How To Prepare Comparative Income Statement

Comparative income statement defined.

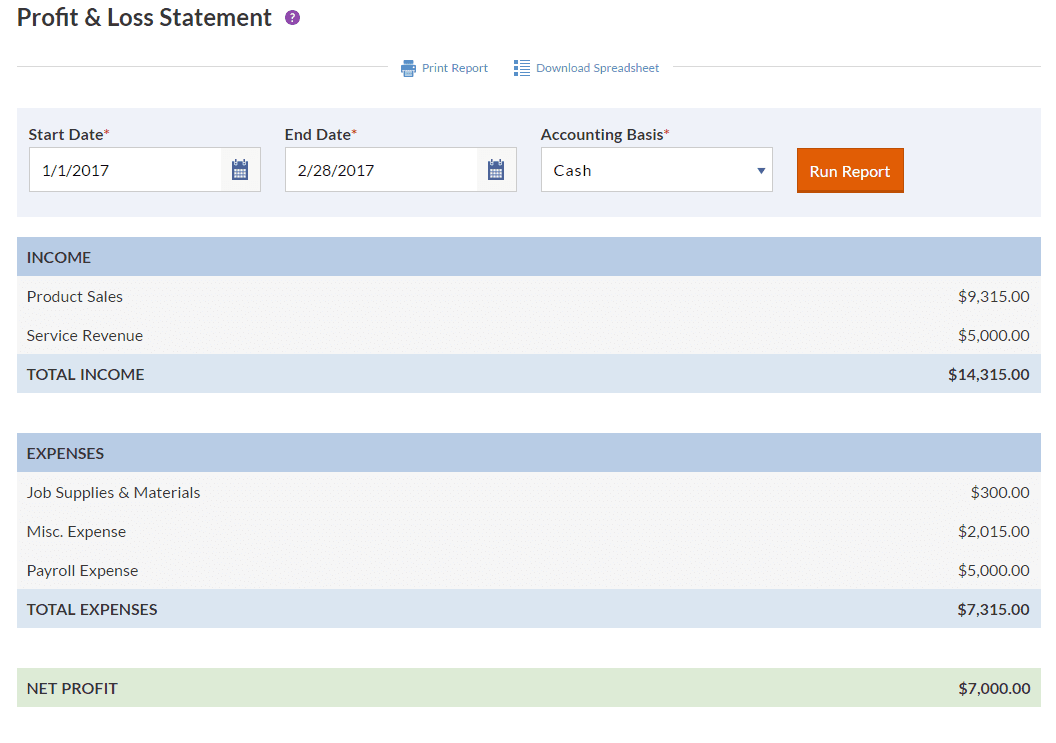

How to prepare comparative income statement. Let s understand the comparative income statement with the help of an example. The comparative financial statements of synotech inc will serve as a basis for an example of horizontal analysis and vertical analysis of a balance sheet and a statement of income and retained earnings. The income statement is another name for the small business owner s profit and loss statement. There is no standard comparative income statement format.

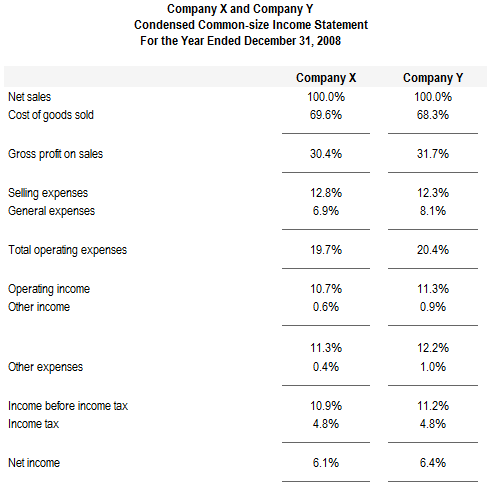

Comparative income statement example. You don t have to flip back and forth between individual documents. An income statement is used for both financial analysis to show how the earnings revenue and the amount you have spent expenses on the balance sheet were arrived at and over what period of time and performance management purposes total profit or loss. Common size analysis is an excellent tool to compare companies of different sizes or to compare different years of data for the same company as in the example.

Abc limited has provided the following information pertaining to its two accounting periods i e 2016 and 2017. Consider the following income statement for m s singhania for the years ended december 31st 2017 and december 31st 2018. A comparative income statement makes it easy to point out trends in performance. This percentage change in items is mentioned in column v of the comparative income statement.

The easiest way to create a comparative income statement is to list the accounts in the left column. The comparative statement compares current year s financial statement with prior period statements by listing results side by side. Prepare a comparative income statement and interpret the basic findings. The others being the balance sheet and statement of cash flows.

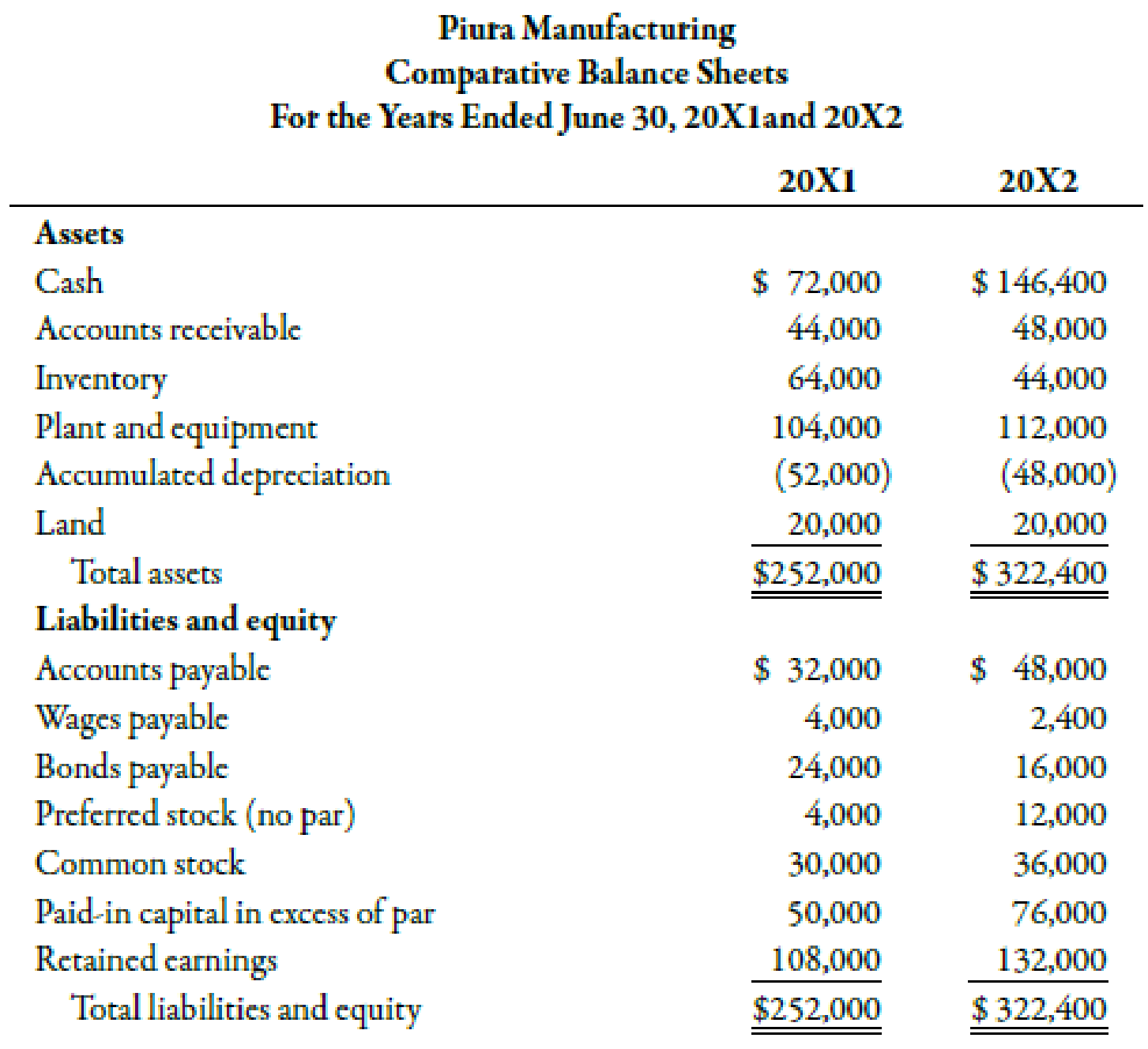

Analyst and business managers use the income statement balance sheet and cash flow statementfor comparative purposes. Example and format of comparative income statement. It is one of the three financial statements that business firms usually prepare. When you show the items of the income statement as a percentage of the sales figure it is easy to compare the income and expenses and understand the financial position of the company.

It is normally printed at the end of an accounting period to show how your company has performed to date in the fiscal period. To prepare an income statement generate a trial balance report calculate your revenue determine the cost of goods sold calculate the gross margin include operating expenses calculate your income include income taxes calculate net income and lastly finalize your income statement with business details and the reporting period.