Income Tax Relief 2020 Singapore

Short title and commencement.

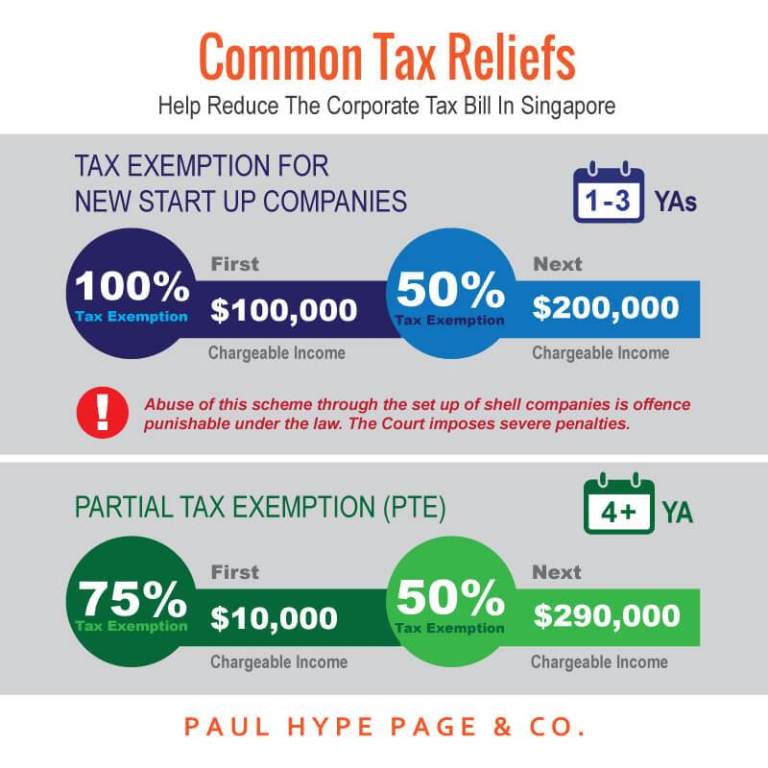

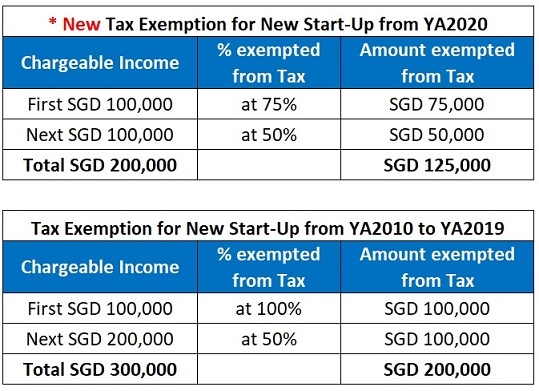

Income tax relief 2020 singapore. Income tax in singapore. Singapore budget 2020 personal tax relief measures quick guide. No matter the market conditions tax is an inevitable part of business. This means you enjoy tax reliefs of up to 7 000 on cash top ups to your sa and a further 7 000 tax relief on cash top ups to your loved one s sa account.

This entry summarises all there is to know about the current income tax relief schemes in singapore as of 2020. Amendment of section 17. Part one explains how you should calculate your income tax. Be it enacted by the president with the advice and consent of the parliament of singapore as follows.

On the other hand individual taxpayers are required to submit their income tax filing by april 2020 for income earned during the year 2019. Taxpayers may elect to carry back to the relevant preceding yas an estimated amount of qualifying deductions available for ya2020 before the actual filing of their income tax returns for ya2020. Iras will provide the details of the change by end february 2020. Complete and submit the handicapped related tax relief form 243kb doc by email in addition please amend your filing as follows.

As we usher in the new year in 2020 the tax season is approaching once again. Individuals can claim up to 80 000 of tax reliefs per financial year. This act is the economic expansion incentives relief from income tax amendment act 2020 and comes into operation on a date that the minister appoints by notification in the gazette. By lowering your chargeable income by up to 14 000 you may fall into a lower tax bracket and enjoy even greater tax savings.

The deadline for ya2019 income tax filing for companies recently elapsed last december 19 2019. This entry is one of three income tax guides for singaporeans on wiki sg. Singaporean permanent residents and all other resident taxpayers are eligible. Singapore budget 2020 personal tax relief measures covid 19 has adversely impacted the global economy just as singapore companies and businesses suffered negative by the various circuit breaker measures implemented.

Home posts guides iras tax relief quick guide. However there is always a smarter way of doing things so we ve compiled 8 of the best ways you can benefit from singapore income tax relief in 2020. Re file within 14 days of your previous submission or by 18 apr 2020 extended to 31 may 2020 new whichever is earlier you can only re file once. A if you have filed your tax return online.

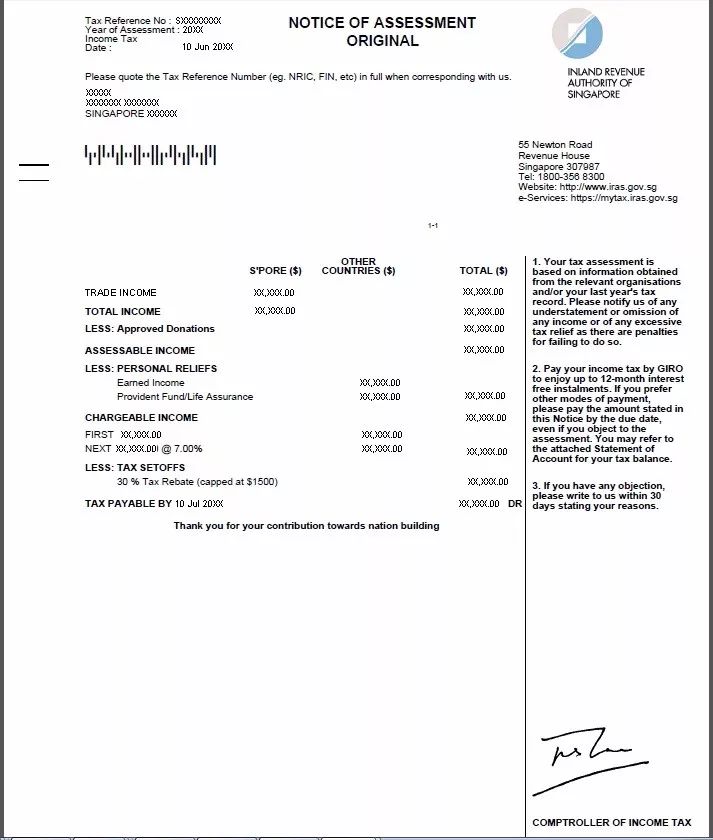

To check if you will be affected by the relief cap you can use the income tax calculator for ya 2020. Calculating your cpf relief 2020 from wiki sg. The tax reliefs to be allowed to you will be capped at 80 000 which will be reflected in your notice of assessment.