Deferred Tax Calculation Income Statement Approach

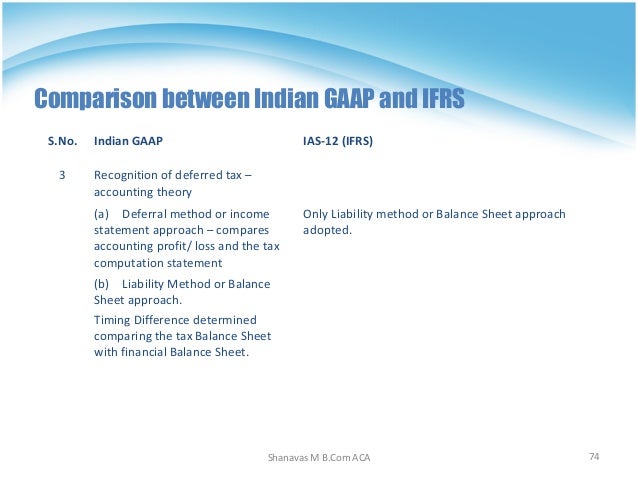

Income statement approach accounting standard as 22 taxes on income advocates income statement approach.

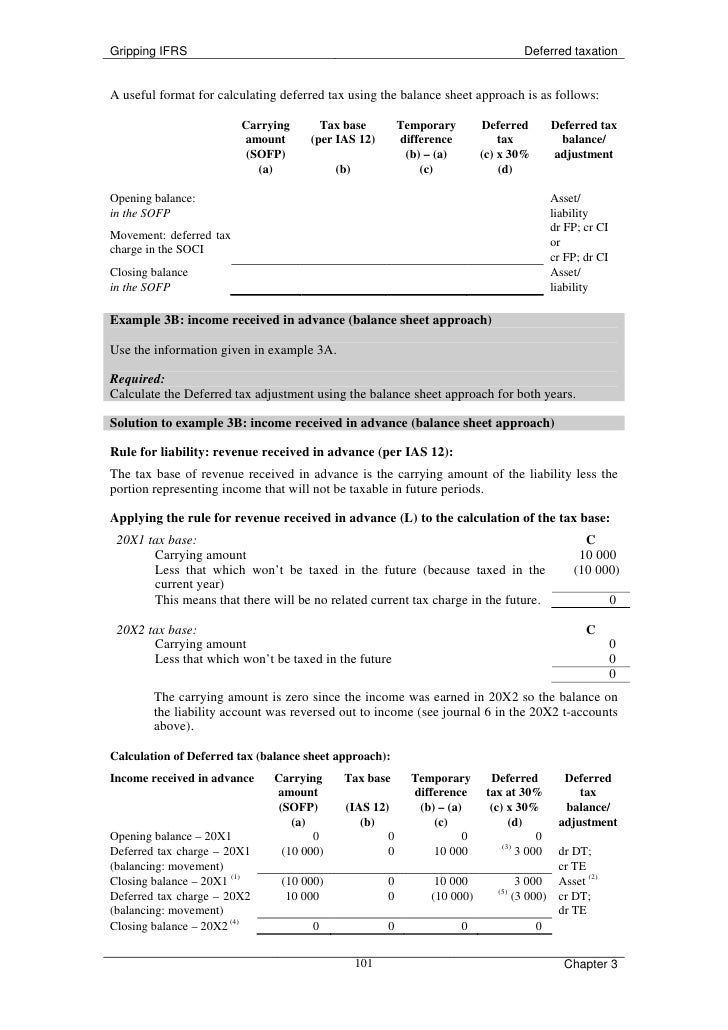

Deferred tax calculation income statement approach. Income statement reports straight line depreciation in years 1 4 of 2 500 each year. Assuming a 20 tax rate the company recognizes 500 deferred taxes from a 2 500 depreciation difference on the tax return and income. I m very proud to publish the first guest post ever in this website written by professor robin joyce fcca who will explain you in a detail how to understand deferred taxation and how to tackle it in a logical way. It is an accounting measure more specifically an accrual for tax.

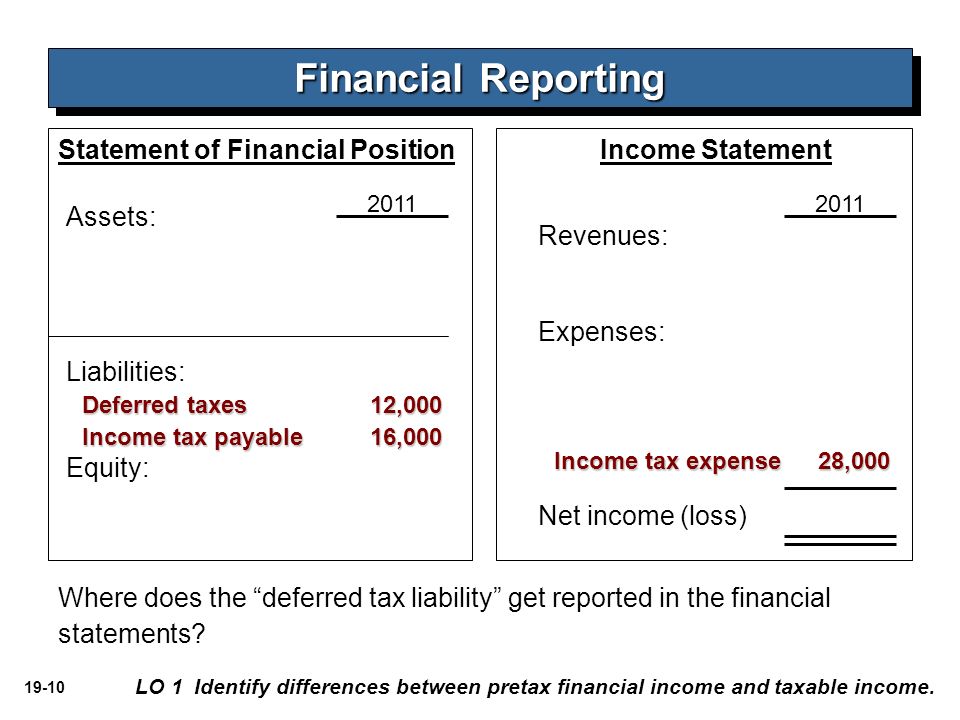

In paper f7 deferred tax normally results in a liability being recognised within the statement of financial position. Ias 12 defines a deferred tax liability as. It represents the net cash flow cash generated less cash spent of an entity during a specific period i e. In simple terms deferred tax is a tax on the gap between the books of account and the tax books.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Deferred tax example 1. These avenues create a disparity between the two financial reports thus generating a deferred tax liability.

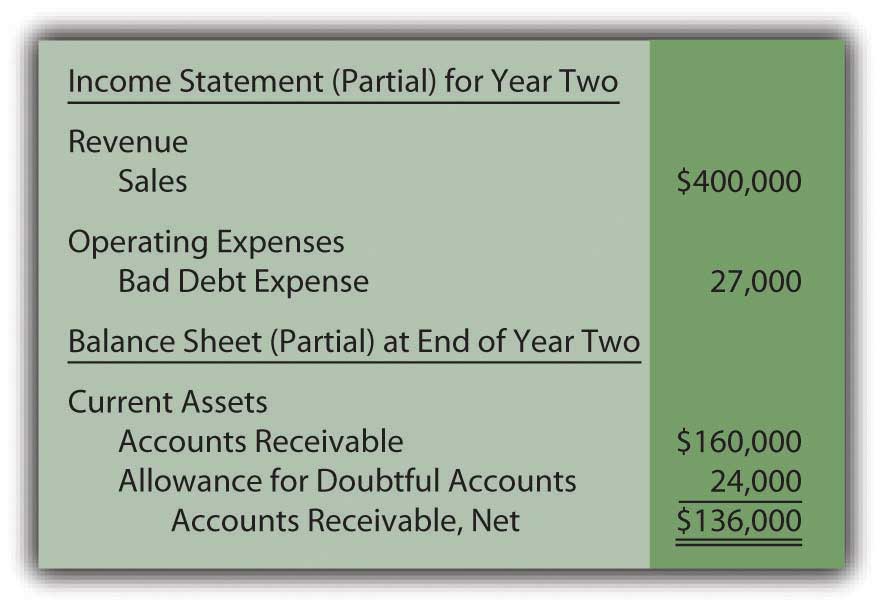

The temporary difference can either be a tax liability to be met in future save tax now pay tax later or a tax asset pay tax now and save tax later. Deferred income tax is a balance sheet item which can either be a liability or an asset as it is a difference resulting from recognition of income between the accounting records of the company and the tax law because of which the income tax payable by the company is not equal to the total expense of tax reported. Income received in advance balance at end of 2015 was r50 000 and at. A deferred tax liability can be manually calculated by recognising avenues that are treated varyingly by a company and the tax department.

What is deferred tax asset. A statement of cash flow is part of the annual financial statements that are presented by an entity along with the statement of financial position statement of comprehensive income and statement of changes in equity. Liability giving rise to future tax consequences waheeda pty limited has a profit before tax of r200 000 in both 2015 and 2016.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)