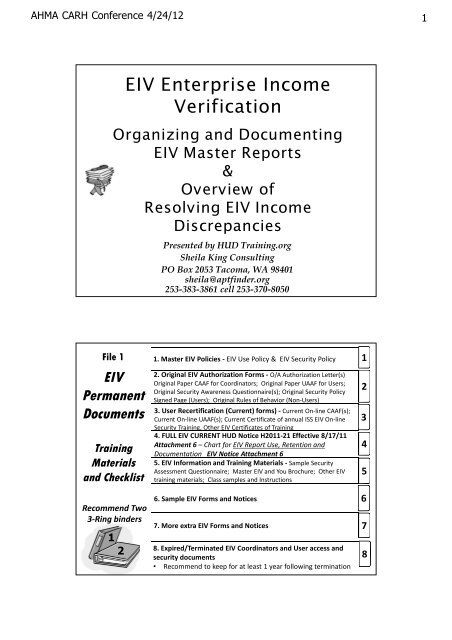

Hud Income Verification Guidelines

Welfare payments as paid states only.

Hud income verification guidelines. Hud announces employment verification guidelines for covid 19 august 6 2020 the fha and hud have announced an extension to certain coronavirus measures initiated to allow lenders to approve fha home loans among other guidelines altered by a multi subject mortgagee letter issued by hud in the last week of july 2020. Hud has released the median family incomes and income limits for fiscal year fy 2020. Income not expected to last full 12 months must be calculated based on 12 months and interim recertification completed when benefits stop. Sample verification forms for determining part 5 adjusted income appendix j.

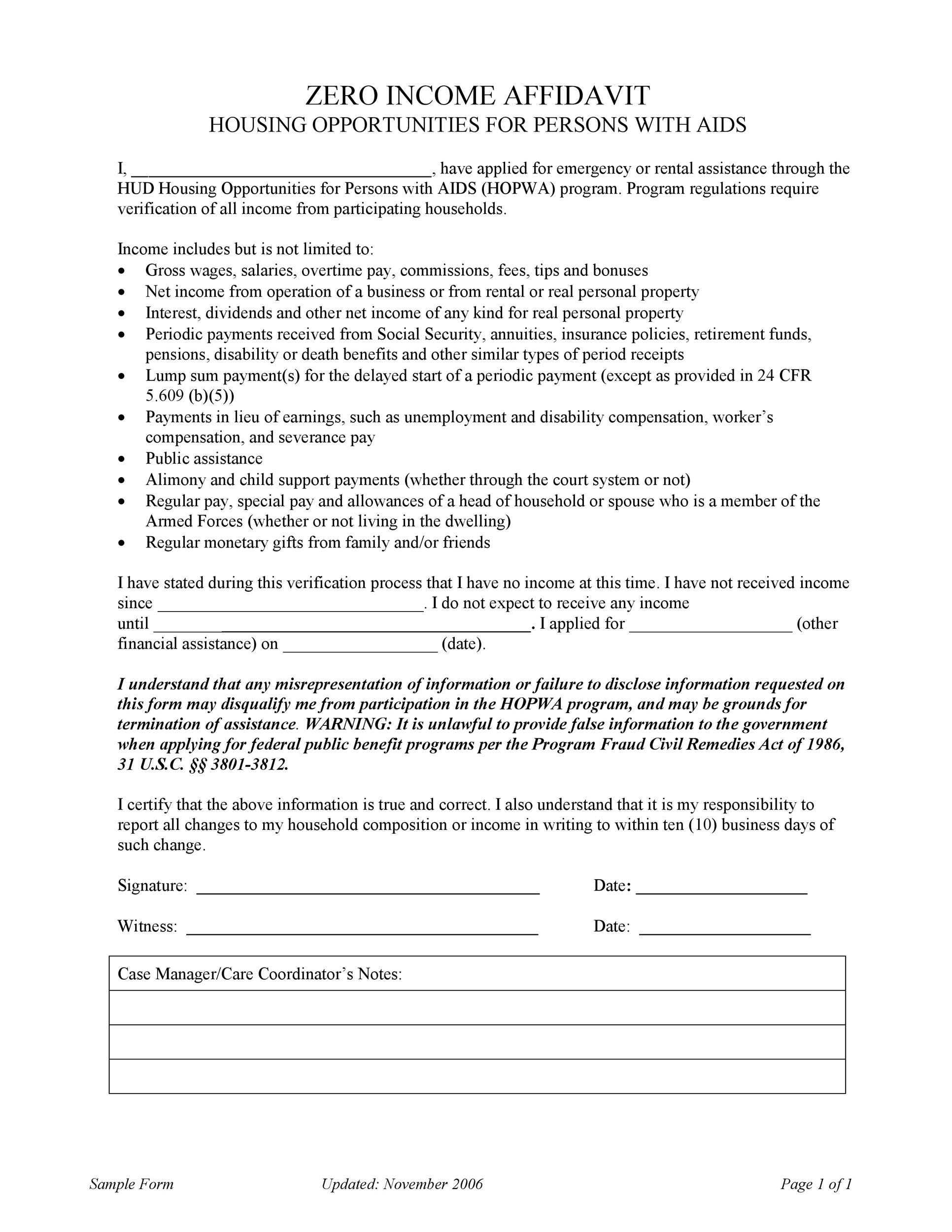

Technical guide for determining income and allowances for the home program iii. Assistance programs such as hud s enterprise income verification system you may propose. Tenant based rental assistance and rental units. The form of third party verification used may be.

4 using that system in your work plan provided the income and occupancy limits set forth in section 1011 of title x are complied with. Fy 2020 hud income limits. In addition persons under the. Verification form completed by welfare department indicating maximum amount family may receive.

Median incomes are used as the basis for income limits in several hud programs including the public housing section 8 housing choice and project based voucher section 202 housing for the elderly and section 811 housing for persons with disabilities programs as well as in. 24 cfr 92 203 a 1 i income targeting. Annual income as used in hud programs like section 8 and defined in 24 cfr 5 609. Income of adults and dependents 1.

Count the annual income of the head spouse or co head and other adult members of the family. Figure 5 2 summarizes whose income is counted. For more information on home income requirements see 24 cfr 92 203. Maximum shelter schedule by household size with ratable reduction schedule.

5 6 calculating income elements of annual income a. Income reflected on mary s copy of her form 1040 as her annual income. 24 cfr 92 216 income targeting.