Minority Interest Income Statement Meaning

Again this figure gets reported on brk s consolidated income statement as net income attributable to the minority interest a separate non operating line item.

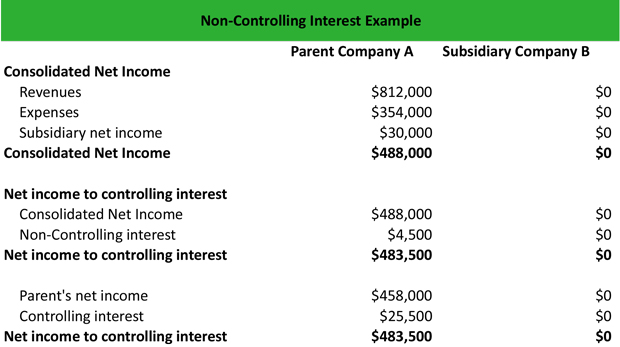

Minority interest income statement meaning. This means the profits or losses by the minority interest are not a primary part of the business. Minority interest is. In the consolidated profit and loss account minority interest is the proportion of the results for the year that relate to the minority holdings. Also non controlling interest is reported as a liability on the consolidated statement of financial position representing the percentage of ownership by minority shareholders.

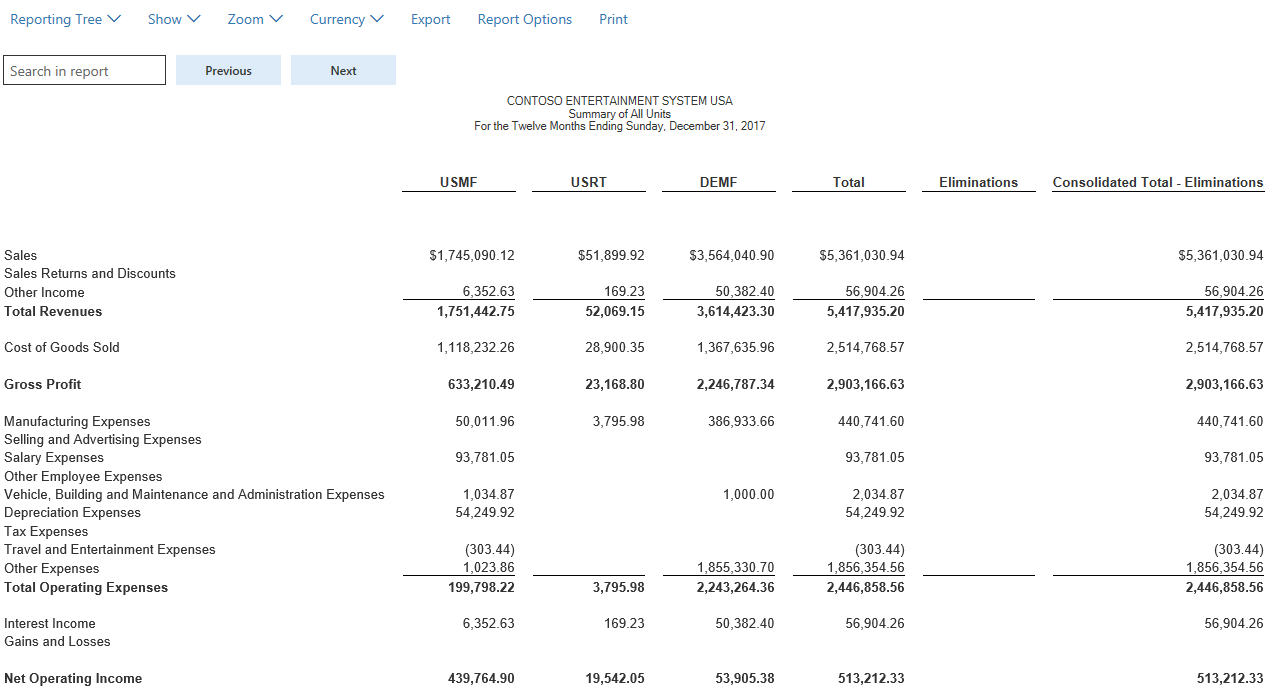

In addition on the consolidated statement of changes in equity company xyz reports the equity changes that took place within the fiscal year. Minority interest belongs to other investors and is reported on the consolidated balance sheet of the owning company to reflect the claim on assets belonging to other non controlling shareholders. It is reported separately only in the consolidated financial statement. It also helps users explore and make informed investment choices.

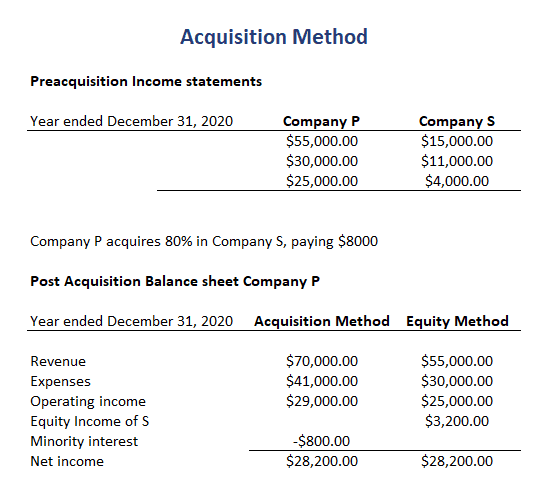

Correspondingly abc marks up the 10 million minority. It also means you ll need to be aware of this inconsistency when studying or analyzing balance sheets contained in older annual reports as the company s minority interest. Minority interest adjustments occur when the parent does not own 100 of the subsidiary. Minority interests must be included in this statement to give an accurate financial report.

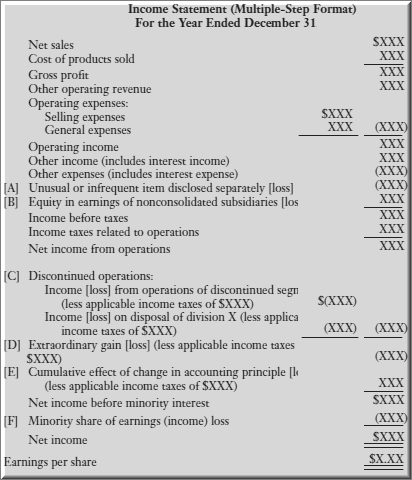

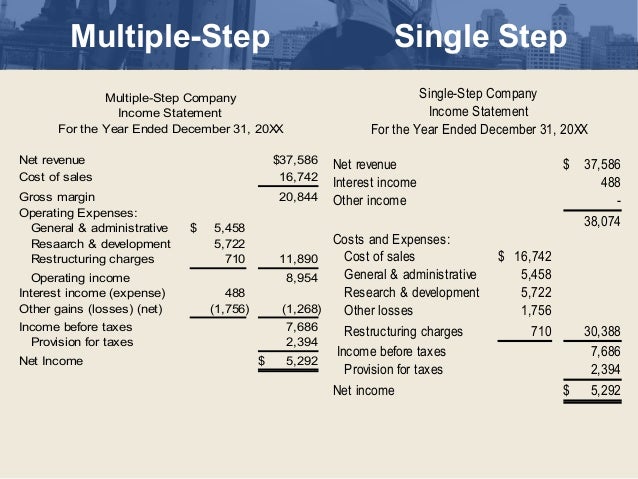

The income statement usually lists the minority interest as a non operating line item. This major shift in accounting policy means that for annual reports and form 10 k filings after this date you ll need to look further down the balance sheet to the equity section to find the minority interest details. The percentage of controlling stake determines the influence and voting rights of minority interests over the decision making process.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)