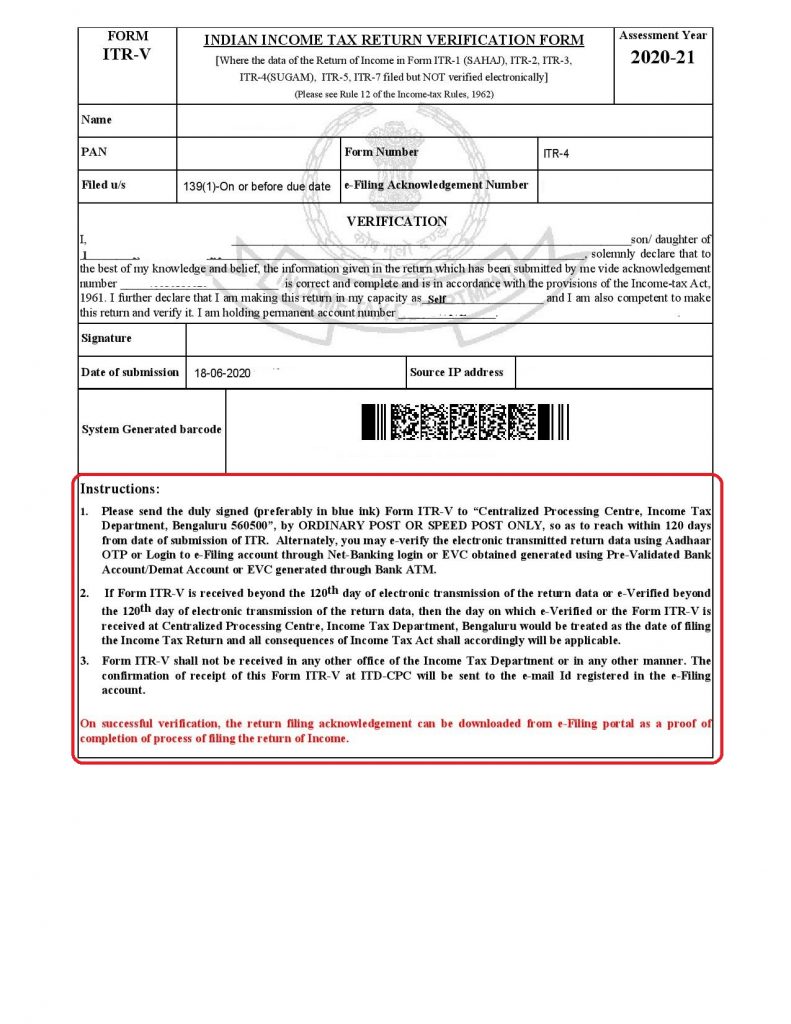

Indian Income Tax Return Verification Form 2020 21

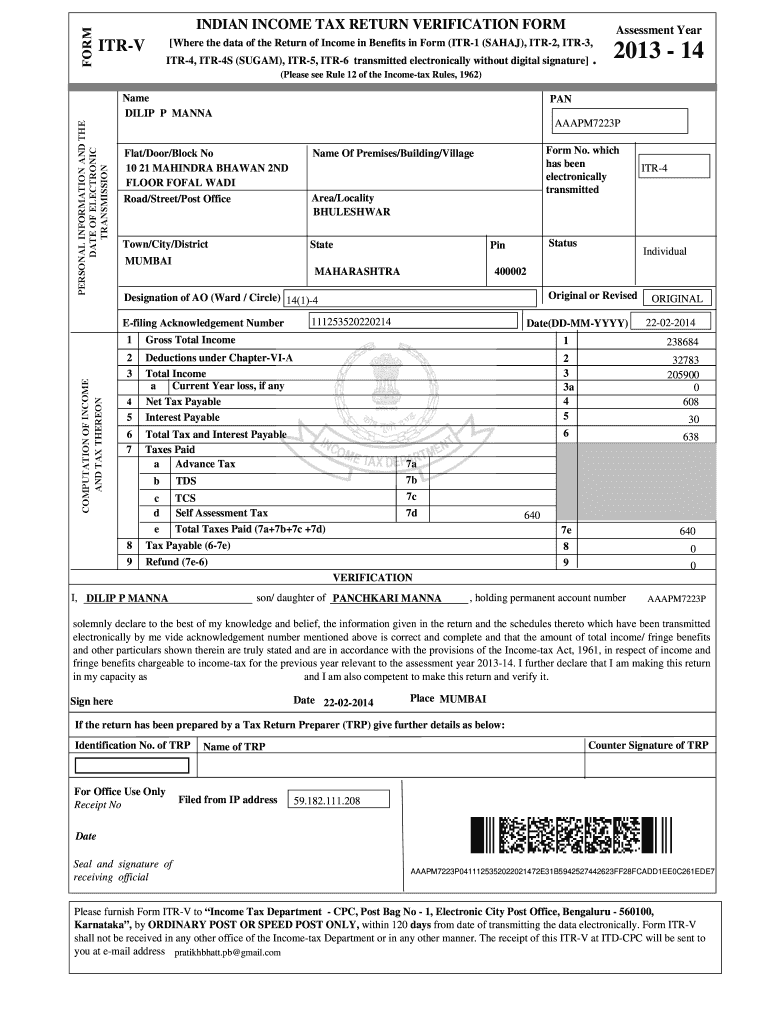

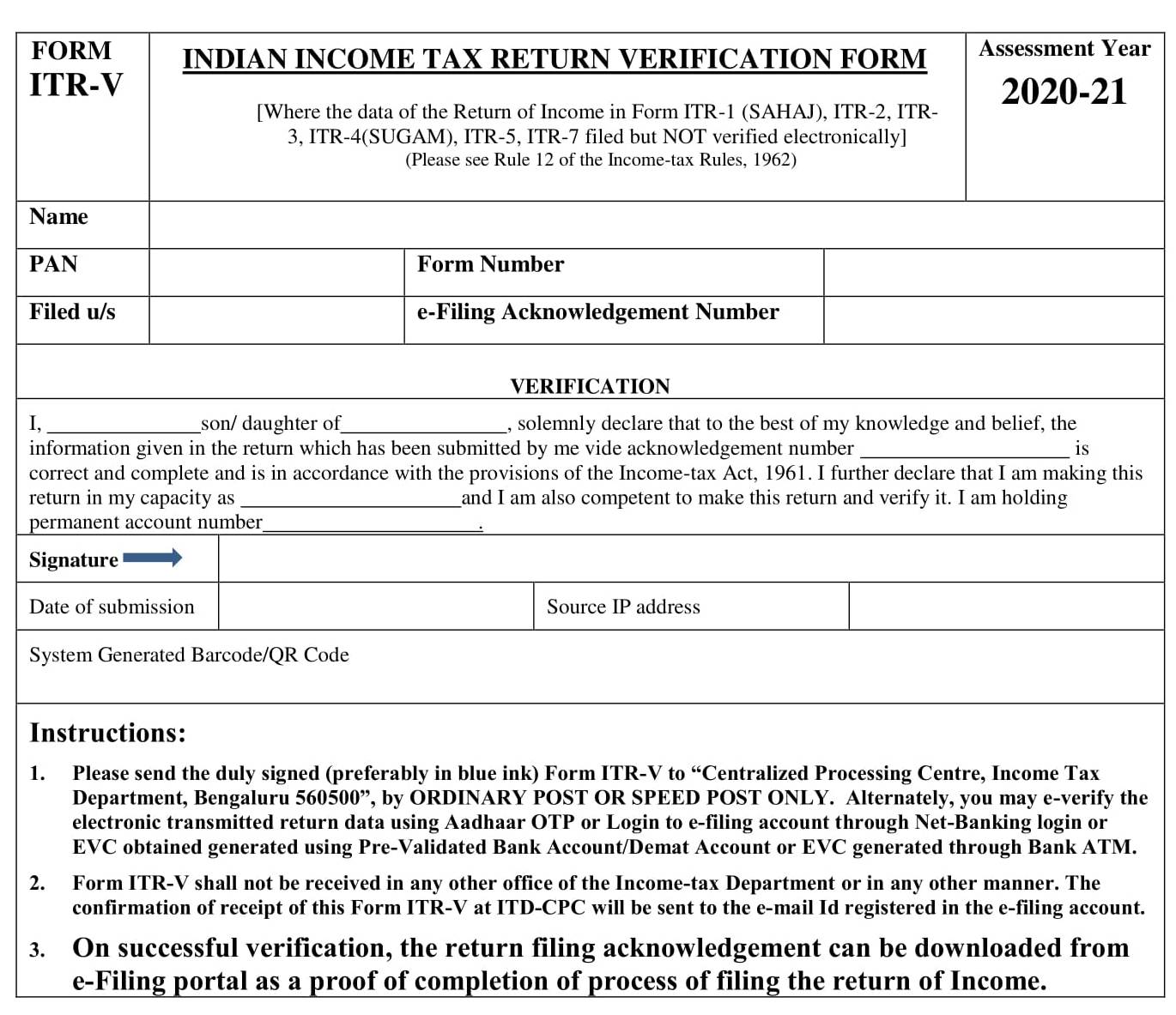

Indian income tax return verification form where the data of the return of income in form itr 1 sahaj itr 2 itr 3 itr 4 sugam itr 5 itr 7 filed but not verified electronically please see rule 12 of the income tax rules 1962 2020 21 name pan form number filed u s e filing acknowledgement number verification.

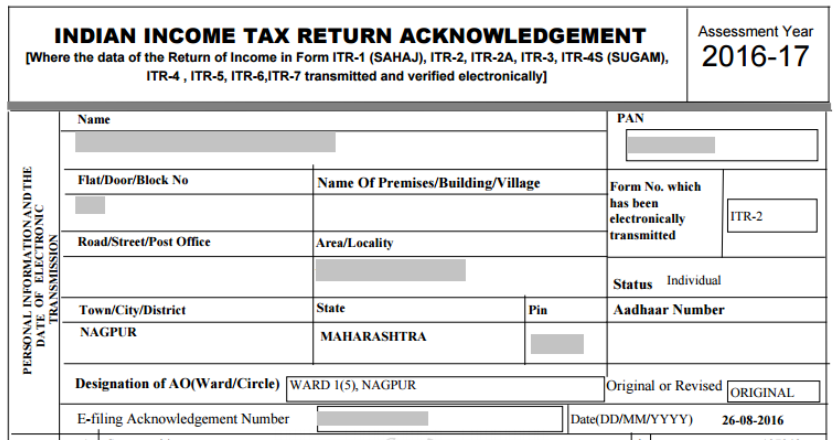

Indian income tax return verification form 2020 21. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. Itr is filed to the income tax department by a salaried or self employed individual hindu undivided family huf companies or firms. 01 2020 which has been further amended on 29th may 2020. Indian income tax return verification form.

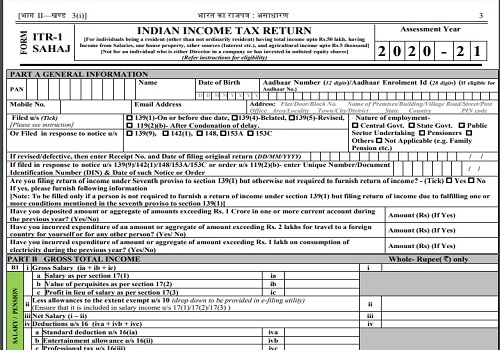

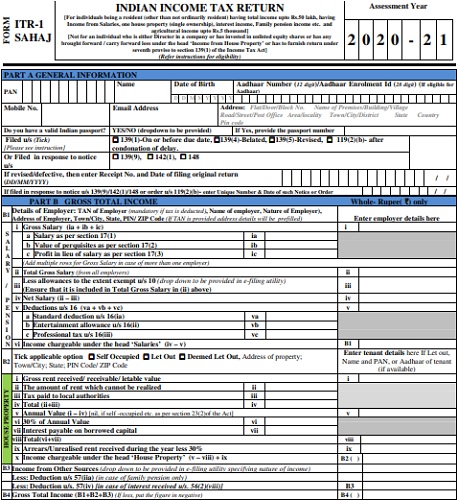

Verification stamp receipt no seal. Download itr 1 form pdf english https www incometaxindia gov in forms income tax 20rules 2020 itr1 english pdf. Form itr 7 in pdf format for ay 2020 21 fy 2019 20. Form itr 1 sahaj indian income tax return for individuals being a resident other than not ordinarily resident having total income upto rs 50 lakh having income from salaries one house property other sources interest etc and agricultural income upto rs 5 thousand.

Income tax return verification also referred to as itr v is an acknowledgement that is sent by the income tax department in lieu of the successful filing of the income tax return once the verification has been checked the form has to be printed signed and sent to cpc bangalore in order to complete the returns process. Form itr v in pdf format for ay 2020 21 fy 2019 20. Indian income tax return verification form where the data of the return of income in form itr 1 sahaj itr 2 itr 3 itr 4 sugam itr 5 itr 7 filed but not verified electronically please see rule 12 of the income tax rules 1962 2020 21 name pan form number. Income tax return itr is a form for reporting gross taxable income from different sources claiming tax deductions and declaring net tax liability to the income tax authority.

E filing home page income tax department government of india. Where the data of the return of income in form itr 1 sahaj itr 2 itr3 itr 4 sugam itr 5 itr 7 filed but not verified electronically.