Income Tax Sme Definition

Bhd rents a shop lot to b which is an eligible sme for rm5 000 a month rm60 000 yearly.

Income tax sme definition. A direct tax is a tax that is levied on a person or company s income and wealth. The uk definition of sme is generally a small or medium sized enterprise with fewer than 250 employees. The definition of sme used by sme corporation and bank negara malaysia for purposes of granting financial assistance is not found in the act for income tax purposes. Each country has its own definition of what constitutes a.

Examples of direct tax are income tax and real property gains tax. Sme definition what is an sme. The definition of an sme is based on the national sme s definition as follows. Example of deduction calculation.

Small and mid size enterprises smes are businesses that maintain revenues assets or a number of employees below a certain threshold. The eu also defines an sme as a business with fewer than 250 employees a turnover of less than 50 million or a balance sheet total of less than 43 million. The tax is paid directly to the government. It was not until the sixteenth amendment was ratified in 1913 that the federal government assessed taxes on income as a.

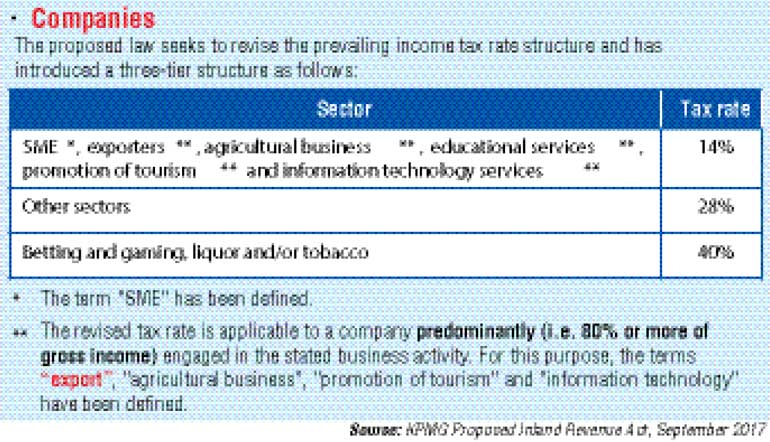

Tax and smes like every business smes are not exempted from payment of taxes. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn. Definition of sme in fact there is no definition of sme under the income tax act 1967 the act. Smes with a paid up capital of rm2 5 million and below are eligible for a reduced corporate tax rate of 20 on the chargeable income of up to rm500 000.

The tax rate on the remaining chargeable income is maintained at 28. An income tax of 3 was levied on high income earners during the civil war. Dividends distributed will be given a tax credit of 20 in the hands of the shareholders. Any registered business whether sme or not are expected to remit one form of tax or another to the relevant statutory bodies upon registration as a company with the corporate affairs commission cac and commencement of business.

A business is considered as sme if it meets one of the two eligibility criteria. Sme taxation in europe an empirical study of applied corporate income taxation for smes compared to large enterprises 2015 this report analyses tax incentives for smes in 20 eu countries and five non eu countries between 2009 and 2013. Landlord building owner lessor must be a taxpayer having rental source under section 4 a and 4 d of the income tax act 1967.

:max_bytes(150000):strip_icc()/dotdash_Final_Small_and_Mid-size_Enterprise_SME_Jun_2020-01-167470ed3ba847aaa6a9acc411e039a3.jpg)