Income Tax Seville Ohio

The income tax rate for seville is 4 5.

Income tax seville ohio. 7 87 the total of all income taxes for an area including state county and local taxes federal income taxes are not included property tax rate. Tax rates can have a big impact when comparing cost of living. Tax rates for seville oh. This rate includes any state county city and local sales taxes.

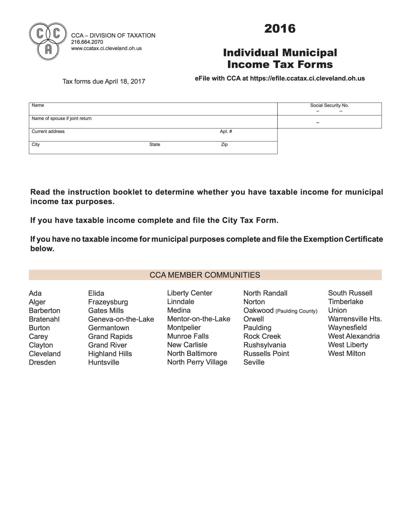

6 50 the total of all sales taxes for an area including state county and local taxes income taxes. Income and salaries for seville the average income of a seville resident is 31 031 a year. Our income tax is billed and collected through the central collection agency in cleveland ohio. See reviews photos directions phone numbers and more for the best accountants certified public in seville oh.

The us average is 28 555 a year. 11 54 the property tax rate shown here is the rate per 1 000 of home value. However in order to apply this doctrine to r. Schedule an appointment with a tax professional today.

The median household income of a seville resident is 55 455 a year. C 4921 25 it would be essential for the ohio general assembly to have contemplated the existence of municipal income and net profits. 2019 rates included for use while preparing your income tax deduction. The village of seville requires all residents of the village that are 18 years and older file an annual village income tax return whether there is tax due or not.

Tax information the village of seville requires all residents of the village that are 18 years and older file an annual village income tax return whether there is tax due or not. Our income tax is billed and collected through the central collection agency in cleveland ohio. The latest sales tax rate for seville oh. The village income tax is 1 00.