Does Income Statement Include Unearned Revenue

Unearned revenue sometimes referred.

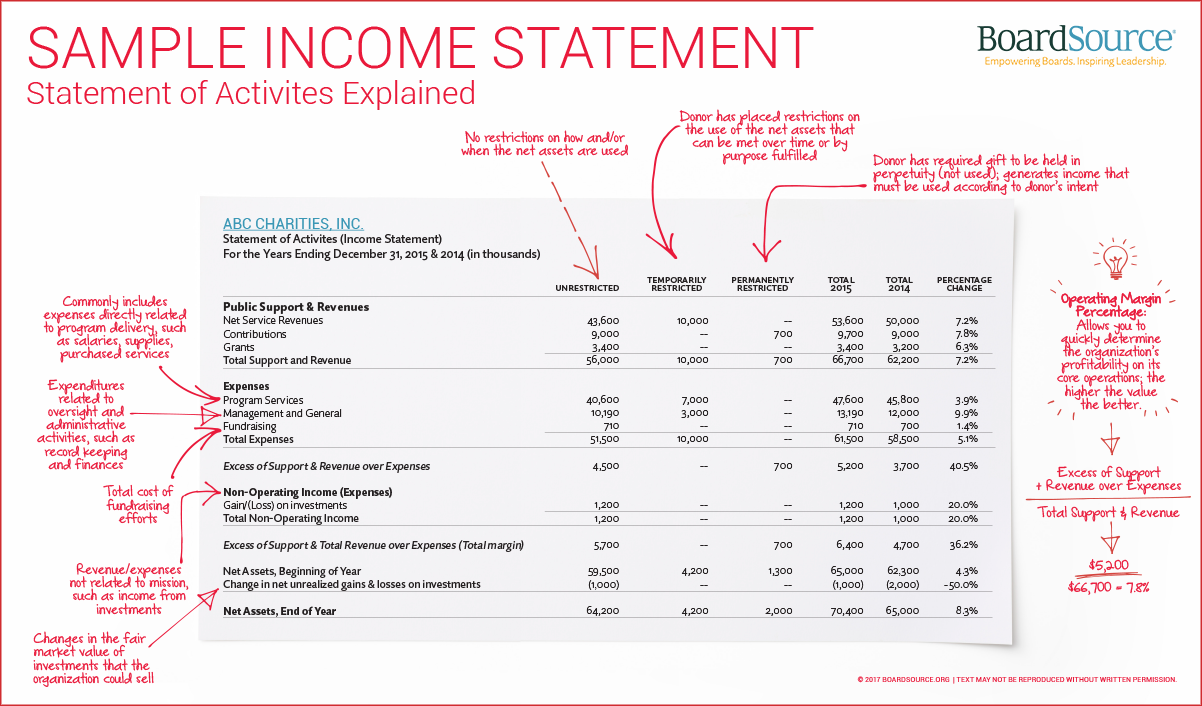

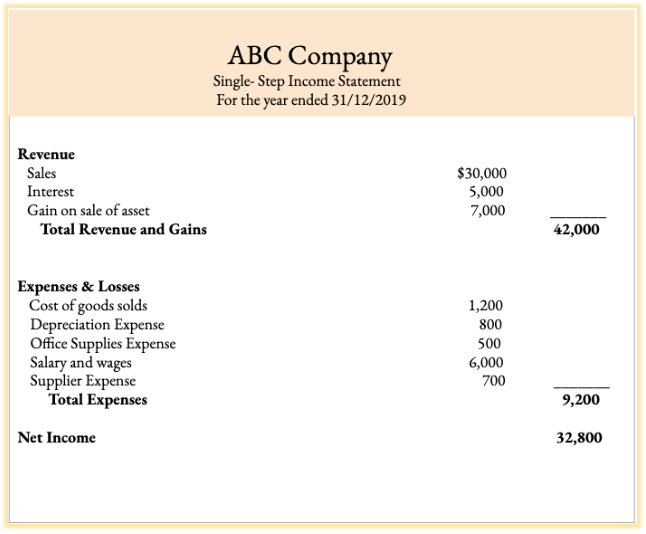

Does income statement include unearned revenue. Hence 1000 of unearned income will be recognized as service revenue. It is essential to understand that while analyzing a company unearned sales revenue should be taken into consideration as it is an indication of the growth visibility of the business. Service revenue is on the income statement under revenues. So it s good to know.

Receiving funds early is beneficial to a company as it increases its cash flow that can be used. I actually had an interview a few months ago and was asked about how to account for deferred revenue. In 2019 unearned revenue account had a balance of 6500 whereas in 2018 it amounted to 4000. If a customer pays for good services in advance the company does not record any revenue on its income statement and instead records a.

Once the product or service is delivered unearned revenue becomes revenue on the income statement. Unearned service revenue is on the balance sheet not the income statement so the answer is nowhere. The 12 000 in unearned service revenue is recorded as a liability on the income statement and the appropriate portion entered as revenue after each completed month of service. Examples of unearned income.

The other 2 000 is still unearned because it is for work you re going to perform in february and march so you do not include it in the income statement for january. Some examples of unearned revenue include advance rent payments annual subscriptions for a software license and prepaid insurance. It also involves estimating the value of the miles.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)