Income Tax Calculation Statement For The Financial Year 2020 21 Form

The finance minister has proposed to bring a new and simplified personal income tax regime wherein income tax rates will be significantly reduced for the individual taxpayers who forego certain deductions and exemptions however the same is options to individual.

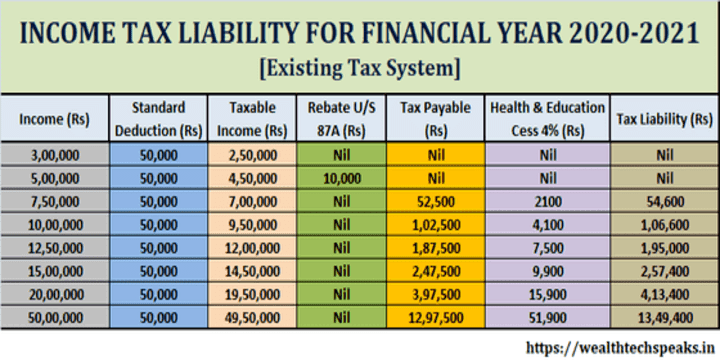

Income tax calculation statement for the financial year 2020 21 form. For income tax calculator for fy 2020 21 ay 2021 22 click here to download in excel. Suppose your total income in fy 2020 21 is rs 16 lakh. Five year time deposit in post office. Tax credit of 12 500 for income up to 5 00 000 under section 87a.

Contribution to nps max 10 of basic da. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Format for financial year 2020 21 assessment year 2021 22. Salary challenge entry facility and 10 e form preparation field is provided in the new version.

The calculation of income tax that you are liable to pay under the new tax regime can be explained with an example. Form 16 is also known as the income tax calculator and it consists of two parts part a and part b if you want to file it returns for the financial year 2019 20 in the assessment year 2020 21 then you can easily calculate your net income tax return amount by using the above form 16 excel format. Annual return of salaries under section 206 of the income tax act 1961 for the year ending 31st march form no 24 see section 192 and rule 37 annual return of salaries under section 206 of the income tax act 1961 for the year ending 31 st march iii the amount of tax shown in. Income tax calculator salary statement and form 16 generator for the fy 2019 20.

Slabs are the same both for male female. Income tax calculator in excel. For income tax calculator for fy 2018 19 ay 2019 20 click here to download in excel for free. Further during the year your employer has contributed rs 60 000 to your nps account which is eligible for deduction under section 80ccd 2.

Total rent paid for the financial year. To calculate interest for fy 2018 19 ay 2019 20 click here to download in excel for free. Anticipatory income tax calculator for 2020 21. Actual hra received during the year.

The tool is designed to prepare anticipatory income tax statements for the financial year 2019 20 ay 2020 21. Tax slab for the financial year 2019 20 the assessment year 2020 21. Income tax calculation sheet for the financial year 2019 20 ay 2020 21 automated salary tax calculator along 15 other features april 4 2019 january 4 2020 payrollexperts 80c deductions 80ddb excel vba dashboard gratuity house rent allowance hra human resource hr income tax tds payroll provident fund pf. Download the malayalam menu based income tax estimator for ugc and kerala govt.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. Income tax statement details hra rebate details.