The Income Statement Always Shows A Net Profit

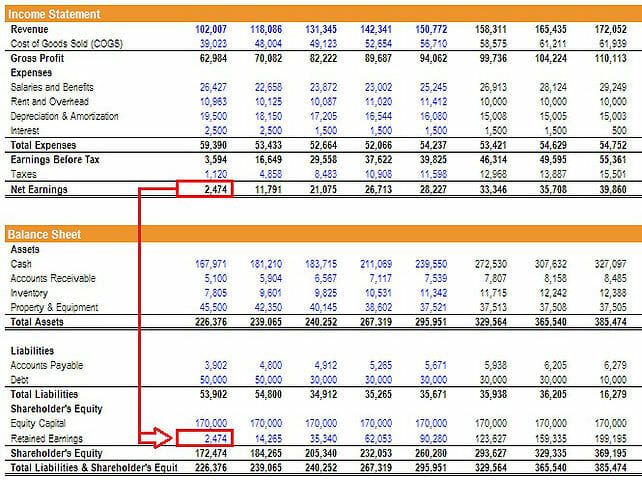

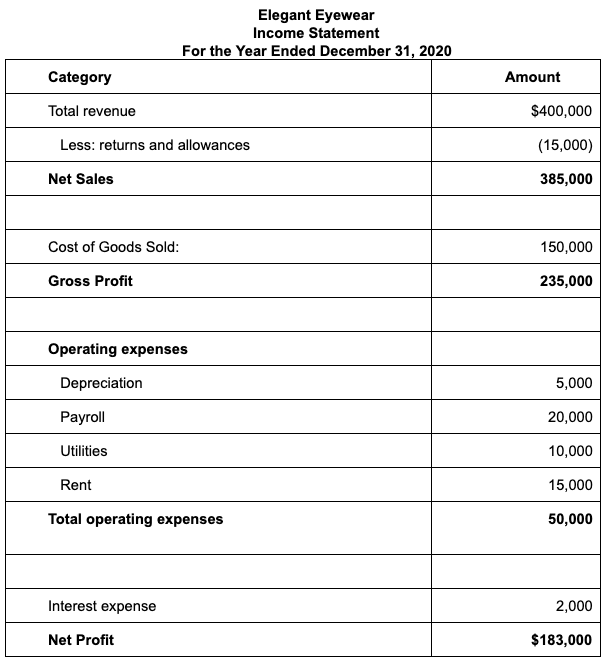

Here is a sample income statement to show how net profit might be reflected on the income statement of a small hypothetical company.

The income statement always shows a net profit. The income statement or profit and loss report is the easiest to understand it lists only the income and expense accounts and their balances. Income statement and balance sheet overview. To discover how much cash a company generates you need to examine the cash flow statement. A calculation which shows the profit or loss of an accounting unit during a specific period of time providing a summary of how the profit or loss is calculated from gross revenue and expenses.

The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period the income statement is the first financial statement typically prepared during the accounting cycle because the net income or loss must be calculated and carried over to the. Sign up for our online financial statement training and get the income statement training you need. The expense side it is said to have earned a net profit. To illustrate the difference between net income and profit let s take a look at berkshire hathaway s annual income statement for 2018.

Amounts shown in thousands. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. The difference between net sales and the cost of goods sold. The positive inter annual trends in all the income statement components both income and expense have lifted the company s profit margins net income net sales from 40 to 44 again that s.

Its gross profit listed as gross income revenues minus. Net profit net income and net earnings all mean the same thing. In a company s income statement if the credit side i e. The income side is in excess of the debit side i e.

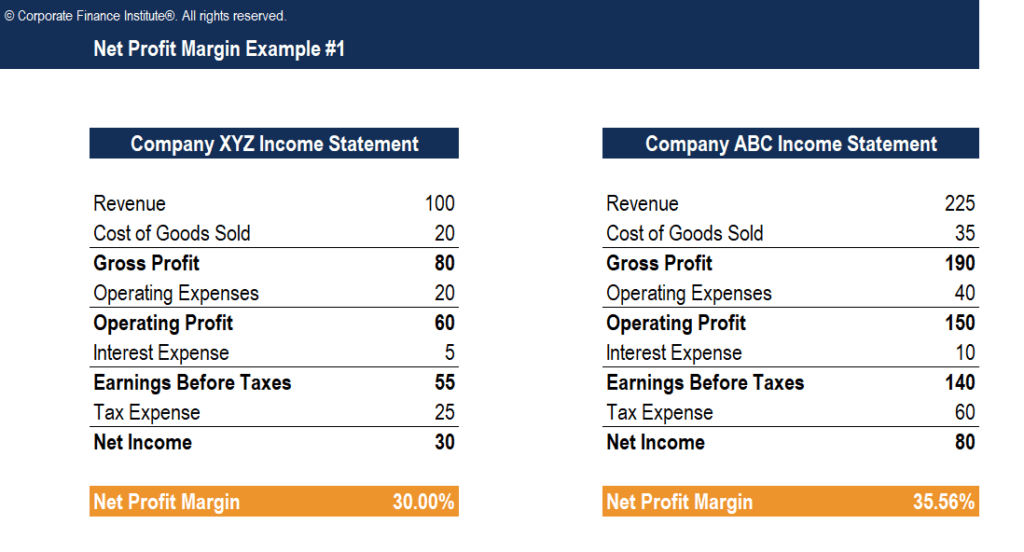

What is an income statement. If you refer back to the income statement for company z the gross profit was 80 000 and the net profit was 30 000. Gross profit minus operating expenses and taxes. The amount calculated is the balancing figure to be put on the debit side as a part of balancing the account.

The difference between net profit and gross profit is what you subtract from the total revenue.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)