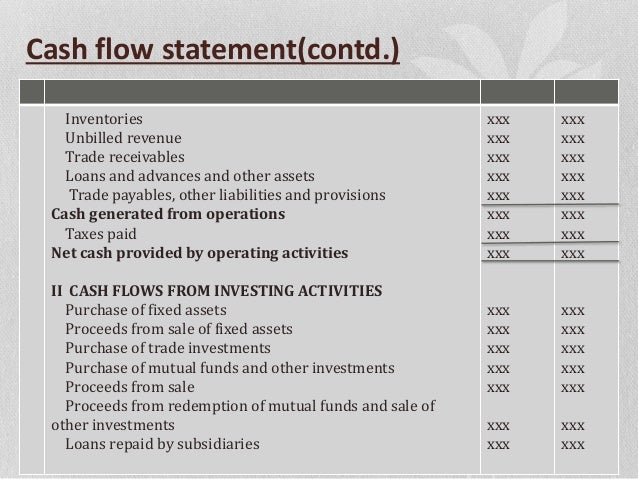

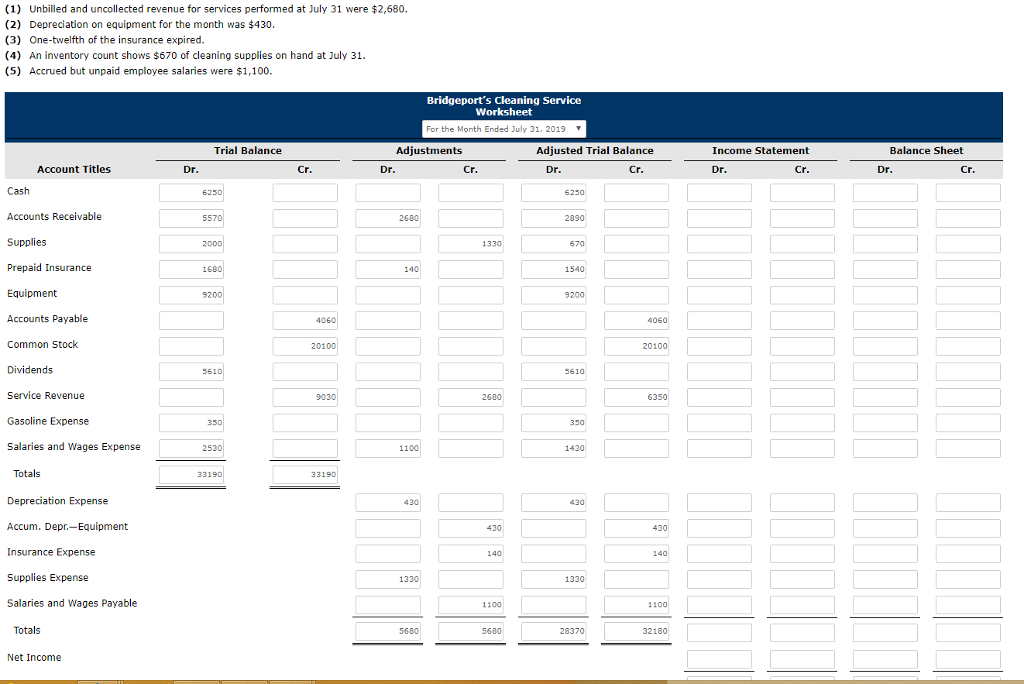

Unbilled Revenue Income Statement

This means that in 2019 there has been a cash inflow of 2500 as unearned revenue which had no impact on the income statement and has been recorded as a current liability in the balance sheet.

Unbilled revenue income statement. We have completed the project. You always like to see the unearned revenue higher than the unbilled. The difference of 2500 6500 4000 shall be reported in the cash flow statement under the operating activities section in order to get net cash. It is that revenue which we have earned but we still did not write the bill or invoice for getting the revenue.

Contract and revenue management is an intacct module that provides an automated solution for the effects of asc 606 and ifrs 15. Contract revenue management a solution for asc 606 and ifrs 15. Recognition of this accrued unbilled income adds to the revenue reported in the income statement and also results in a corresponding asset on the balance sheet. For example we are service company.

For information of unbilled revenue at the beginning of financial year previous year audited financial statement can be used. Gst was implemented from 1 st of july 2017 hence the invoice issued between 1st april 2017 to 30th june 2017 must be excluded for calculation. Whether we have obtained the cash from sale or not we show total sale revenue in our income statement. On january 1 when you run the unbilled revenue accrual process it picks up the revenue of 1 000 usd.

That is consistently the case with granite. Whether we have obtained the cash from sale or not we show total sale revenue in our income statement. We have completed the project. The relationship between unbilled and unearned revenue is a quick way to check a project based business prospects.

In fact at the end of 2016 granite s unearned revenue was 97 5 million while its unbilled revenue was 73 1. At the start of accounting period one the bill consists of one line of activity 1 000 usd. For example we are service company. Unbilled revenue case is different from outstanding revenue.

And it takes care of the various designations contract asset unbilled receivable billed receivable paid or contract liability of revenue from. However you want to recognize unbilled revenue activity monthly at the end of each accounting period. This counts as a prepayment from the buyer perspective for goods and services that need to be supplied at a later date to them. It is that revenue which we have earned but we still did not write the bill or invoice for getting the revenue.

%20(1).png?width=780&name=unbilled-receivable%20(1)%20(1).png)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)