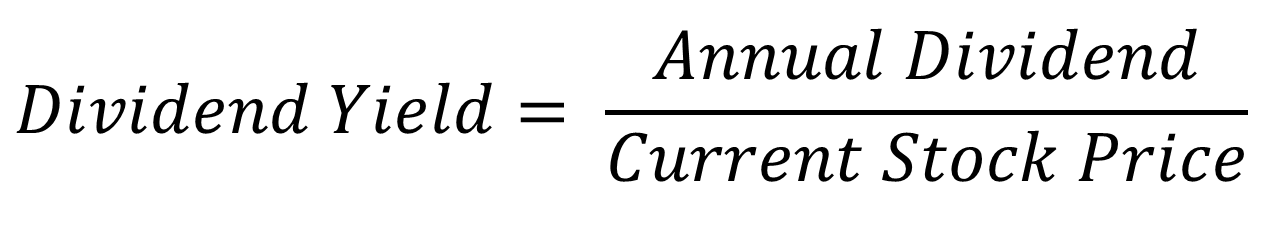

Net Income Yield Formula

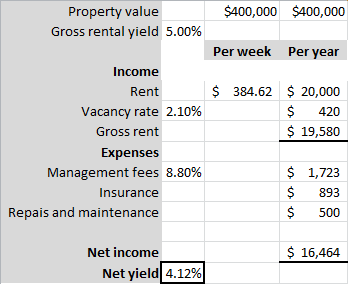

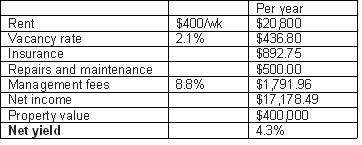

For example if you buy a property for 750 000 with an annual rental income of 78 000 1 500 a week and yearly costs of 12 000 you would get a net yield of 8 8.

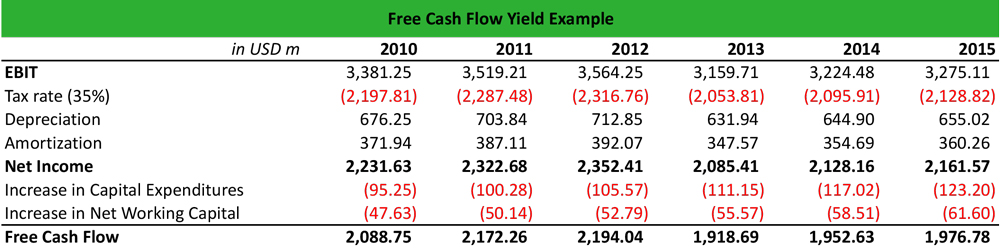

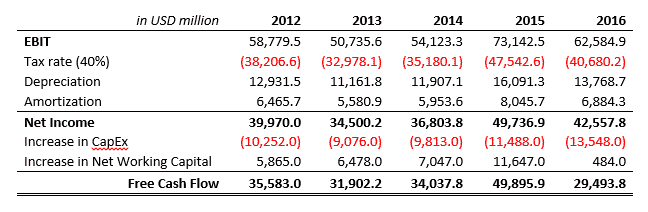

Net income yield formula. A company has revenue of 50 000 the cost of goods sold is 15 000 operating expense 5 000 and loss from the operations of a discounted component is 1 200. Net income 54 200 net income formula example 2. Net income total revenue total expense. All revenues and all expenses are used in this formula.

Looking at a stock s dividend yield is the quickest way to find out how much money you ll earn from a particular income stock versus other dividend paying stocks or even other investments such as a bank account. Compute net rental yield by dividing the building s net income by the purchase price. Many different textbooks break the expenses down into subcategories like cost of goods sold operating expenses interest and taxes but it doesn t matter. This practice referred to as burning the yield is done.

An income of 27 360 minus costs of 23 521 equals 3 839 cash return over cash out and 3 839 divided by a cash investment of 60 000 equals a cash on cash rental yield of 6 4 percent. The main thing to look for in choosing income stocks is yield. Expressed as an annual percentage the yield tells investors how much income they will earn each year relative to the cost of their investment. It is most commonly measured as net income divided by the original capital cost of the investment.

That makes the net yield more accurate than gross yield because it s based on the actual amount of money you ll end up with after costs. The net income is equal to net rental revenue minus operating costs minus mortgage expenses. But there s still something missing return on investment roi return on investment roi is the annual profit income minus costs generated by an asset divided by the cash you ve put in. The net income formula is calculated by subtracting total expenses from total revenues.

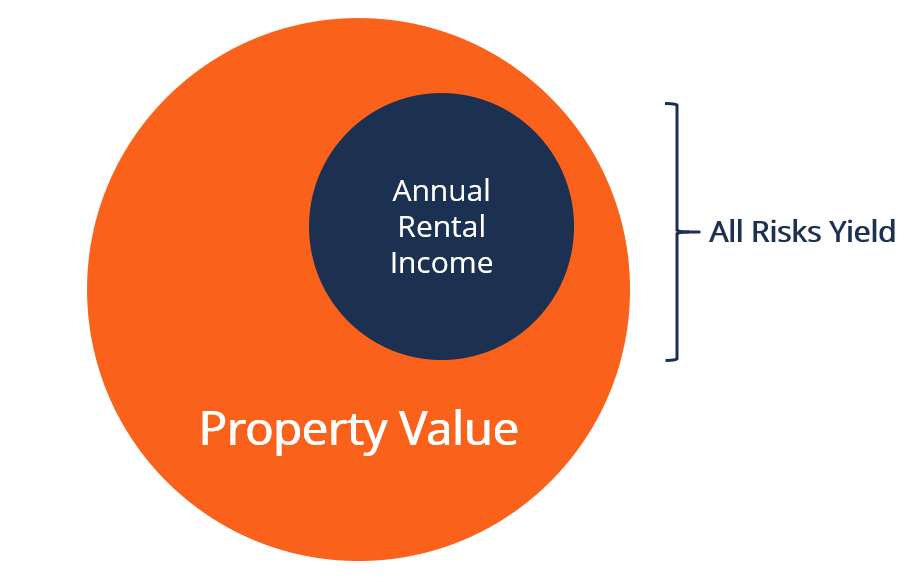

The illegal practice of underwriters marking up the prices on bonds for the purpose of reducing the yield on the bond. Yield is defined as an income only return on investment it excludes capital gains calculated by taking dividends coupons or net income and dividing them by the value of the investment. Net yield weekly rental x 52 costs property value x 100. The percentage rate of return paid on a stock in the form of dividends.

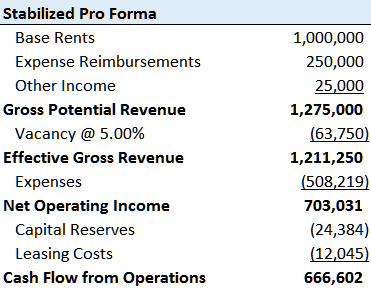

Using the current example the net rental yield equals 114 000 8 400 58 119 1 000 000 4 7.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-02-ba61fb5a7de74ce8b29266f0607d3a88.jpg)

/dividendyield-5c67fc5946e0fb00011a0c31.jpg)