Income Tax Rates Quebec 2020

Canadian provincial corporate tax rates for active business income.

Income tax rates quebec 2020. 2020 personal income tax rates québec. 2020 includes all rate changes announced up to july 31 2020. Ontario tax brackets 2020. Provincial tax brackets and rates for 2020.

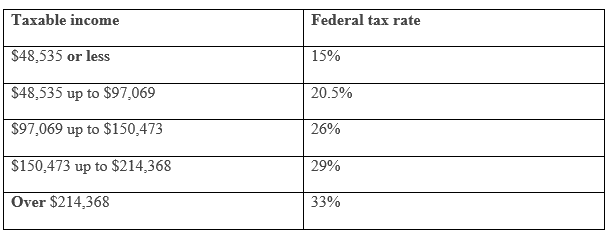

15 up to 48 535 of taxable income. The information deisplayed in the quebec tax brackets for 2020 is used for the 2020 quebec tax calculator. Where the tax is determined under the minimum tax provisions the above table is not applicable. 20 5 between 48 535 and 97 069.

The period reference is from january 1st 2020 to december 31 2020. More than 89 080 but not more than 108 390. 2020 federal tax bracket rates. The 2020 tax year in quebec runs from january 2020 to december 2020 with individual tax returns due no later than the following april 30 th 2021.

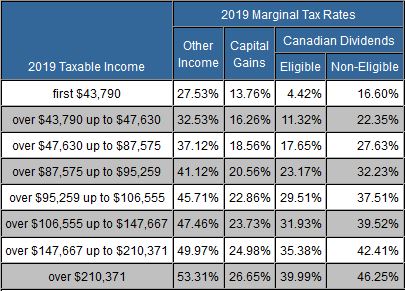

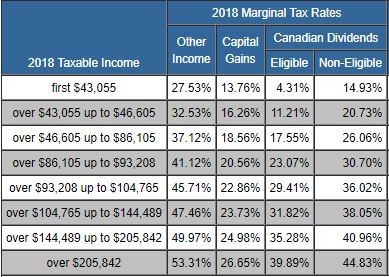

The different provinces and territories in canada also collect income taxes that are payable along with your federal return. Canadian corporate tax rates for active business income. For eligible dividends table takes into account the gross up of 38 the federal tax credit of 15 and the provincial tax credit of 11 70. 2019 includes all rate changes announced up to june 15 2019.

The tax rates reflect budget proposals and news releases to july 31 2020. Please read the article understanding the tables of personal income tax rates. I ll include a few basic examples below of how you can calculate your own income tax rates in your province of residence. Quebec collects its provincial income taxes directly via agence du revenu du quebec.

Income tax rates for 2020 the income tax rates for the 2020 taxation year determined on the basis of your taxable income are as follows. The quebec tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 0126. Quebec federal tax3 taxable income2 excess rate on provincial tax taxable income2 taxable income2 combined tax rates on dividend income 20201 1. 26 between 97 069 and.

The provincial tax rates and brackets for 2020 are below. Your average tax rate is 27 55 and your marginal tax rate is 44 03 this marginal tax rate means that your immediate additional income will be taxed at this rate. 2020 includes all rate changes announced up to july 31 2020. 2020 income tax in quebec is calculated separately for federal tax commitments and quebec province tax commitments depending on where the.

Quebec tax rates current marginal tax rates quebec personal income tax rates quebec 2021 and 2020 personal marginal income tax rates. More than 44 545 but not more than 89 080. If you make 52 000 a year living in the region of quebec canada you will be taxed 14 326 that means that your net pay will be 37 674 per year or 3 139 per month.