Maximum Earned Income While On Social Security

2020 s earnings test limits.

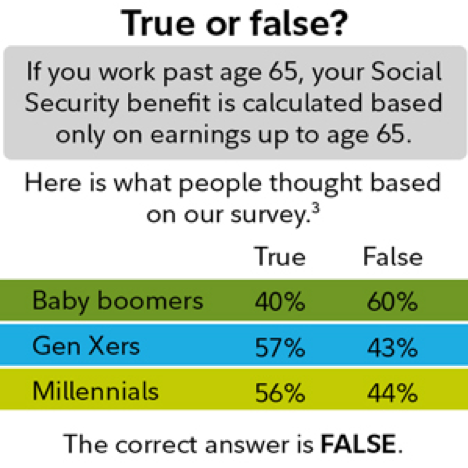

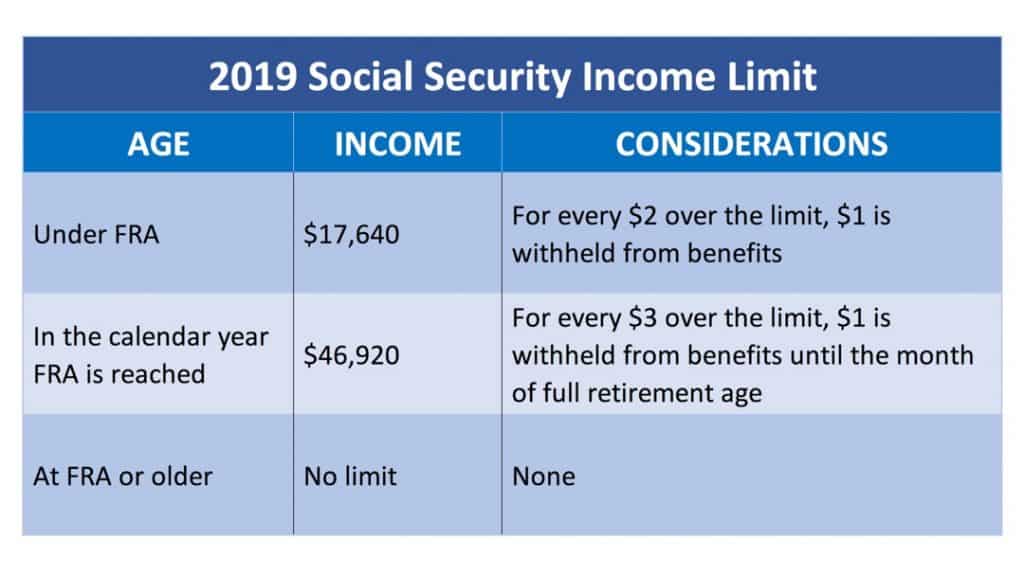

Maximum earned income while on social security. Some people who file for benefits mid year have already earned more than the yearly earnings limit amount. There s a limit on how much you can earn and still receive your full social security retirement benefits while working. En español at that age you can earn any amount and collect the full social security retirement spousal or survivor benefit you are entitled to receive. What you need to know about the social security earnings test and income limit the first thing to know is that right now the earnings limit only applies before your full retirement age.

If you are collecting social security benefits and earn more than the annual earnings limit in a year in which you will not be reaching your full retirement age social security will take back 1 of social security for every 2 you earn over the limit. Once your income exceeds that point you ll have 1 in social security withheld for every 2 you earn. Income earned before the year you reach full retirement age. Based on the formula above the maximum income you can earn to qualify for ssi in 2020 is as follows.

If you re collecting social security but haven t yet reached fra and won t be. 28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages. We have a special rule for this situation. For 2020 those who are younger than.

Social security s annual earnings limit the maximum people who claim social security early can make from work without triggering a benefit reduction no longer applies as of the month you attain full retirement age which is. The amount of money you can earn before losing benefits will depend on how old you are. Special earnings limit rule. What s the limit on earnings if i m younger than full retirement age throughout 2020.

Once you reach your full retirement age you can earn a bazillion dollars and continue to receive your full social security benefit. Maximum income 2 x federal benefit rate 20 783 2 20 1 586. Maximum income 2 x federal benefit rate 65 783 2 65 1 631.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)