Graduated Income Tax Us History

History of the income tax.

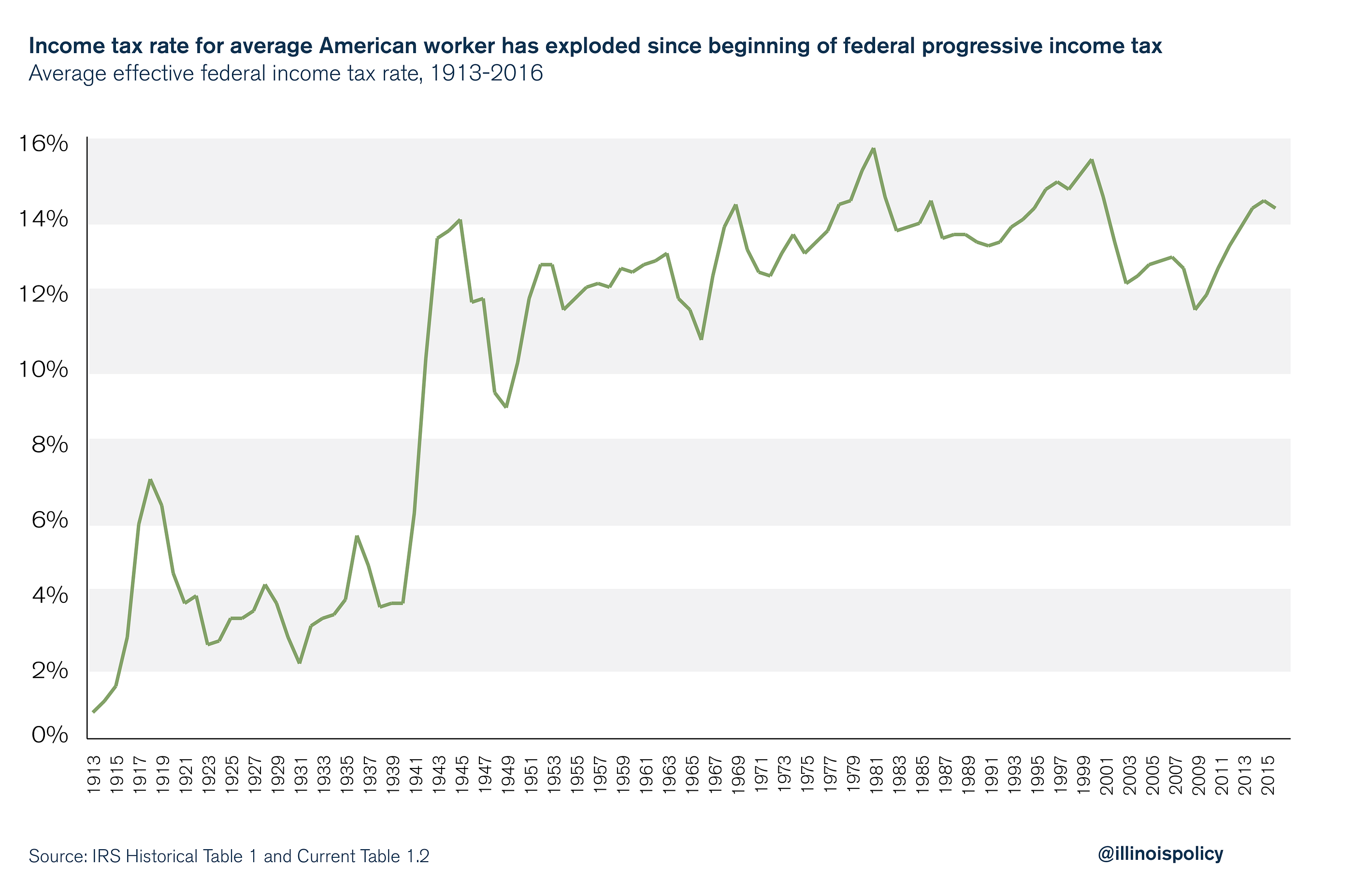

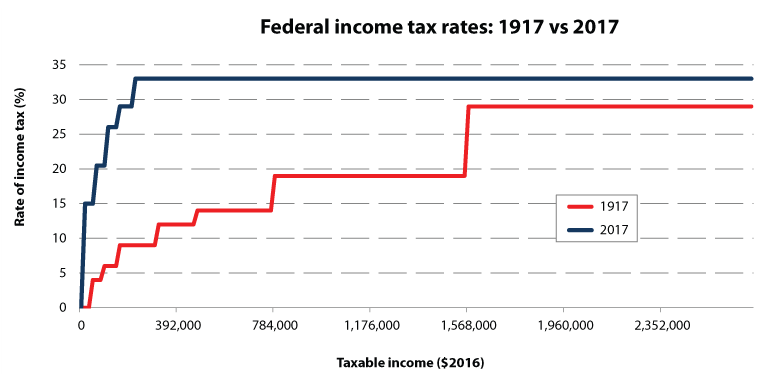

Graduated income tax us history. Congress did turn to high marginal rates later in the decade but strictly as a war finance measure to fund the united states entry into world war i. The graduated schedule of the original 1913 income tax topped out at only 7 percent assessed against all income above 500 000. Pitt s new graduated progressive income tax began at a levy of 2 old pence in the pound 1 120 on incomes over 60 and increased up to a maximum of 2 shillings 10 on incomes of over 200. Many states refer to some extent to federal concepts for determining taxable income.

The first 30 years of the twentieth century witnessed the rise of the modern income tax. The income tax arrives. What this means for you. Income tax revisions in 1917 and 1918 raised the top rates to.

Income tax in the united states. This history is important because it shows that the tax law is always changing. The top rate was hiked last in 1993 to 35 percent. Starve the beast policy taxation in the united states.

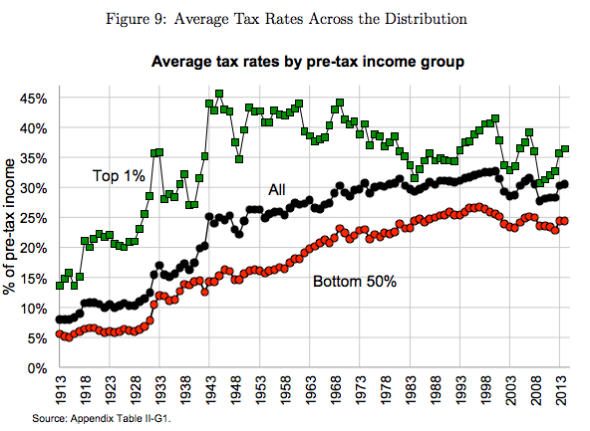

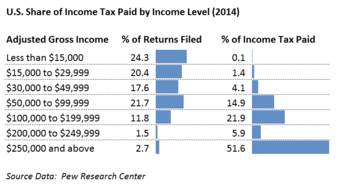

More energized than demoralized by the supreme court s invalidation of the 1894 income tax fiscal reformers mounted a powerful campaign to resuscitate the levy. The tax systems within each jurisdiction may define taxable income separately. The opposite is a regressive tax where people earning more money pay a lower portion of their income in tax. A progressive tax is one where higher earners pay a higher portion of their income in tax.

The first income tax in the united states was implemented with the revenue act of 1861 by abraham lincoln during the civil war. Income taxes in the united states are imposed by the federal most states and many local governments the income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductions individuals and corporations are directly taxable and estates and trusts may be taxable on undistributed income. The united states corporate tax rate was at its highest 52 8 percent in 1968 and 1969. Under the tax cuts and jobs act of 2017 the rate adjusted to 21 percent.

History through 1916 early history. Tax collectors would literally go door to door and ask if the individual had income during the year. Pitt hoped that the new income tax would raise 10 million but actual receipts for 1799 totalled just over 6 million. The first attempt to tax income in the united states was in 1643 when several colonies instituted a faculties and abilities tax.

The opposite of a graduated income tax is a flat income tax where all incomes are taxed at the same rate for example all income could be taxed at 33 percent and for each dollar you earn you.