Income Tax General Definition

P x 1 τ x p y 1 τ y y a proportional income tax.

Income tax general definition. Definition long term capital gains tax is a tax on the sale of assets held longer than a year. While economic gain is not always taxable as income the realization of gain need not in order to constitute income be in cash derived from the. An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. Definition alternative minimum tax amt is a supplemental income tax that applies to certain individuals in.

Xp x yp y y 1 t when the t and τ rates are chosen respecting this equation where t is the rate of income tax and tau is the consumption tax s rate. A general tax on consumption. Long term capital gains tax is often lower than ordinary income tax many investors hold assets for longer than a year in order to qualify for the lesser tax burden of long term capital gains. Additional adjustments like credits could further reduce the amount of tax you pay.

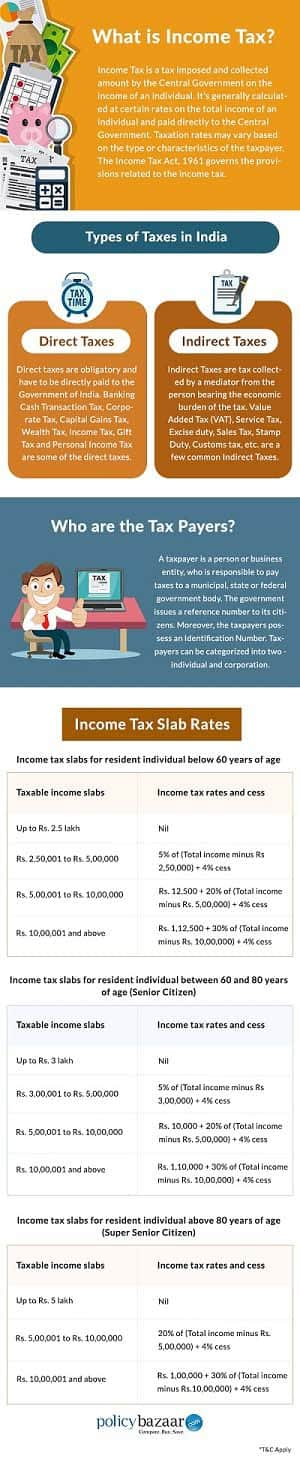

Taxation rates may vary by type or characteristics of the taxpayer. Corporate income tax is imposed on net profits computed as the excess of receipts over allowable costs. Income tax levy imposed on individuals or family units and corporations individual income tax is computed on the basis of income received. Gross income a general definition except when otherwise provided in this title gross income means all income derived from whatever source including but not limited to the following items.

It was not until the sixteenth amendment was ratified in 1913 that the federal government assessed taxes on income as a. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Income tax generally is computed as the product of a tax rate times taxable income. It is usually classified as a direct tax because the burden is presumably on the individuals who pay it.

Income tax is used to fund public services pay government. A tax on an individual s net income after deductions for various expenses and payments such as charitable gifts calculated on a formula which takes into consideration whether it is paid jointly by a married couple the number of dependents of the taxpayers special breaks for ages over 65 disabilities and other factors. An income tax of 3 was levied on high income earners during the civil war. In general you can choose to take a standard deduction or itemize your deductions by tallying up all of the individual deductions you qualify for.

Taxpayers who use a tax agent to prepare their income tax return will be required have their return lodged by their tax agent before an agreed time between the tax agent and the commissioner general of taxation.