Maximum Income While On Social Security 2019

For instance if your pay period is one week and you worked 20 hours at 12 00 per hour.

Maximum income while on social security 2019. If your earnings exceed 17 640 in 2019 and you re under full retirement age for the entire year then social security will reduce your social security income by 1 for every 2 earned above the. In 2019 the annual earnings limit for those achieving full retirement age in 2020 or later was 17 640. 12 00 x 20 240 00. Are under full retirement age all year.

For every 2 earned after that the benefit reduces by 1. In 2021 the limit is 18 950 for those reaching their full retirement age in 2022 or later. In the year the person turns full retirement age the earnings limit becomes 41 880 and for every 3 earned thereafter benefits reduce by 1 until full retirement age is reached. That means that your gross pay for that pay period is 240.

However you may notice that this is not the final amount of your paycheck. The special rule lets us pay a full social security check for any whole month we consider you retired regardless of your yearly earnings. For 2019 people in this category will have 1 of their social security benefits withheld for every 2 in earned income in excess of 1 470 per month or 17 640 per year. Say you ll be younger.

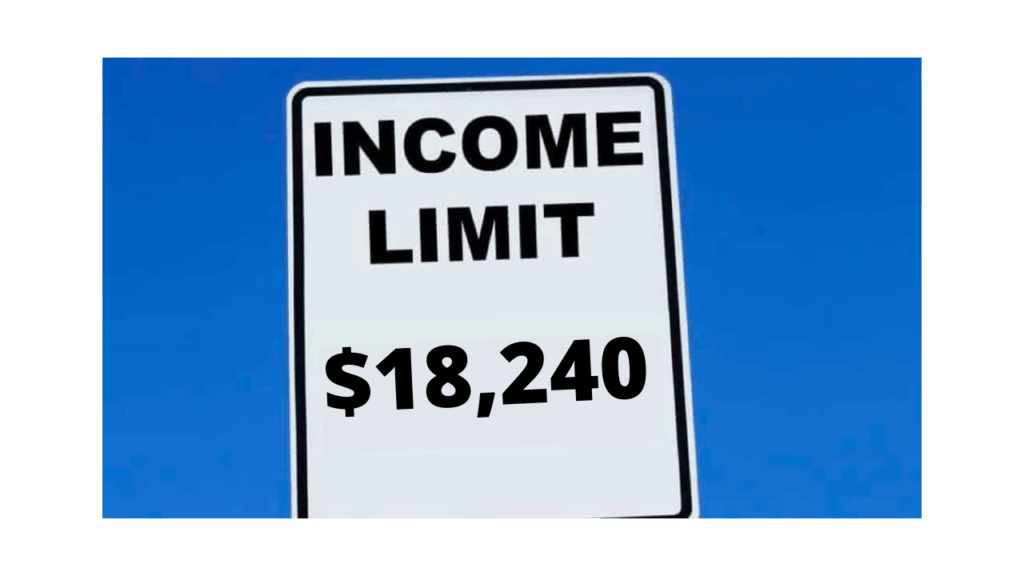

9 600 for the year you work and earn 28 240 10 000 over the 18 240 limit during the year. Be under full retirement age for all of 2020 you are considered retired in any month that your earnings are 1 520 or less and you did not perform substantial services in self employment. You are entitled to 800 a month in benefits. Full retirement age is 66 and is gradually rising to 67 over the next several years.

If you exceed this income. In other words if your income exceeds the cap on yearly earnings which in 2020 is 18 240 for people who claim benefits before full retirement age social security will withhold money from your retirement payments. For the period between january 1 and the month you attain full retirement age the income limit increases to 48 600 for 2020 without a reduction in benefits. If you will reach full retirement age in 2019 you can earn up to 46 920 with no benefit reductions in the months leading up to the month you reach full retirement age.

Full retirement age based on your year of birth. You are receiving social security retirement benefits every month in 2020 and you.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)

:max_bytes(150000):strip_icc()/GettyImages-177533853-dc6089dd14bb439f8e788c386de273e8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)