Maximum Allowed Income While On Social Security

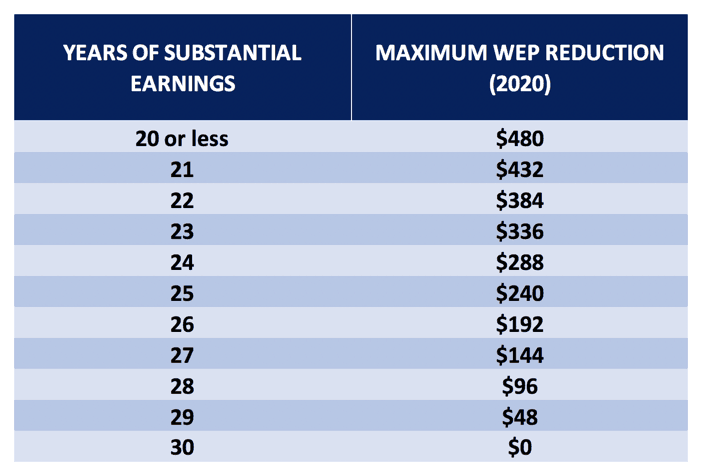

We have a special rule for this situation.

Maximum allowed income while on social security. En español at that age you can earn any amount and collect the full social security retirement spousal or survivor benefit you are entitled to receive. Your age and your income. 2020 s earnings test limits. Remember if you have any change in your employment status you are obligated to let social security know about the status.

Of that number 1 1 million recipients were children. What is the social security earnings limit. If you will reach full retirement age during that same year it will be reduced every month until you reach full. If you take social security benefits before you reach your full retirement age and you earn an annual income in excess of the annual earnings limit for that year your monthly social security benefit will be reduced for the remainder of the year in which you exceed the limit.

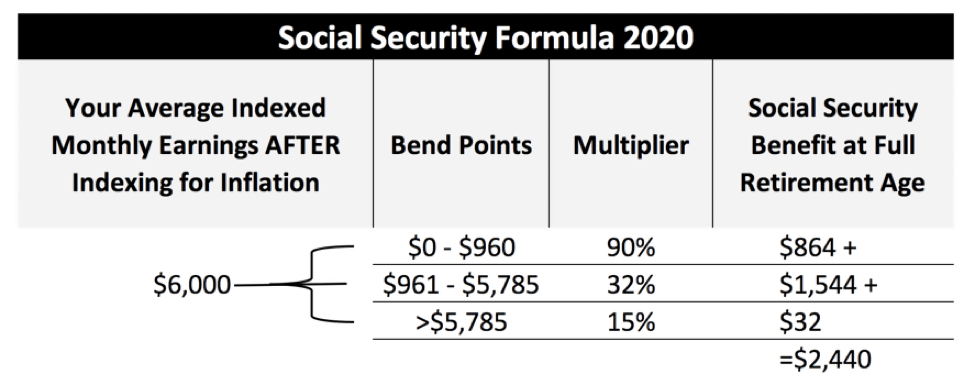

28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages. Social security s annual earnings limit the maximum people who claim social security early can make from work without triggering a benefit reduction no longer applies as of the month you attain full retirement age which is. Some people who file for benefits mid year have already earned more than the yearly earnings limit amount. For every 3 you earn over the income limit social security will withhold 1 in benefits.

There s a limit on how much you can earn and still receive your full social security retirement benefits while working. Whether or not you ll have a portion of your benefits withheld by working and receiving social security will depend on two factors. If you turned 64 in 2015 and collected social security retirement benefits and worked 31 over the limit allowed how much money are you taxed on. At your full retirement age there is no income limit.

Special earnings limit rule. Beyond the trial work period social security allows a 36 month extended period of eligibility during which you are allowed to work and receive benefits for any month where you earned money but not over the sga amount. The 17 640 amount is the number for 2019 but the dollar amount of on the income limit will increase on an annual basis going forward.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)