Federal Income Tax Withholding Tables 2020 Calculator

1 2020 you determine your 2020 irs paycheck tax withholding by tax return filing status pay period paycheck income and most importantly by the estimated.

Federal income tax withholding tables 2020 calculator. The new 2020 w 4 tax withholding form no longer lets you enter allowances. In 2020 there are more than 30 inflation based calculations to establish the schedules of the tax bracket. The quantity of federal withholding tax is changed each year based on the usa tax code and has actually been so given that the 1980s. The payucator tool below will provide you with your actual paycheck federal or irs tax withholding amount per selected pay period during tax year 2020.

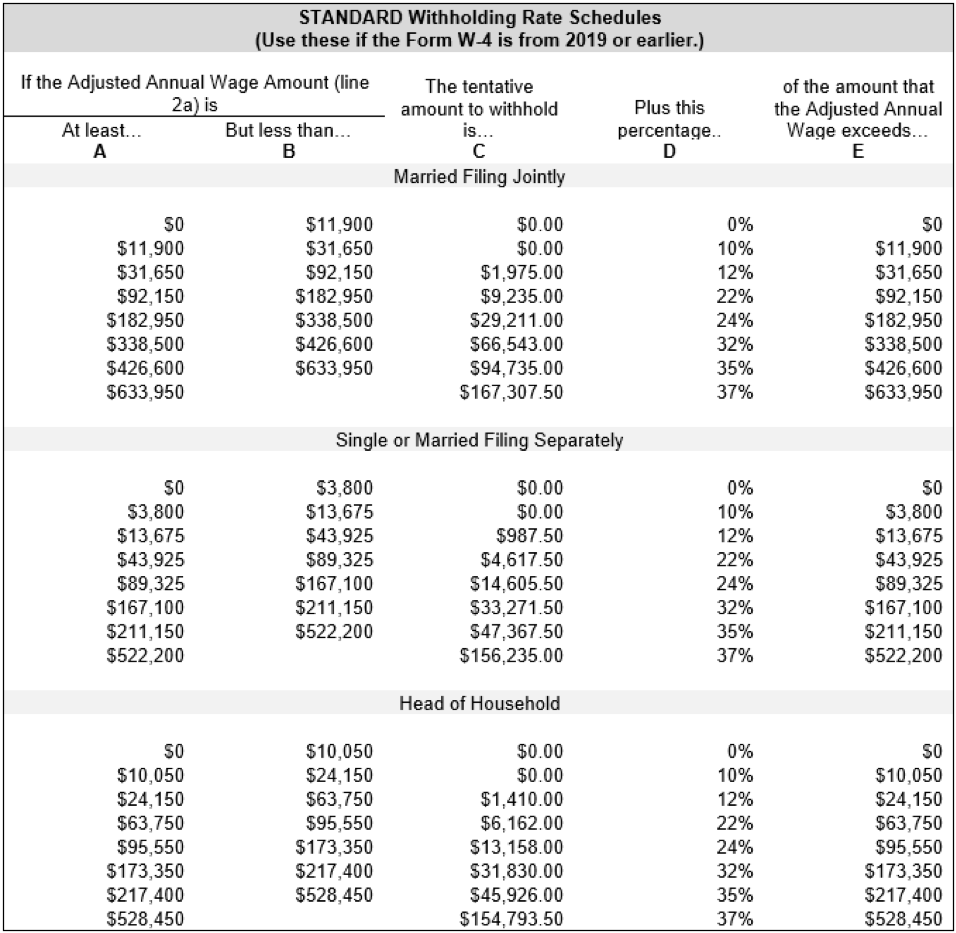

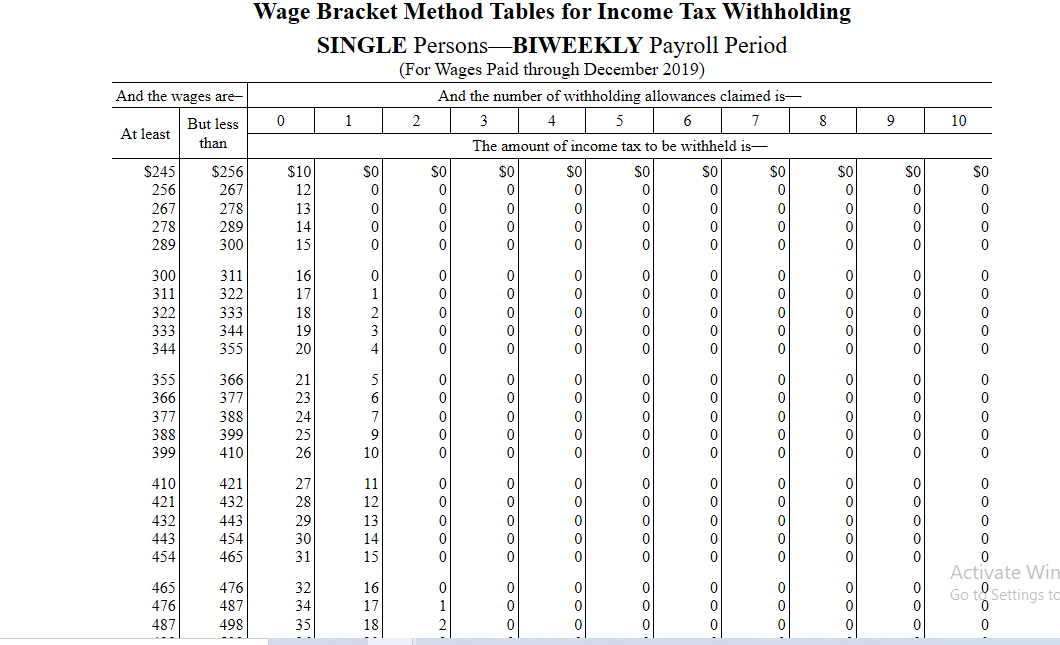

Federal income tax withholding tables 2020. So if you do not file a new form w 4 for 2020 your withholding might be higher or lower than you intend. Icalculator aims to make calculating your federal and state taxes and medicare as simple as. You might check the withholding tax in 2020 on the following tables.

A mid year withholding change in 2019 may have a different full year impact in 2020. How to calculate federal tax based on your annual income. The 2020 tax calculator uses the 2020 federal tax tables and 2020 federal tax tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.