Uk Income Tax Rates 2021 22

Supporting the covid 19 recovery.

Uk income tax rates 2021 22. Then with the marginal bands you only pay this tax rate on the stipulated portion of earnings. Member of cfe tax advisers europe registered as a charity no. Income tax rates ay 2021 22. The personal allowance is how much you can earn tax free that is without being legally obliged to pay income tax.

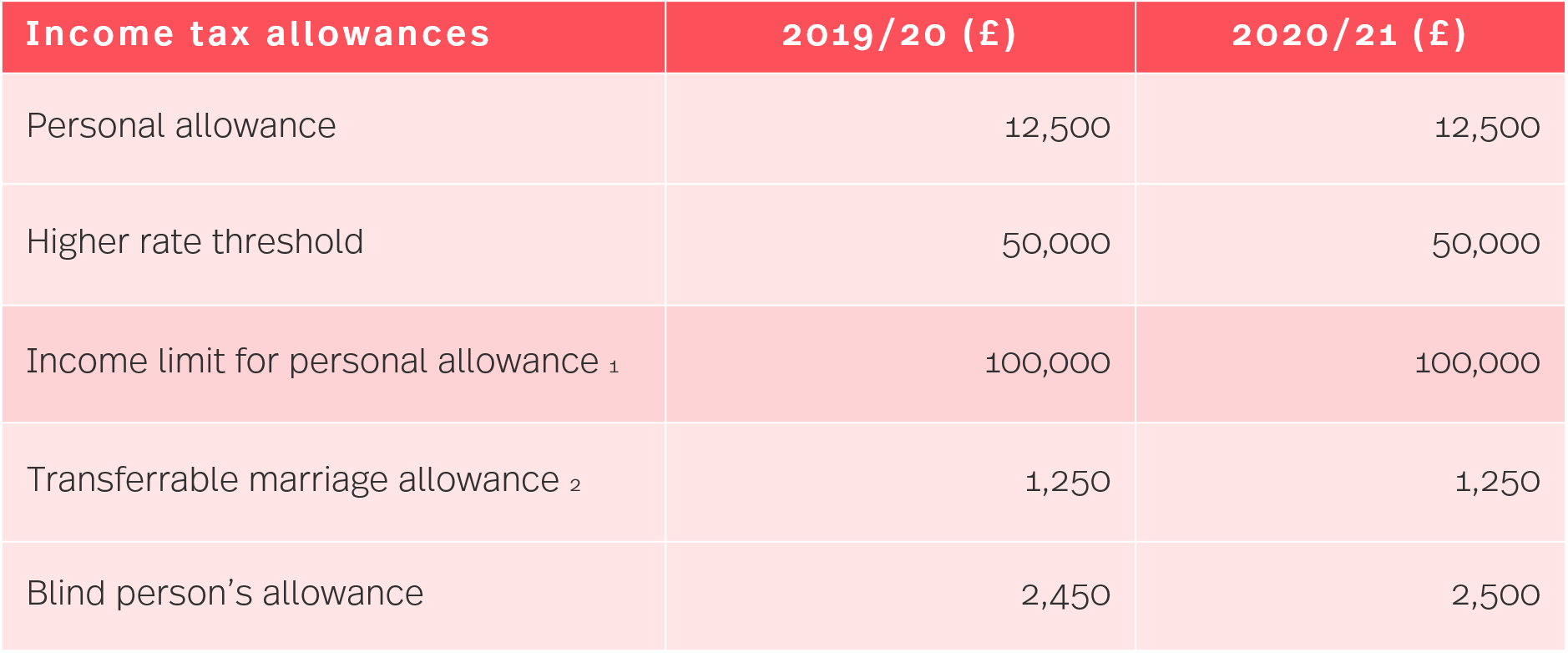

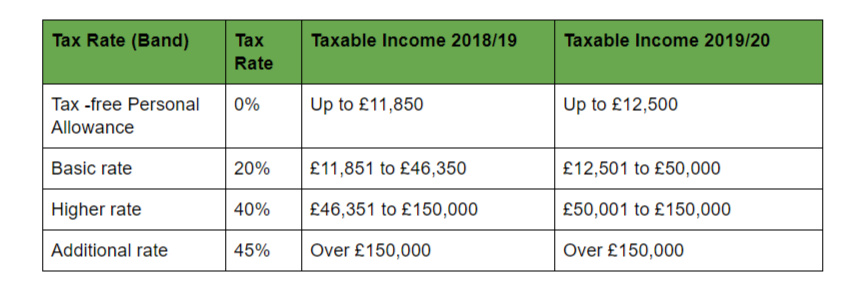

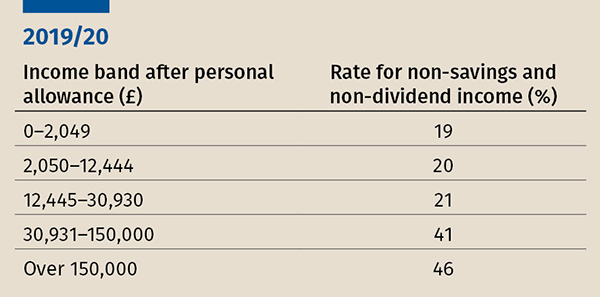

Income limit for personal allowance. Rates allowances and duties have been updated for the tax year 2019 to 2020. Income tax slab rate for ay 2021 22 for individuals opting for old tax regime. The rest of the uk ruk rates are reduced by 10 for welsh taxpayers before writ rates are added back on effectively ensuring welsh taxpayers pay the same rates as the rest of the uk excluding scotland.

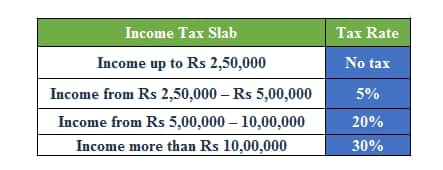

Nirmala sitharaman has presented the union budget 2020 21 in the parliament on february 1 2020. Tax rates and allowances have been added for the tax year 2020 to 2021. Tax rates for assessment year 2021 22 the finance minister smt. Tax year 2019 20 tax year 2020 21 standard rate on first 1 000 of income which would otherwise be taxable at the special rates for trustees up to 20 depends on the type of income up to 20 depends on the type of income trust rate 45 45 3 apply to dividend income received above the 5 000 tax free dividend allowance introduced in april.

Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. From the 2021 22 tax year both the personal allowance and basic rate limit will be indexed with the consumer price index. Response by the chartered institute of taxation. Welsh rates of income tax writ have been set at 10 for the 2019 20 tax year.

For special tax rates applicable to special incomes like long term capital gains winnings from lottery etc. In this part you can gain knowledge about the normal tax rates applicable to different taxpayers. 1 1 the chartered institute of taxation ciot welcomes the opportunity to respond to the scottish. The new tax year in the uk starts on 6 april 2020.

Here s what you need to know about the 2020 21 income tax rates and a rundown of how new budget measures will affect your. Individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year. Refer tax rates under tax charts tables.