Pennsylvania Income Withholding For Support

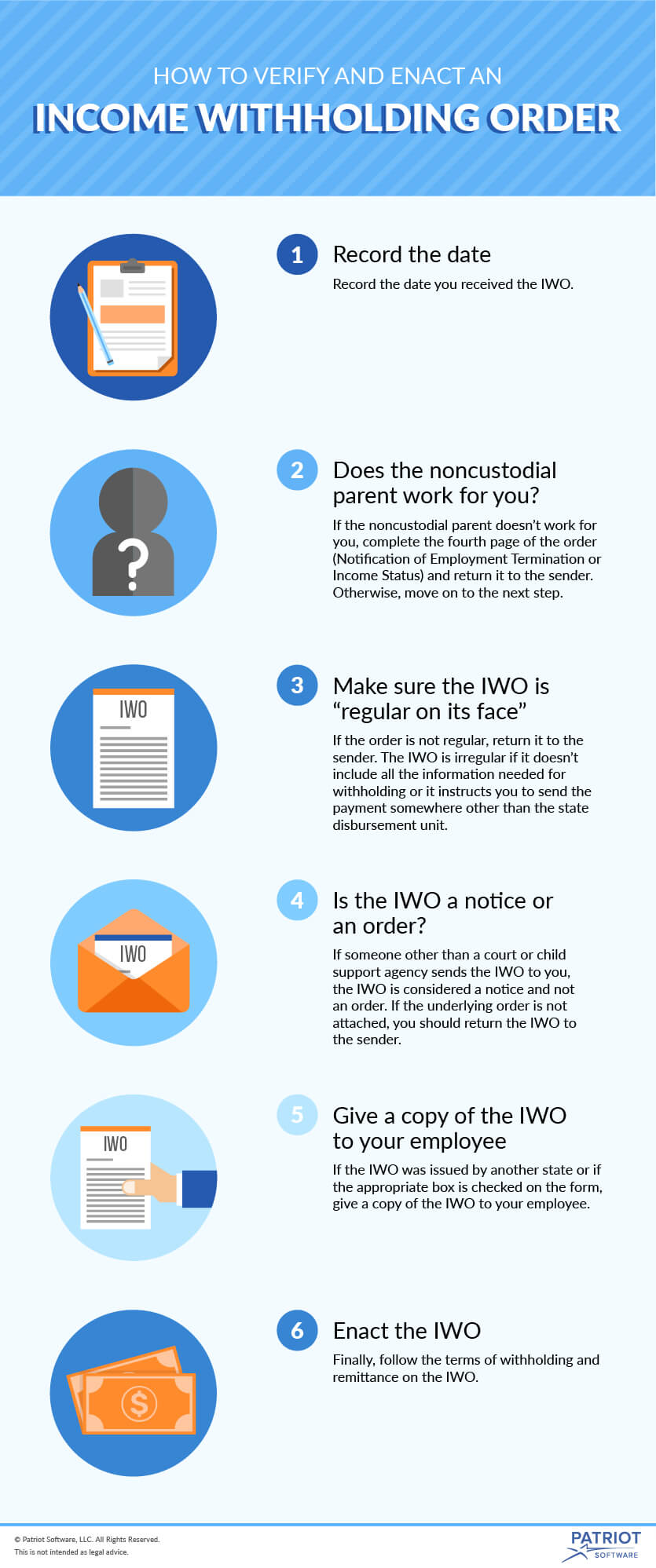

A immediate income withholding every order of court shall contain an immediate order for the withholding of income unless 1 there is no overdue support owing under the order and 2 either the court finds there is good cause not to require immediate income withholding or the parties agree in writing to an alternative arrangement.

Pennsylvania income withholding for support. 4374 b pennsylvania law requires employers to submit electronic payments to the state collection and disbursement unit when the employer is ordered to withhold income for child support from more than one obligor and employs 15 or more persons. 1 the obligor is not behind in payment of support in an amount equal to or more than one month s support payment. If no active income withholding order is in place and total arrears are equal to or greater than three months accrued support or the obligor has failed to comply with subpoenas or warrants relating to paternity or child support proceedings or a visitation or partial custody order the court may issue an order directing the pennsylvania game. You should keep the completed forms on file at your business and update them as necessary.

Further a withholding order for child support garnishment. Mandatory compliance is effective january 1 2012. Clearly label w 4s used for state tax withholding as your state withholding form. Or 3 a written agreement is reached.

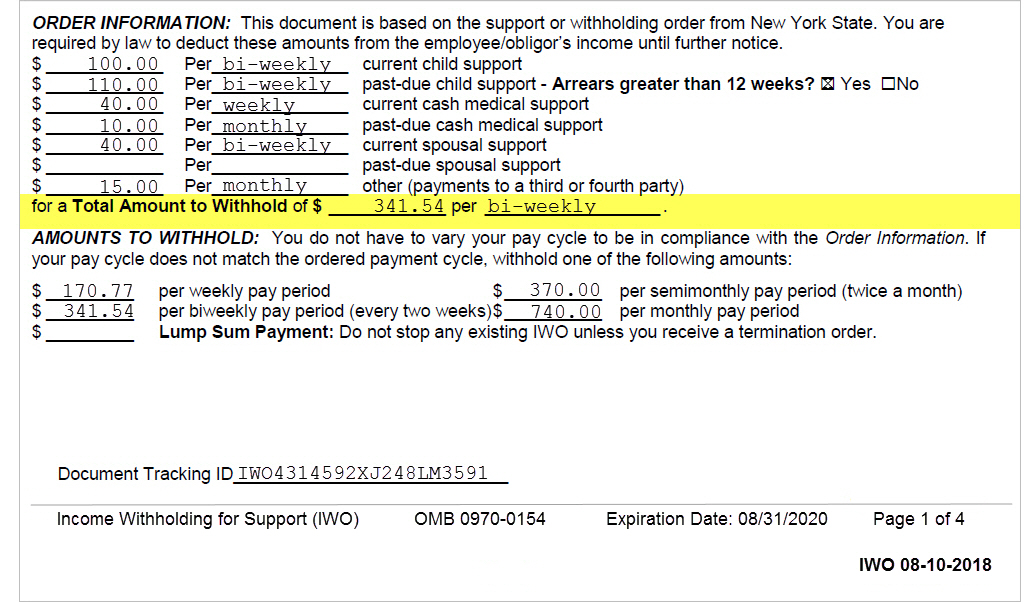

Rev 415 employer withholding information guide general information for withholding pennsylvania personal income tax. Rev 588 starting a business in pennsylvania a beginner s guide. Make scheduled withholding tax payments. Wage garnishment law in pennsylvania follows the wage garnishment limits set forth in the consumer credit protection act ccpa when withholding the wages of a noncustodial parent.

Overview on july 2 2008 the pennsylvania legislature enacted an amendment act 32 of the local tax enabling act act 511 of 1965 with the goal of consolidating and simplifying the collection of local earned income taxes on a countywide basis. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees compensation in two common cases. And 2 if the court finds that there is good cause not to require immediate income withholding. In pennsylvania income withholding is mandatory for all child support orders except when.

In pennsylvania there are four possible payment schedules for withholding taxes. Rev 419 employee s nonwithholding application certificate. These maximum wage garnishment limits vary and can change if the noncustodial parent is supporting a second family and or is late on support payments. In pennsylvania the support enforcement agency is the domestic relations section drs of a county court of common pleas.

Semiweekly semimonthly monthly or quarterly.