No Interest Expense On Income Statement

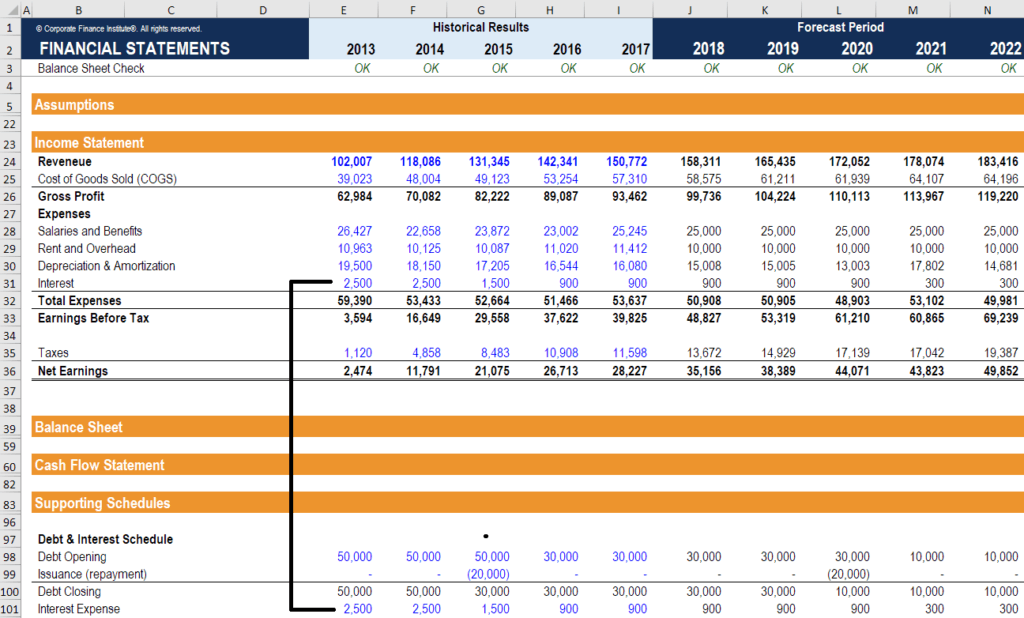

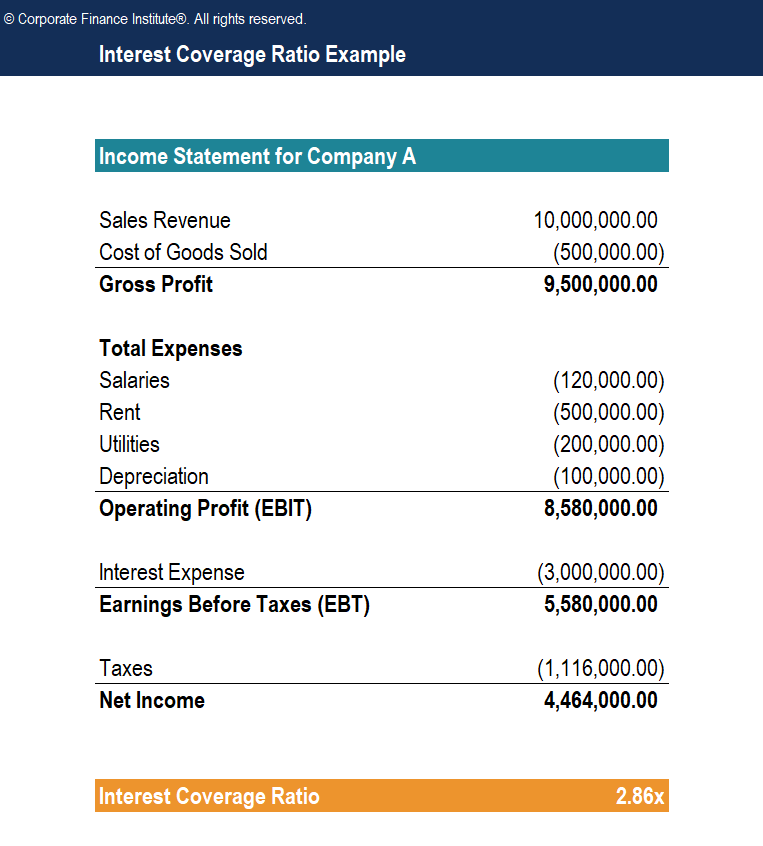

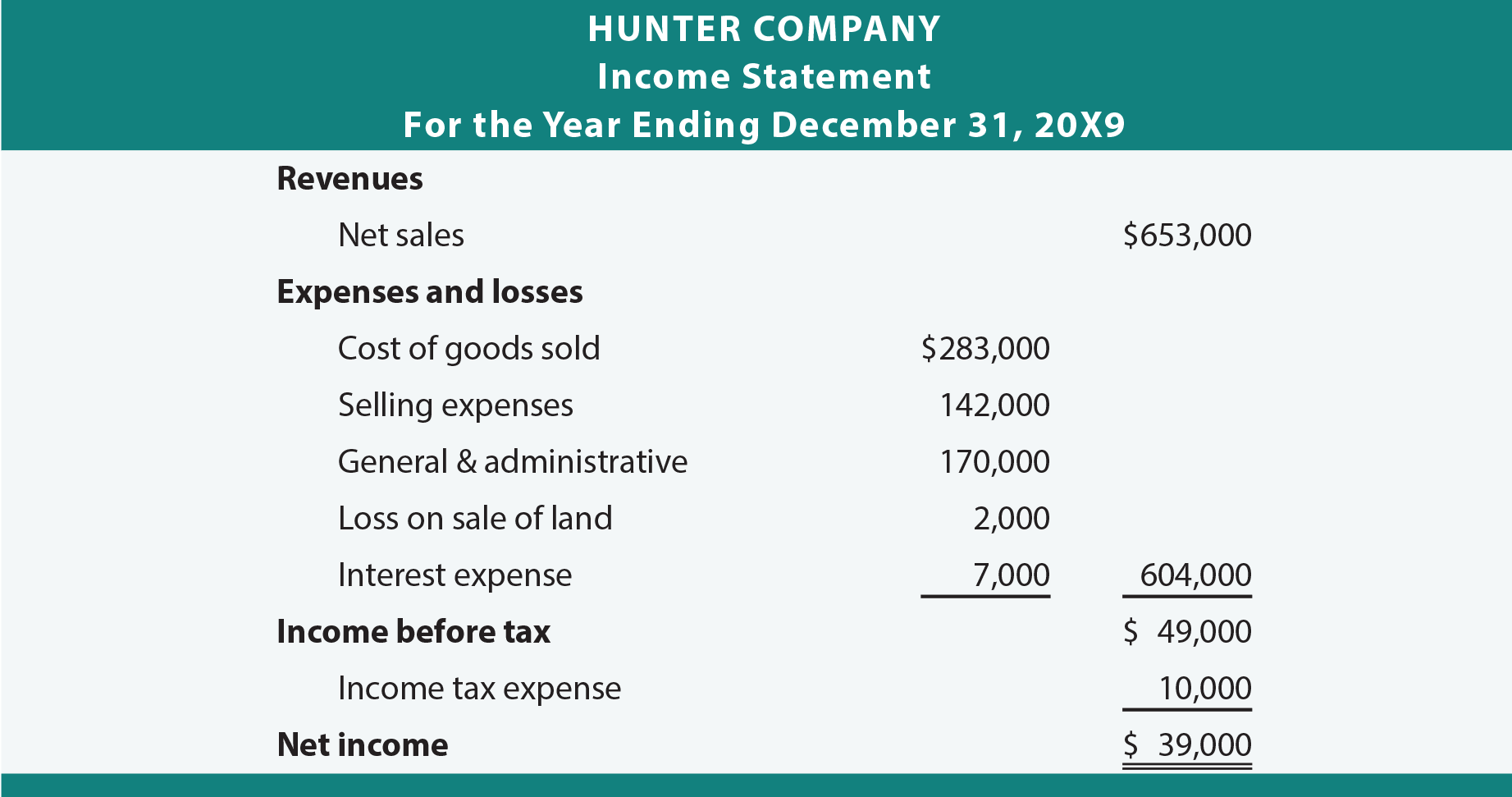

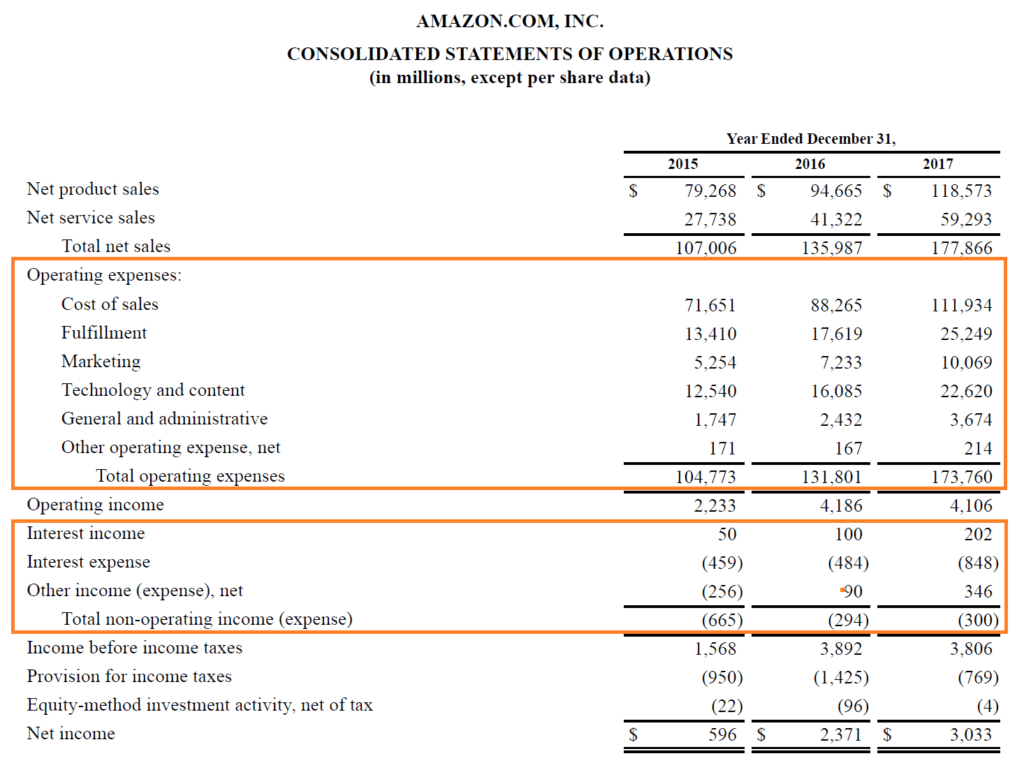

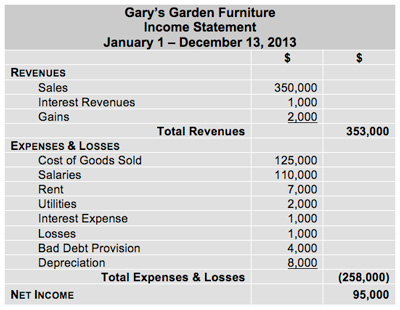

Interest expense is one of the core expenses found in the income statement income statement the income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

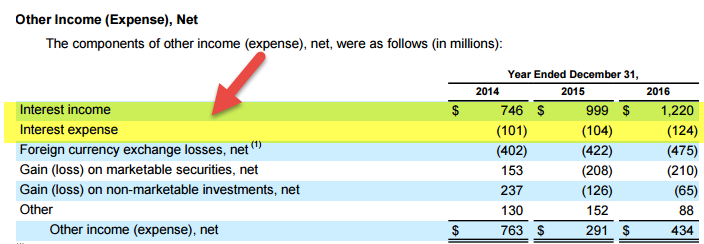

No interest expense on income statement. This applies accordingly to interest resulting from a negative interest rate on a financial liability which must not be presented as a negative part of interest expense i e a reduction. As a result of this analysis the staff recommended the following presentation in the statement of comprehensive income. Interest expense is a non operating expense shown on the income statement. It is reported within the interest income account in the general ledger.

If negative the net effect is inco. Net refers to the fact that management has simply subtracted interest income from interest expense to come up with one figure. It is essentially. Financial expenses and income on your income statement are the last group of results presented just after the operating profit.

If the number is positive the net effect of the two means expense. This income is taxable as per irs and the ordinary tax rate is applicable for this income. It represents interest payable on any borrowings bonds loans convertible debt or lines of credit. It is a line item and is generally recorded separately from interest expense in the income statement.

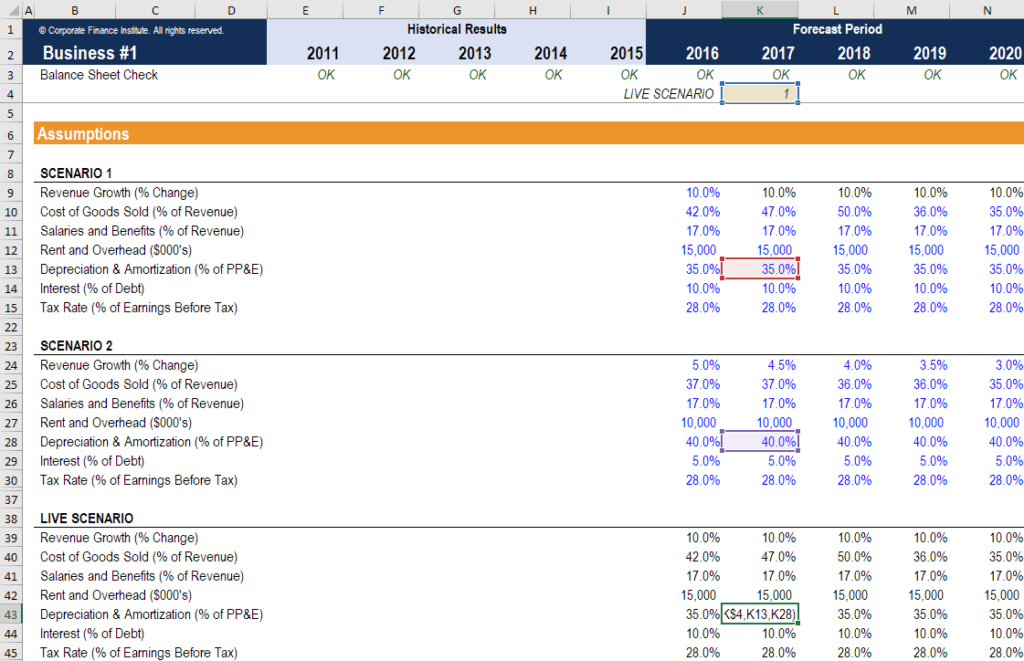

Sometimes companies record a net figure here for interest expense and interest income from invested funds. Interest expense represents an amount of interest payable on any borrowings which includes loans bonds or other lines of credit and its associated costs are shown on the income statement. Some companies prefer to mention this type of income as penalty income. Interest income and expense reflects the amount companies pay on their debt on their deposit accounts and is reported as net on the income statement.

In other words if a company paid 20 in interest on its debts and earned 5 in interest from its savings account the income statement would only show interest expense net of 15. Sometimes interest expense is combined with interest income. This item reflects the costs of a company s borrowings. You ve presented your operating results the very core results of your business and everything supporting it and now you show what s the extra bit you do with your funds.