Income Tax On 1040

There are 3 different versions of the standard tax return.

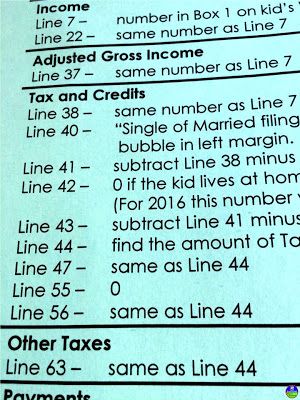

Income tax on 1040. Information about form 1040 u s. Write in on schedule 1 form 1040 or 1040 sr part ii line 22 or form 1040 nr line 34. The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government. Individual income tax return including recent updates related forms and instructions on how to file.

Most likely you ll be filing the 1040a. Corporations will use form 1120 and partnerships will use form 1065 to file their. On the dotted line next to line 22 or line 34 depending on which form is filed enter the amount of the adjustment and identify it using the code ed67 e. Income tax returns for individual calendar year taxpayers are due by tax day which is usually april 15 of the next year except when april 15 falls on a saturday sunday or a legal holiday.

The form contains sections that require taxpayers to disclose. In those circumstances the returns are due on the next business day. Form 1040 is an irs tax form used for personal federal income tax returns filed by united states residents. If you re filing a zero income tax return you ll probably not be using a 1040ez which is for individuals with no dependents claiming no credits.

Form 1040 is the standard internal revenue service irs form that individual taxpayers use to file their annual income tax returns. In the u s individuals use variations of the internal revenue system s form 1040 to file federal income taxes.