Goodwill Impairment Income Statement Presentation

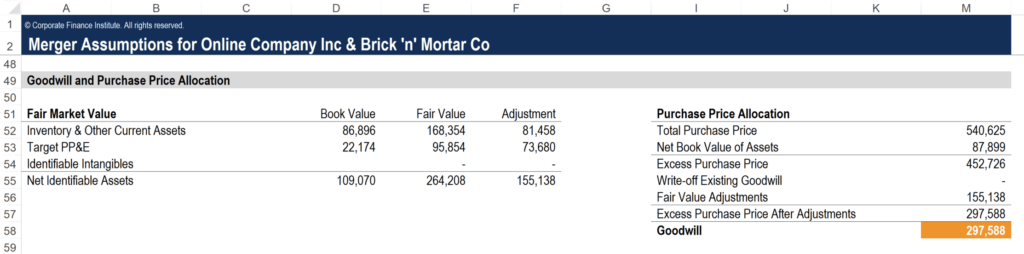

If that s the case the company undergoes what s known as goodwill impairment perhaps a year after the acquisition the teal orchid.

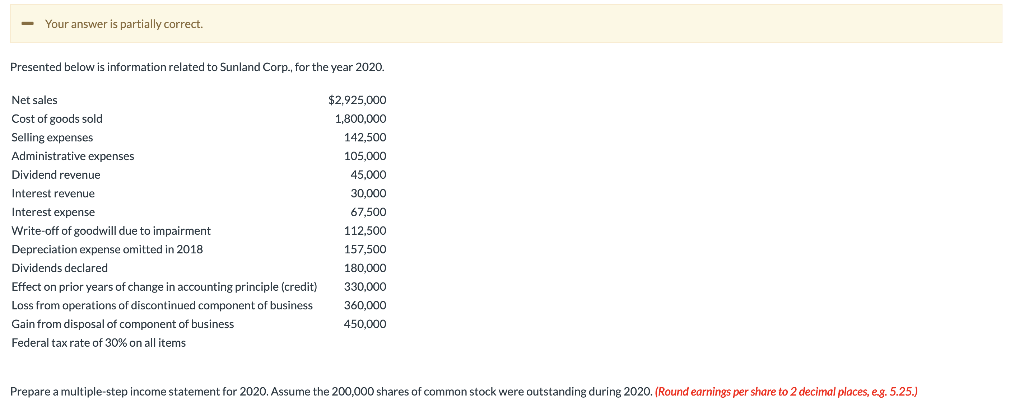

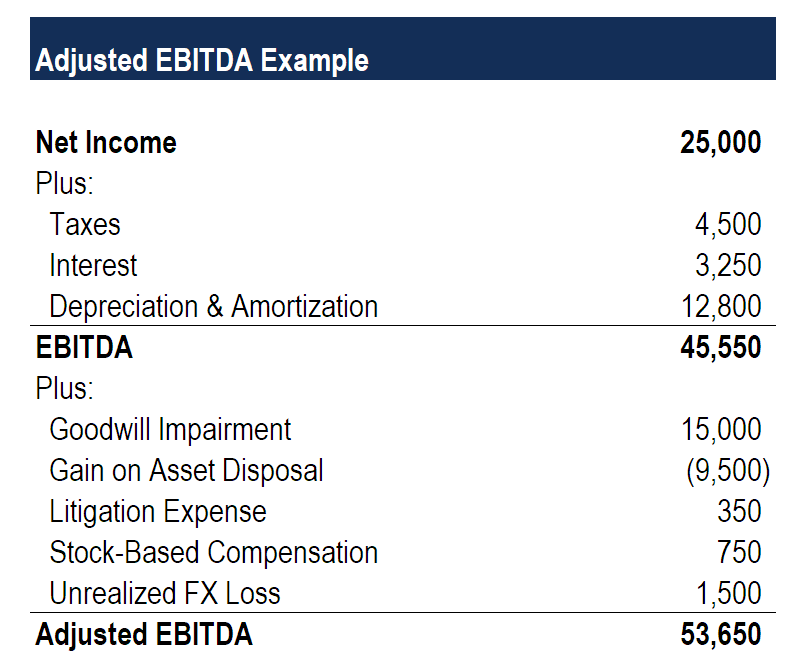

Goodwill impairment income statement presentation. The amount can change however if the goodwill declines. If an asset is impaired the impairment loss is recognized in the income statement just like any other operating expense. Also known as an impairment charge an impairment loss happens when a company writes off products or assets that it considers damaged unusable or less worthy operationally and financially speaking. How to improve the impairment test.

2 impact on income statement. This is because accounting rules require that any loss of goodwill not only reduce the amount of goodwill on the balance sheet but also be recorded as an expense on the income statement. Brief background of goodwill and impairment research project 4 7 improving effectiveness of impairment testing of goodwill using the headroom approach 8 19 1. With impairment loss being recognized the net profit is impacted negatively.

Companies will allocate goodwill impairment losses if any to individual amortizable units of goodwill of the entity. Illustrates one continuous statement of income and comprehensive income in condensed format. Pros and cons of the headroom approach 6. Frequently used terms 2.

3 impact on cash flow statement. Income before income taxes. We will look here how the impairment asset is disclosed in the financial statements as. An impairment charge of 3m is recorded reducing net earnings by 3m.

Appendix a provides a comprehensive list of presentation and disclosure requirements for goodwill accounted for. By debiting loss on goodwill impairment you are recording the fact that a loss of 100 000 has occurred which will appear on the income statement as an expense. Condensed for presentation purposes 24. Accounting for goodwill while still providing useful information to financial statement users.

The events and circumstances leading to the impairment loss. Consolidated statements of income continued. Impairment losses recognized in the income statement impairment losses reversed in the income statement the line item in the income statement in which the impairment losses are included if an individual impairment loss or reversal is material then this information should be disclosed. Presentation in financial statement.

Why improve the impairment test.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)