Ohio State Income Tax 401 K Distribution

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Box 18 will be the same as box 5.

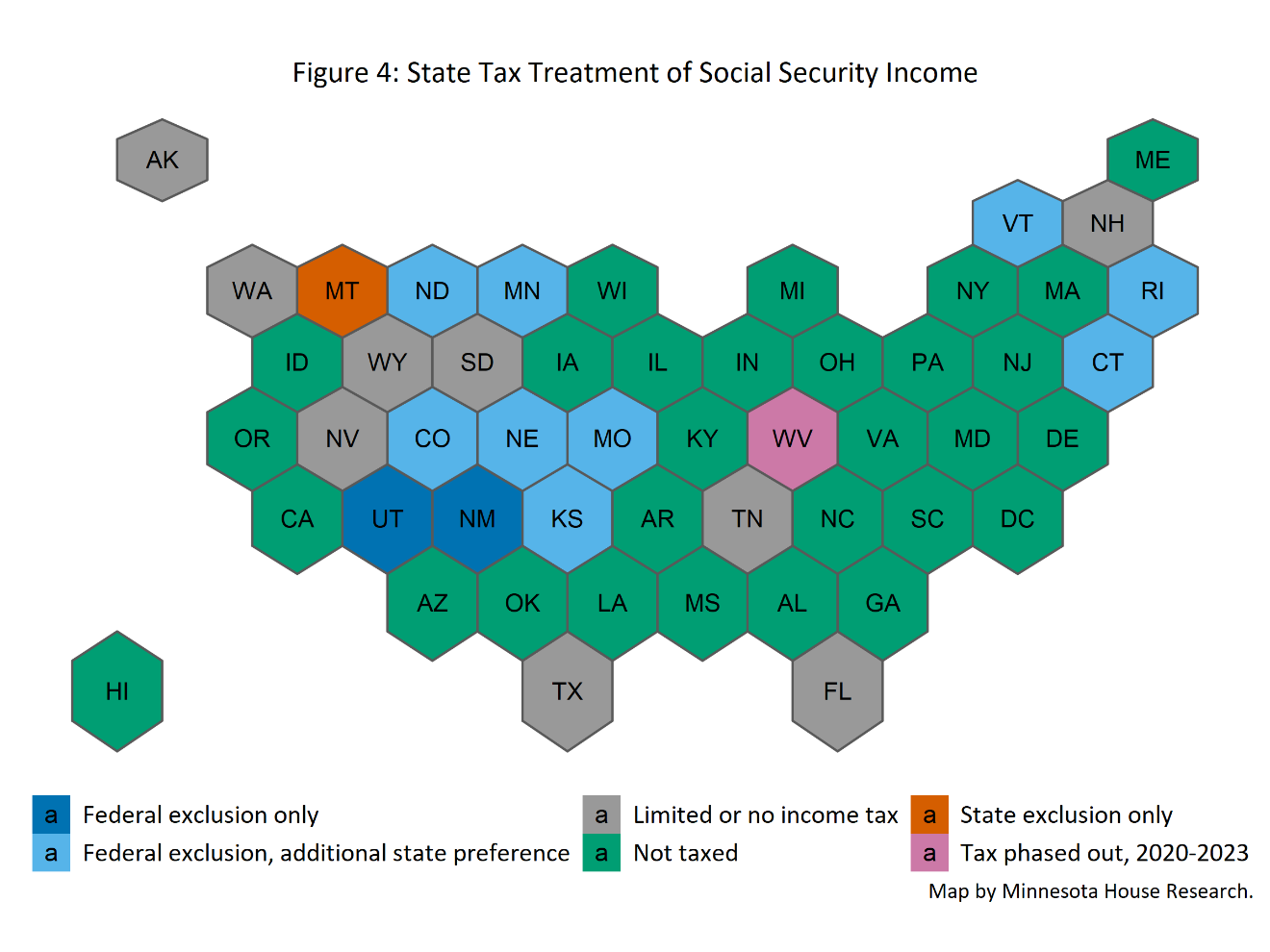

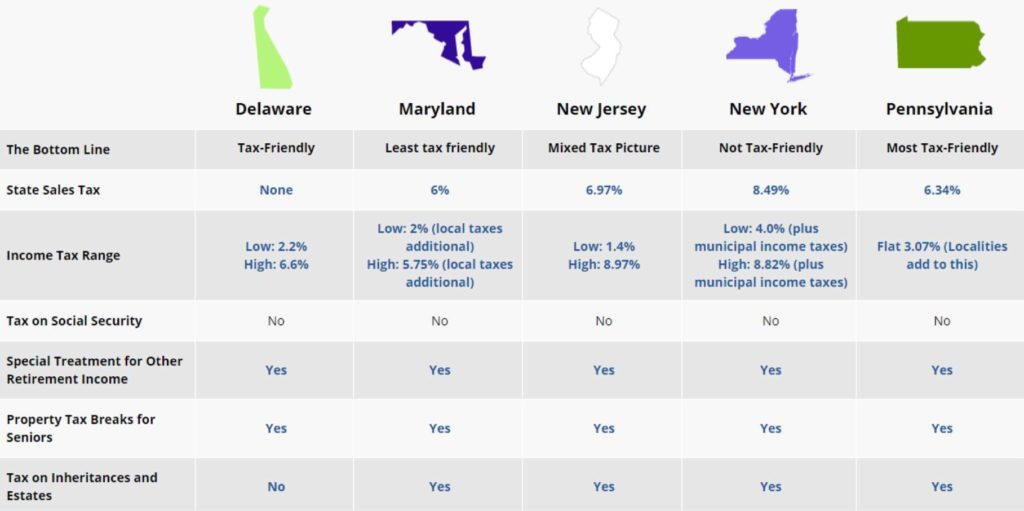

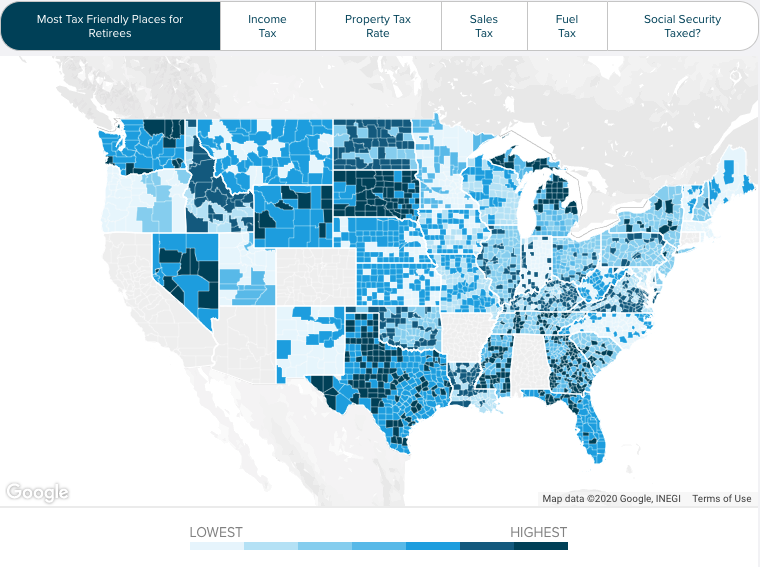

Ohio state income tax 401 k distribution. Alabama arkansas connecticut hawaii idaho illinois kansas louisiana maine massachusetts missouri new jersey north dakota ohio oregon. Social security retirement benefits are fully exempt from state income taxes in ohio. For example 29 states offer a full or partial break on taxes on military retirement income according to wolters kluwer a provider of tax information and services. Overview of ohio retirement tax friendliness.

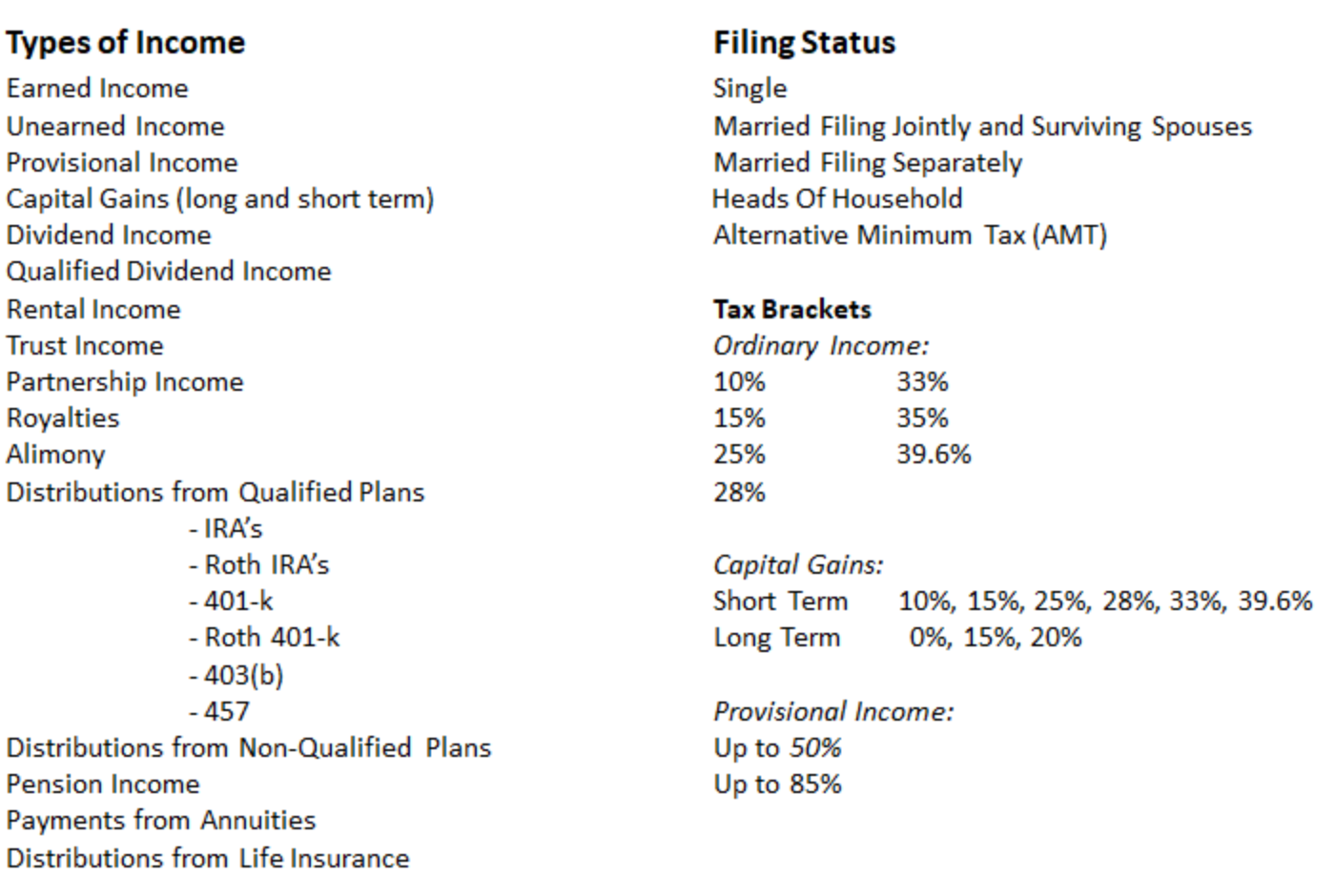

Because payments received from your 401 k account are considered income and taxed at the federal level you must also pay state income taxes on the funds. Taxing retirement plan distributions isn t an all or nothing proposition. Both property and sales tax rates are higher than the national average. The state does not tax your 401k contributions but ohio cities do.

State income taxes also apply to the amount of your 401 k plan cash out. The state income tax rates will be lower than the federal income tax rates but will still take a bit out of your distribution. C a taxpayer who received a lump sum distribution from a pension retirement or profit sharing plan in the taxable year and whose modified adjusted gross income for the taxable year less applicable exemptions under section 5747 025 of the revised code as shown on an individual or joint annual return is less than one hundred thousand dollars may elect to receive a credit under this. Box 16 on the w 2 should be the same as box 1.

Since ohio did not tax your money as you contributed it to your 401 k any money withdrawn from the 401 k is considered income by oh just like it is considered income by the irs. The fiduciary your employer may not withhold for tax purposes but that does not preclude the taxation on the income. Ohio taxes all of your private retirement income. The ohio department of taxation provides the collection and administration of most state taxes several local taxes and the oversight of real property taxation in ohio.

This includes retirement income from all pensions from your employer annuities from either your employer or private insurance arrangements and any retirement account such as a 401k plan ira 403b plan or any other private or employer based retirement scheme. The department also distributes revenue to local governments libraries and school districts.

/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)