Income Tax Rates London

This is as follows.

Income tax rates london. Income tax is paid on any amount over your personal allowance. We ll also explain how these changes will affect your tax bill. Unlike tax free allowances these actually reduce your tax bill. Inheritance tax inheritance tax rates and allowances stamp duty land taxes the current percentages of stamp duty and the various uk property land transaction taxes national insurance earnings thresholds and contribution percentages for class 1 employed class 2 and 4 self employed and class 3 voluntary national insurance contributions.

How are income tax rates changing in 2019 20. If you earn 50 000 you will pay. From 6 april 2010 the personal allowances will reduce by 1 for every 2 of income above 100 000 until they are nil. From april 2010 the labour government introduced a 50 income tax rate for those earning more than 150 000.

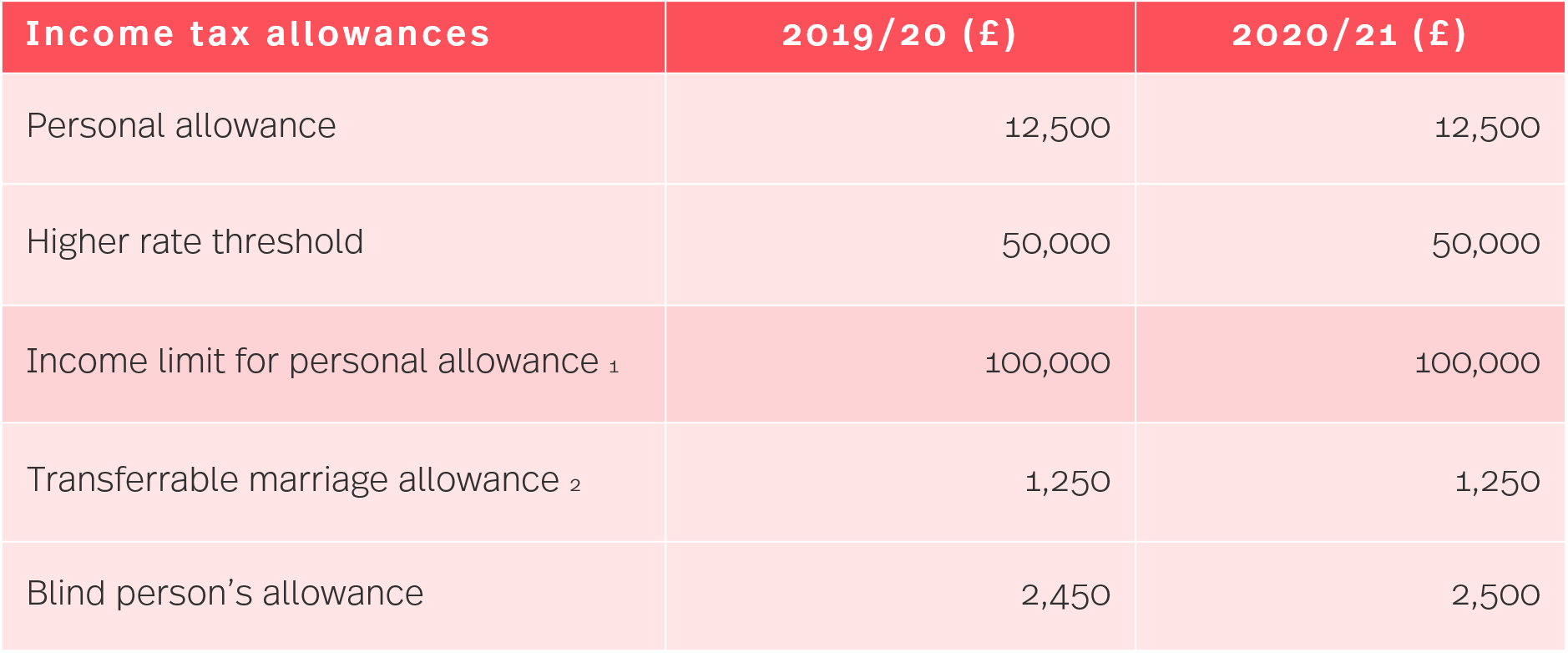

Income limit for personal allowance. For those earning between 0 to 31 785 per annum the income tax payable is a basic rate of 20. Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. The personal income tax rate in the united kingdom stands at 45 percent.

The government announces changes to income tax in the autumn budget. The higher rate for income over 150 000. The main personal allowance is 8 105. Income tax rates and taxable bands uk excluding scotland 2020 21.

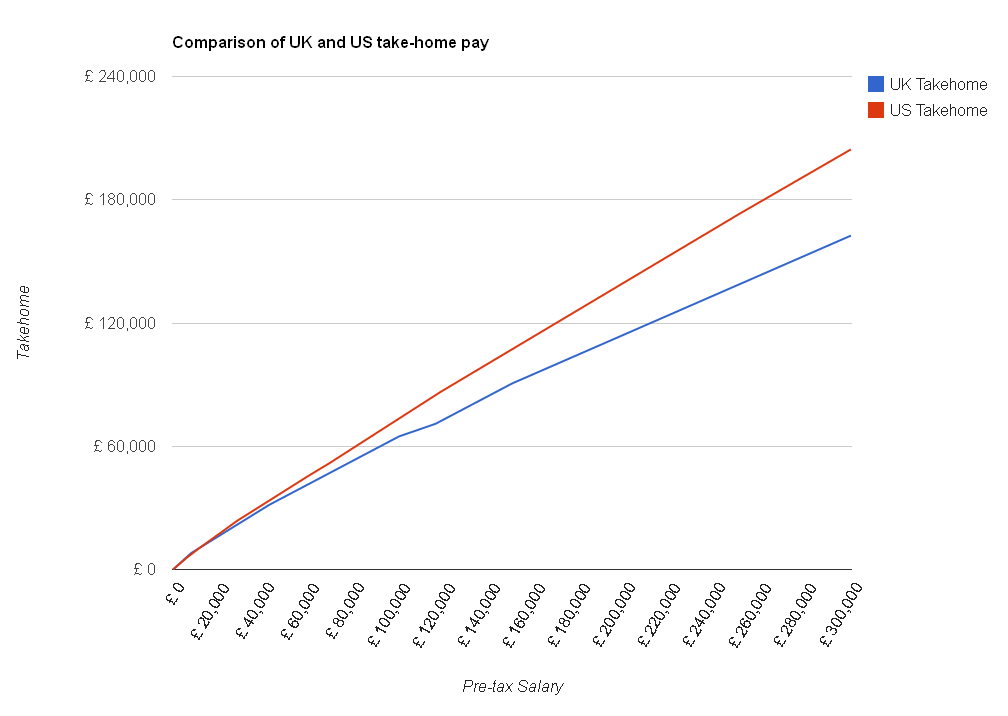

If you need the tax rates for next year click the link to get the current 2020 21 uk income tax rates. Income threshold for high taxation rate on income was decreased to 32 011 in 2013. Personal income tax rate in the united kingdom averaged 42 26 percent from 1990 until 2020 reaching an all time high of 50 percent in 2010 and a record low of 40 percent in 1991. The amount of income tax you pay on the amount over and above your personal allowance depends on the size of your income.

Band taxable income tax rate. Tax rates 2012 13 the basic rate for income 0 34 370. The higher rate for income 34 371 to 150 000.