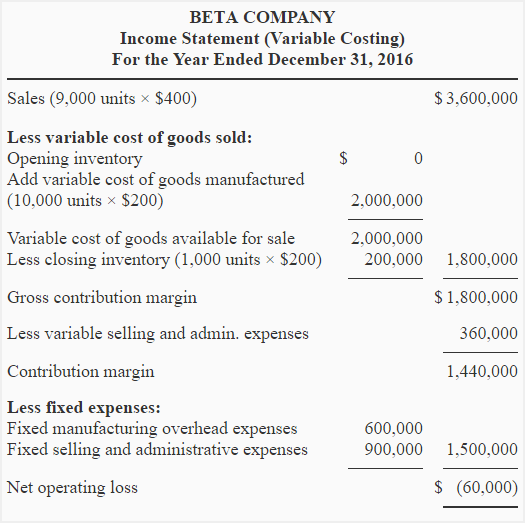

How to prepare variable costing income statement. Explanation of the variable costing formula. Solution 1 variable costing income statement. Variable expenses fixed expenses 8 320 000 80 000 kgs 8 4 12 b variable costing income statement. The variable costing formula can be calculated in the following five steps.

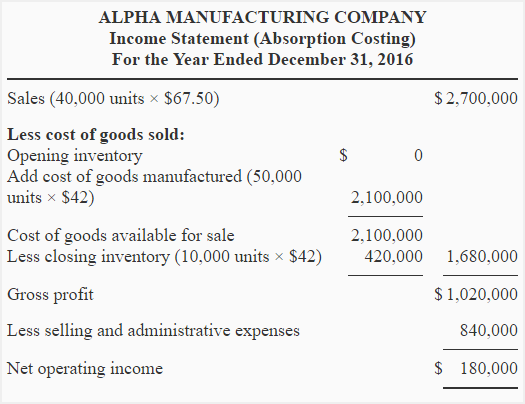

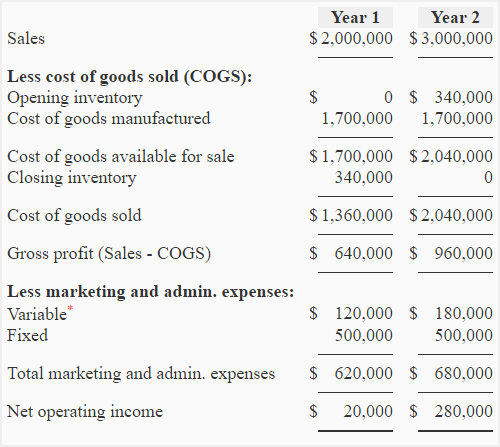

Notably traditional reports can be. Sales 9 000 x 8 per unit 72 000. For reconciliation of net operating income figures. Firstly direct labor cost directly attributes to production.

Prepare a variable costing income statement using above information. Cost of goods sold 9 000 x 3 30 per unit 29 700 selling expenses 9 000 x 0 20 per unit 1 800 total variable costs 31 500. The direct labor cost is derived according to the rate level of expertise of the labor and the number of hours employed for the production. From this all fixed expenses are then subtracted to arrive at the net profit or loss for the period.

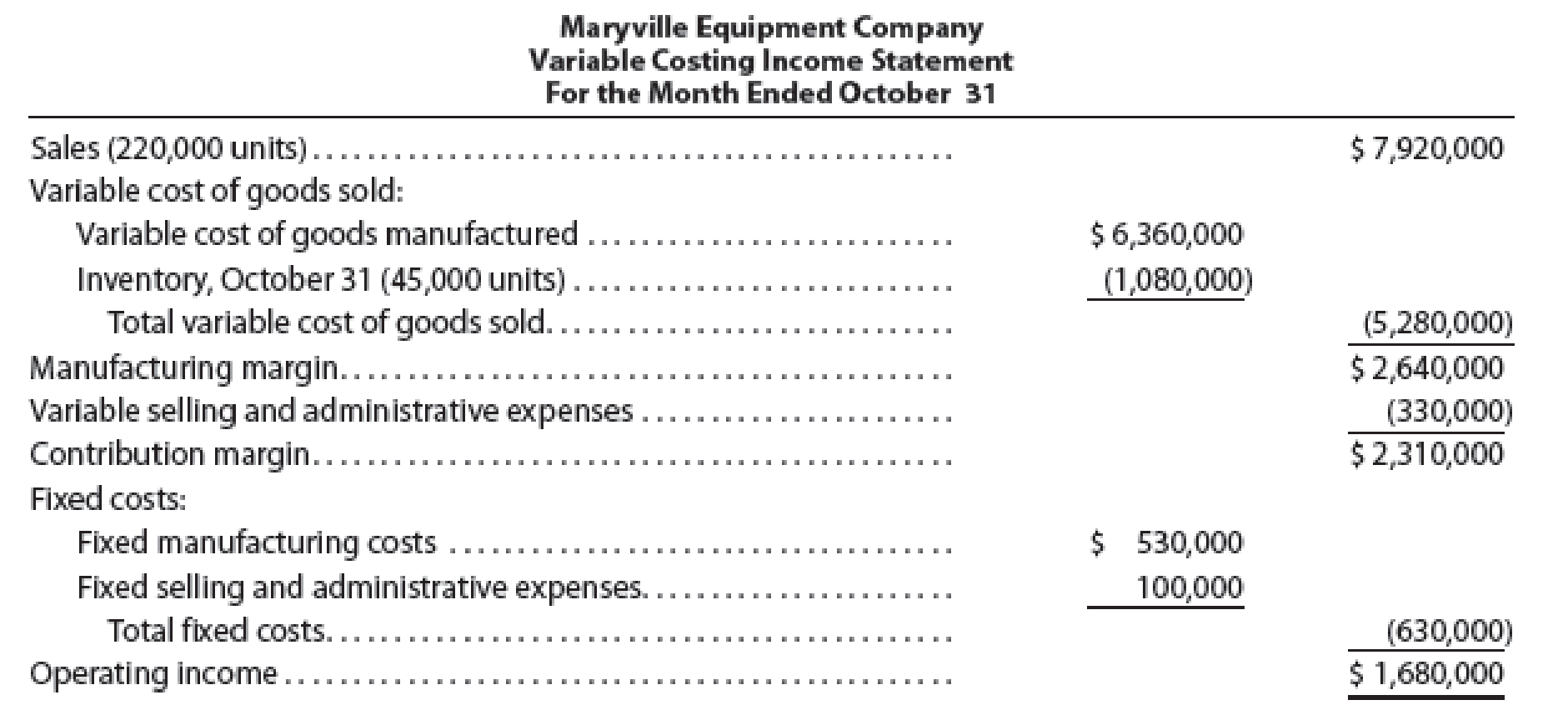

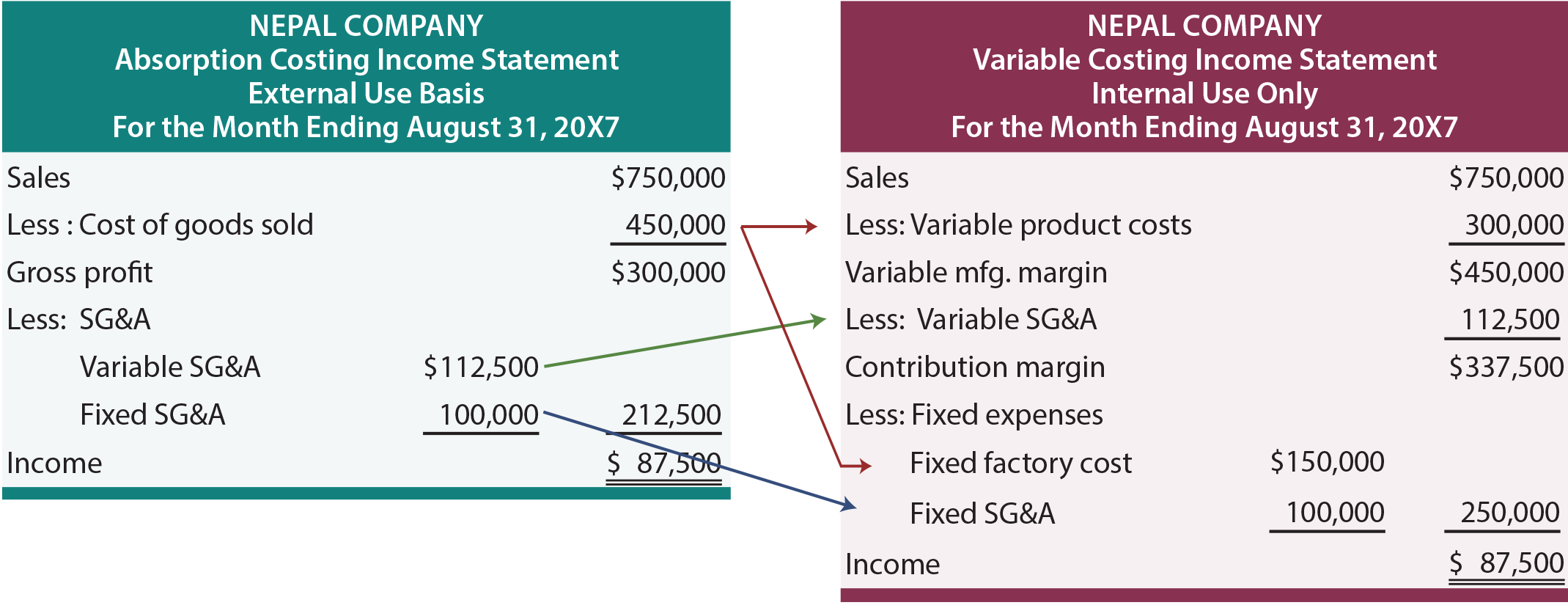

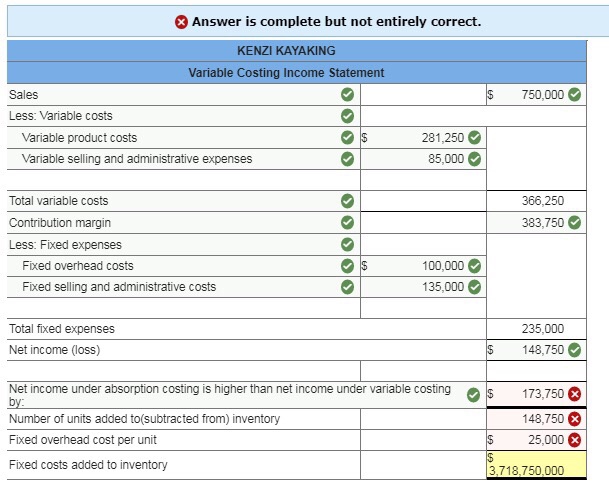

Income statement variable for month ended may. Fixed overhead fixed portion only 6 000. Therefore the phrase absorption costing income statement cost of goods sold that is often used in google search to look for recommendations on how to prepare a variable costing income statement is incorrect. The variable costing income statement is one where all variable expenses are subtracted from revenue which results in contribution margin.

Reconcile net operating income figures obtained under two costing systems. To do this you ll need your sales revenue and variable cost information. It is useful to create an inc. Variable costing statement is different.

The first step in creating your contribution margin income statement is to calculate the contribution margin. It considers the variable costs exclusively.