Which Of The Following Income Statement Line Items Are Affected By The Inventory Method Chosen

The standard requires a complete set of financial statements to comprise a statement of financial position a statement of.

Which of the following income statement line items are affected by the inventory method chosen. What are the elements of financial statements. Thus the elements of the financial statements of a for profit business vary somewhat from those incorporated into a nonprofit business which has no equity accounts. These groupings will vary depending on the structure of the business. This system is preferred by most companies but it is especially used in companies where the inventory is perishable or subject to quick obsolescence.

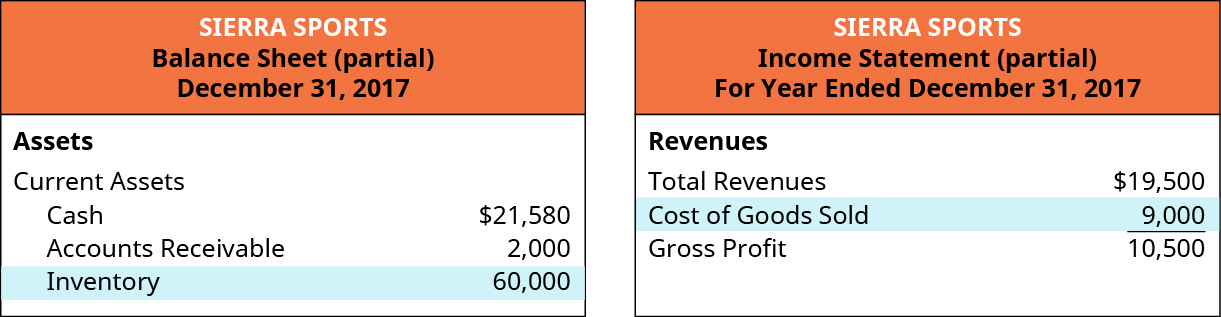

What of the following income statement line times are affected by the inventory method chosen. Reported as a current asset because it will be converted into cash within a year of the balance sheet date. The elements of financial statements are the general groupings of line items contained within the statements. 1 it is easy to apply 2 the assumed flow of costs corresponds with the normal physical flow of goods 3 no manipulation of income is possible and 4 the balance sheet amount for inventory is likely to approximate the current market value.

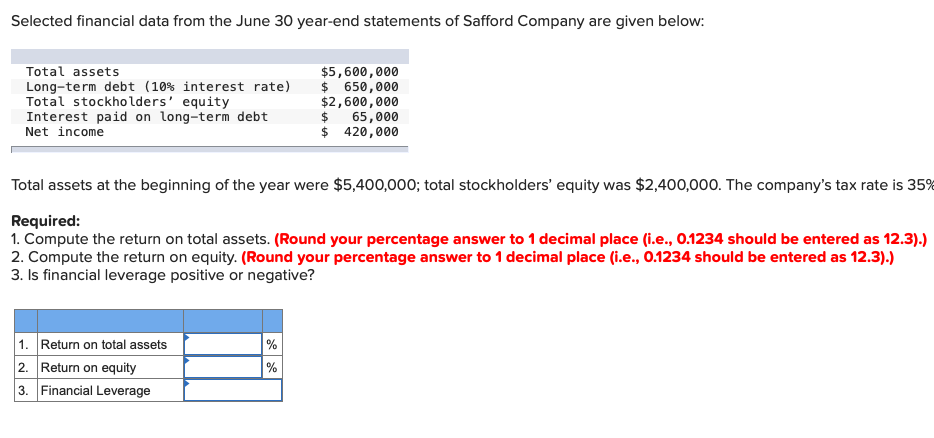

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. It is important to investors also on a per share basis as earnings per share eps as it represents the profit for the accounting period attributable to the shareholders. Why does inventory get reported on some income statements. Accounting fundamentals of financial.

View which of the following income statement line items are affected by the inventory method chosen png from accounting financial at northwest vista college. Ias 1 sets out the overall requirements for financial statements including how they should be structured the minimum requirements for their content and overriding concepts such as going concern the accrual basis of accounting and the current non current distinction. In other words the first items of inventory you purchased are sold first. Inventory is not an income statement account.

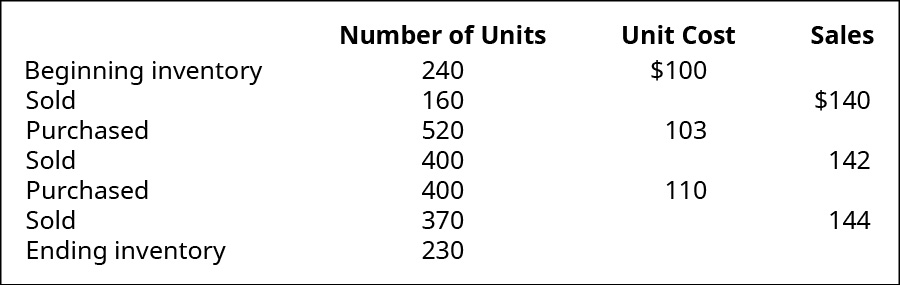

Advantages and disadvantages of fifo the fifo method has four major advantages. The bottom line of an income statement is the net income that is calculated after subtracting the expenses from revenue. 550 delta diamonds had 5 one carat diamonds available for sale this year. The fifo method assumes that the first items put on the shelf are the first items sold.

Reporting of inventory on financial statements. 1 purchased june 1 for 500 2 purchased july 9 for 550 each and 2 purchased september 23 for 600 each. Income from operations 3. However the change in inventory is a component in the calculation of the cost of goods sold which is often presented on a.

Which of the following income statement line items are affected by the inventory method chosen. Income before income tax expense 2.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-68758d3fa7644130a0b7e6a2383545a0.jpg)