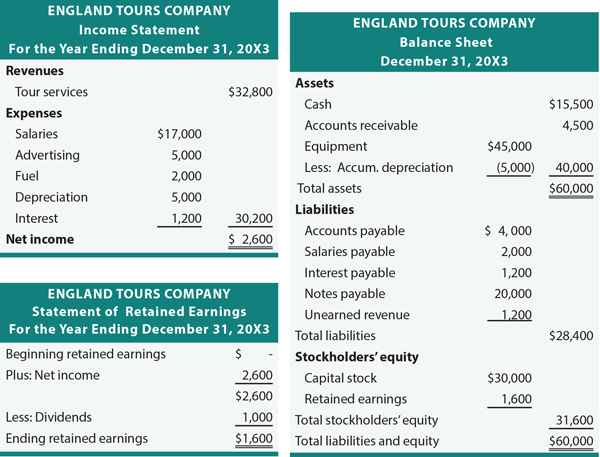

Income Statement Accounts Are Also Known As Temporary Accounts

Income statement accounts are also known as which of the following.

Income statement accounts are also known as temporary accounts. Both a and b financial statements. It is never closed out to zero. None of these c. The income statement accounts record and report the company s revenues expenses gains and losses.

Examples of temporary accounts there are basically three types of temporary accounts namely revenues expenses inventoriable costs inventoriable costs also known as product costs refer to the direct costs associated with. There are three. The balances in temporary accounts are used to create the income statement. Income statement accounts that are closed out to a zero balance at the end of an accounting period.

Permanent accounts balance sheet accounts that retain a perpetual balance. Both a and b a. Permanent accounts income statement accounts are also called. After the amounts for the year have been reported on the income statement the balances in the temporary accounts will end up in a permanent account such as a corporation s retained earnings account or in a sole proprietor s capital account.

Nominal accounts are also called temporary accounts and are defined as the account types that determine the net loss and profits in the balance sheets. The real accounts are also known as permanent accounts and are kept open throughout a year and its balances are carried forward to the next accounting year. At the end of a fiscal year the balances in temporary accounts are shifted to the retained earnings account sometimes by way of the income summary account. Income statement accounts are also known as which of the following.

Income statement accounts are also referred to as temporary accounts or nominal accounts because at the end of each accounting year their balances will be closed.

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)