Income Tax List Definition

Withholding tax is money withheld from a paycheck often to contribute to income tax liability.

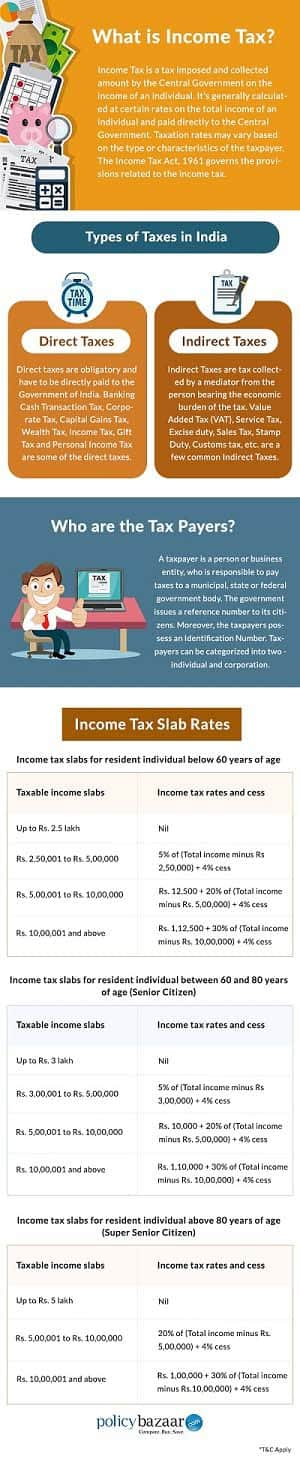

Income tax list definition. The tax was only collected when the government required. An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. Taxation rates may vary by type or characteristics of the taxpayer. Starting from the year 1961 cbdt has omitted various sections by the relevant direct tax laws amendment acts.

Carucage was a tax on land levied in medieval england. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. The title or contents topics covered under sections 1 to 298 of income tax act 1961 as amended by the latest finance act. Income tax generally is computed as the product of a tax rate times taxable income.

Income tax is used to fund public services pay government.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)