Income Tax Payable Definition

Income tax payable definition february 07 2020 steven bragg.

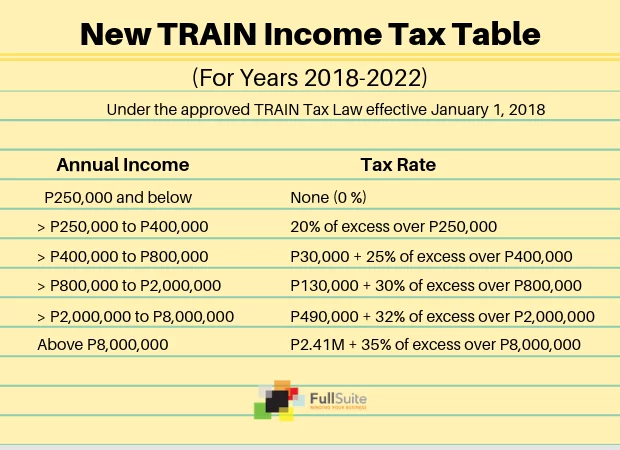

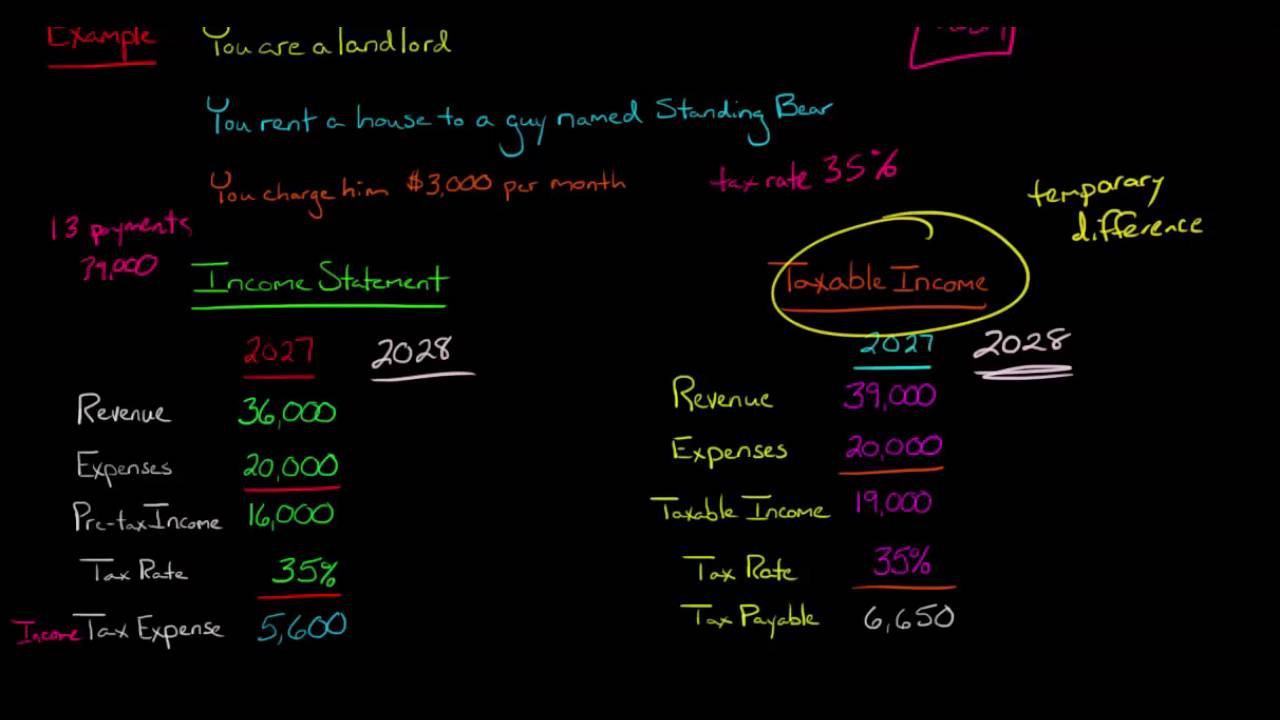

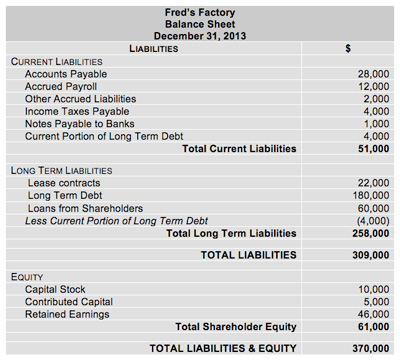

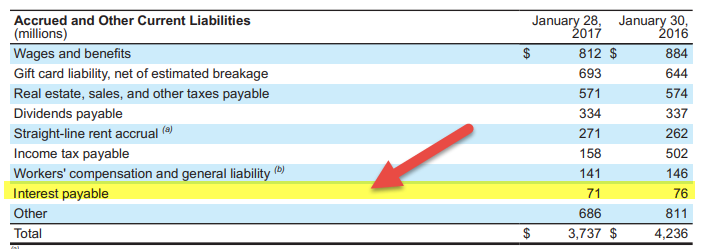

Income tax payable definition. The tax can be payable to a variety of governments such as the federal and state governments within which the entity resides. Income tax payable is one component necessary for calculating an organization s deferred tax liability. Income tax payable is found under the current liabilities section of a company s balance sheet. Tax payable is not considered a long term liability but rather a current liability.

Income taxes payable definition. Income tax payable is a term given to a business organization s tax liability to the government where it operates. Income tax is used to fund public services pay government. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)