Insurance Proceeds Income Statement Presentation

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

A from your subject you could have two types of losses to account for.

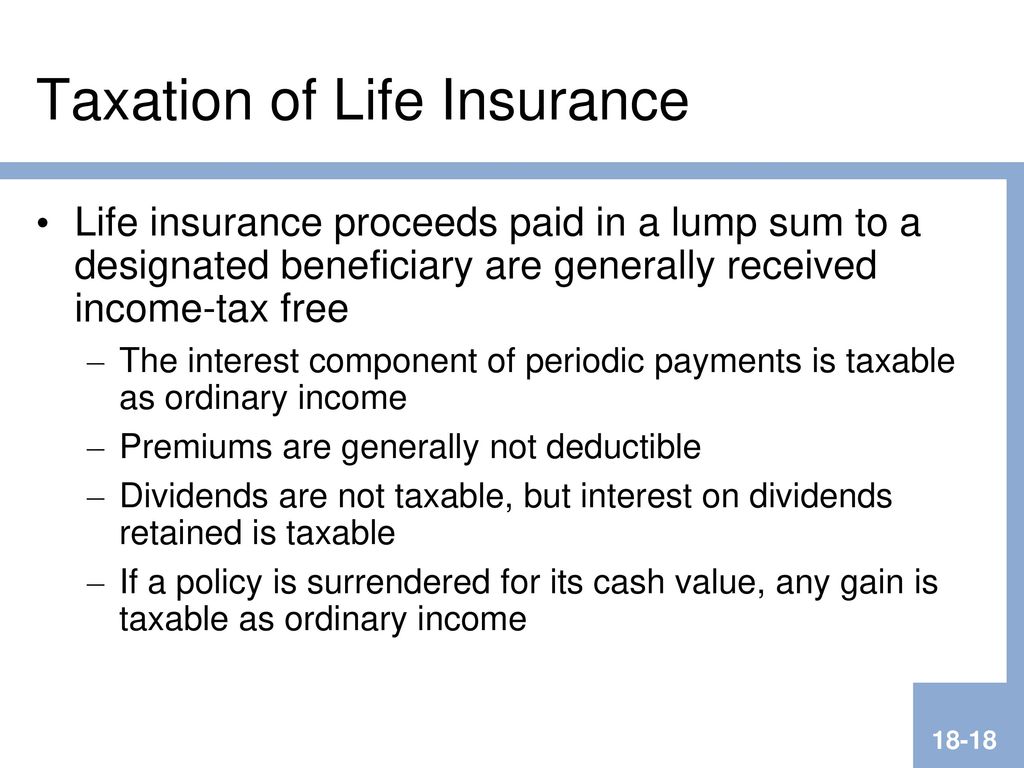

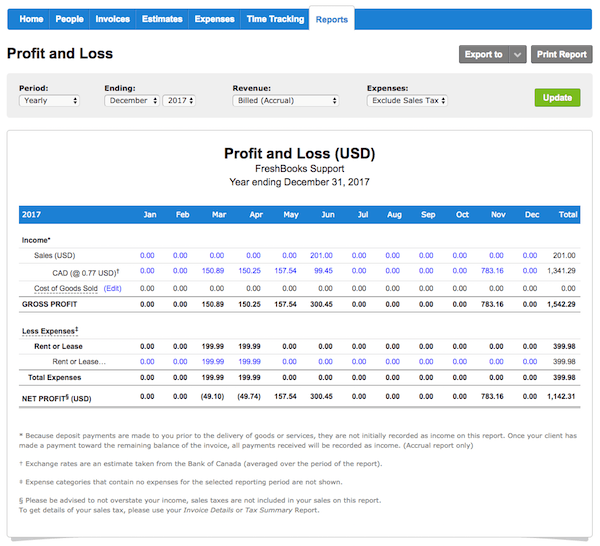

Insurance proceeds income statement presentation. Years ended december 31 dollar amounts in thousands except per share data 2019 2018 2017 interest and dividend income. To the reimbursement be resolved and collection be estimable and probable in order to be recorded in the financial statements. B have a meeting with your insurance agent and his company s adjuster to determine what. Risk mgmt insurance 56.

Write off the damaged inventory to the impairment of inventory account. All entities should carefully evaluate the balance sheet presentation of any similar contingent liabilities with related insurance recoveries. Our financial reporting guide financial statement presentation details the financial statement presentation and disclosure requirements for common balance sheet and income statement accounts it also discusses the appropriate classification of transactions in the statement of cash flows and addresses the requirements related to the statements of stockholders equity and other comprehensive. Business interruption and 2.

Consolidated statements of comprehensive income. Insurance proceeds versus insurance expenditures. On the other hand using similar facts above if the number of insurance proceeds was determined to be probable and estimable as of december 31 2018 the revenue and receivable would then be recognizable in the 2018 financial statements. Loans including fees.

The process is split into three stages as follows. The journal entries below act as a quick reference for accounting for insurance proceeds. Business insurance fundamentals gaap guidebook. Many businesses report unusual extraordinary gains and losses in addition to their usual revenue income and expenses in an income statement.

Illustrates one continuous statement of income and comprehensive income in condensed format for illustration purposes only. When the claim is agreed set up an accounts receivable due from the insurance company. As a cpa having worked with a cpa firm which supported insurance adjustors let me try to be brief about the complex issue of accounting for insurance claim proceeds from a fire loss. Recoveries associated with rental income loss would be recorded in operations while proceeds related to loss of a.

A discontinuity is something that disturbs the basic continuity of its. After subtracting the amount of insurance proceeds from existing policies that can cater to this need like disability income insurance from the total amount the shortfall is derived certified financial planner module 2. Financial statement presentation matters. Every business experiences an occasional discontinuity a serious disruption that doesn t happen regularly or often and can dramatically affect its bottom line profit.

It may be necessary to disclose in the financial statement footnotes the nature of the events resulting in insurance proceeds the amount of the proceeds and the income statement line item in which the resulting gain is recorded.

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)