Business Income Worksheet Meaning

4 business income form cp 00 30 loss determination 3.

Business income worksheet meaning. Business income worksheet named insured. Business income worksheet definition the selected percentage or multiple of the organization s estimated annual business income for the upcoming 12 month period should be based on how long it would take to replace all damaged property and resume operations in the event of a worst case loss. Business income in general pays for net income or loss the insured would have earned or incurred plus continuing normal operating expenses including payroll. You have to do this for all of the columns located in the top row of your daily worksheet.

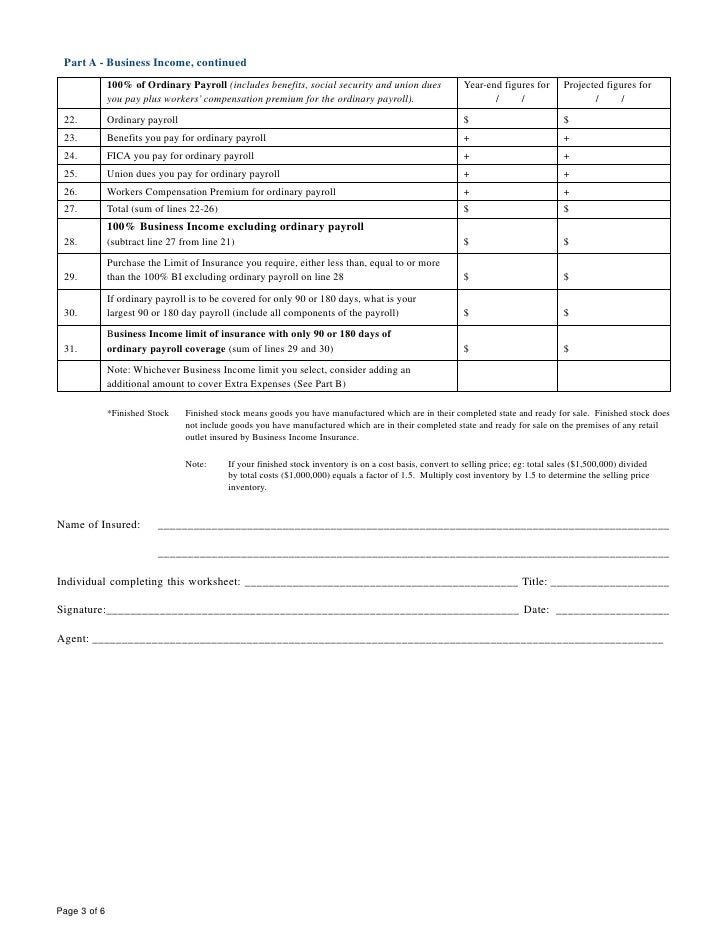

Actual or most estimated total recent values for next 12. Each 30 days l lst 30 days claim 30 000 pays 25 000 2nd 30 days claim 10 000 pays 10 000 3rd 30 days claim 40 000 pays 25 000 4th 30 days claim 25 000 pays 25 000 5th 30 days claim 20 000 pays 15 000. Add total operating expenses sub total if ordinary payroll is to be excluded or limited. Revenue derived from the following.

Business income worksheet a form used to estimate an organization s annual business income for the upcoming 12 month period for purposes of selecting a business income limit of insurance. Read on to discover the definition meaning of the term business income worksheet to help you better understand the language used in insurance policies. Services rendered including residential or outpatient care 2. Simplified business income and extra expense worksheet this worksheet is designed to help determine a 12 month business income and extra expense exposure.

Business income is a type of earned income and is classified as ordinary income for tax purposes. 1 the net income of the business before the direct physical loss or damage occurred. 2 the likely net income of the business if no loss or damage had occurred but not including any net income that would likely have been earned as a result of an. Year months a.

Deduct any or all ordinary payroll expense d. Business income worksheet non manufacturing or mercantile operations actual values for estimated values year ending 200 for year ending 200 a. Understanding business income and extra expense example limit of business income 100 000 written on limitation provides 25 000. Title the first worksheet as income and the second one as expenses by right clicking the tab at the bottom of each worksheet then selecting the rename option and entering the name.

Business income basis a b c. Net income before taxes b. Loss determination a the amount of business income loss will be determined based on. Add the headings for columns.