Withholding Income Tax Jamaica

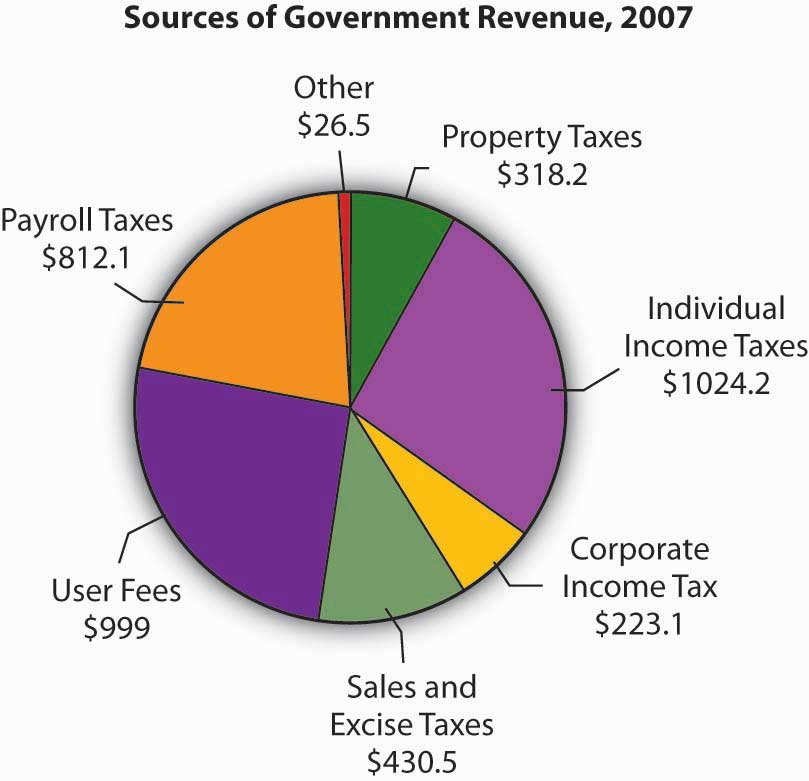

In most jurisdictions withholding tax applies to employment income.

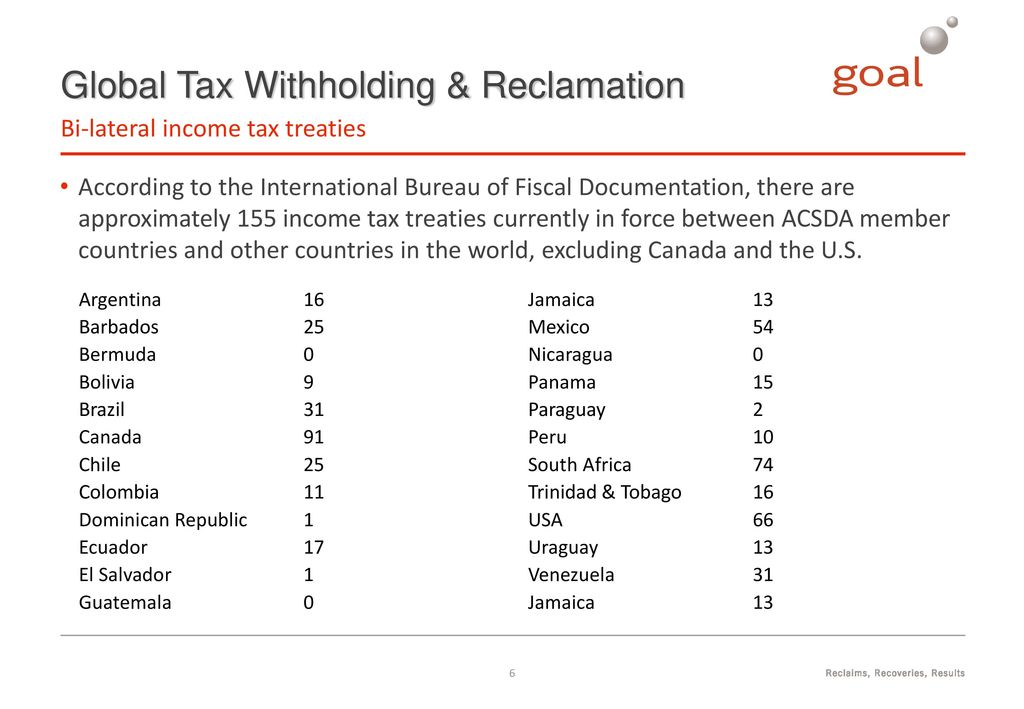

Withholding income tax jamaica. The concept of withholding tax is not new to jamaica. Tax is deducted from interest paid to jamaican residents if payment is made by a prescribed person. Tax is withheld at the rate of 15 where a dividend is paid by a company resident in jamaica to a resident individual shareholder regardless of shareholding. You are viewing the income tax rates thresholds and allowances for the 2020 tax year in jamaica.

Income tax rates thresholds and exemption 2003 2020 notes and instructions for completion of returns of income tax payable it01 it05 payroll taxes and contribution rates employee employer. With regard to non resident. The tax is thus withheld or deducted from the income due to the recipient. Provided the income is not effectively connected with a pe in jamaica.

Tax withholding agents will need to know the names addresses and taxpayer s registration numbers for all specified service providers in order to properly complete the withholding tax certificate. Icalculator jm excellent free online calculators for personal and business use. The withholding tax on specified services is aimed at capturing persons liable to income tax but who are under reporting or not registered. The interest payable on certain securities issued by the government of jamaica primarily to non residents.

Interest income is included in chargeable income and is subject to tax when received. It13 this form is to be completed by any person who is required to deduct income tax from dividend payments to shareholders. A withholding tax or a retention tax is an income tax to be paid to the government by the payer of the income rather than by the recipient of the income. Review the 2020 jamaica income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in jamaica.

Many jurisdictions also require withholding tax on payments of interest or dividends. Where interest is paid by a prescribed person tax is deducted at source at the rate of 25 see the withholding taxes section for more information. It10 this form is to be completed and submitted with supporting documents by any person designated under the income tax act as a tax withholding agent for specified sevices. For 2019 application for exemption for spouse of employment income earner pdf 287kb outline of japan s withholding tax system related to salary the 2020 edition outline of japan s withholding tax system related to salary the 2019 edition pdf 271kb for those applying for an exemption for dependents etc.