Foreign Earned Income Tax Worksheet 2019

Otherwise go to line 50.

Foreign earned income tax worksheet 2019. Because of the 2019 limit use the housing deduction carryover worksheet in the instructions to figure the amount to enter on line 49. If you are filing form 2555 or 2555 ez see the footnote in the foreign earned income tax worksheet before completing this line. Do not use a second foreign earned income tax worksheet to figure the tax on this line 4. Tax on the amount on line 2c.

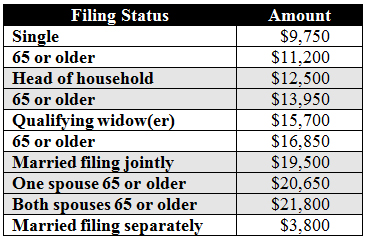

Individual income tax return it is only used if there is foreign earned income in the return if the return is reporting an amount on form 2555 foreign earned income line 45 for the foreign earned income exclusion if form 2555 does not apply to the return the tax amount will be determined directly from the. Citizen who is a bona fide resident of a foreign country or countries for an. If you meet certain requirements you may qualify for the foreign earned income exclusion the foreign housing exclusion and or the foreign housing deduction to claim these benefits you must have foreign earned income your tax home must be in a foreign country and you must be one of the following. If the amount on line 2c is 100 000 or more use the tax computation worksheet 5.

While the foreign earned income tax worksheet is linked to federal form 1040 u s. If any of the foreign earned income received this tax year was earned in a prior tax year or will be earned in a later tax year such as a bonus see the instructions. Beth is anticipating significant changes in her life in 2020 and she has asked you to estimate her taxable income and tax liability for 2020. Subtract line 5 from line 4.

While the foreign earned income tax worksheet is linked to federal form 1040 it is only used if there is foreign earned income in the return if the return is reporting an amount on form 2555 line 45 for the foreign earned income exclusion if form 2555 does not apply to the return the tax amount will be determined directly from the tax tables put out by the irs or schedule d form 1040. Complete the foreign earned income tax worksheet in the instructions for forms 1040 and 1040. For tax year 2019 the maximum foreign earned income exclusion amount was the lesser of the foreign income earned or 105 900 per qualifying person. Since you are excluding 105 900 of your 150 000 gross receipts you will need to multiply that same ratio by the expenses that are directly related to your schedule c gross receipts as follows.

Purpose of form if you qualify you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If the amount on line 2c is less than 100 000 use the tax table to figure this tax. Don t include income from line 14 column d or line 18 column f. Don t use a second foreign earned income tax worksheet to figure the tax on this line.

Income tax withheld from form s w 2 or 1099 respectively any taxes an employer withheld from your pay that was paid to the foreign country s tax authority instead of the u s.